Abstract

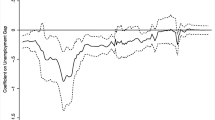

This paper uses an econometric approach to examine the inflation consequences of the American Rescue Plan Act of 2021. Price equations are estimated and used to forecast future inflation. The main results are: (1) The data suggest that price equations should be specified in level form rather than in first or second difference form. (2) There is some slight evidence of nonlinear demand effects on prices. (3) There is no evidence that demand effects have gotten smaller over time. 4) The stimulus from the act combined with large wealth effects from past household saving, rising stock prices, and rising housing prices is large and is forecast to drive the unemployment rate down to below 3.5 percent by the middle of 2022. 5) Given this stimulus, the inflation rate is forecast to rise to slightly under 5 percent by the middle of 2022 and then comes down slowly. 6) There is considerable uncertainty in the point forecasts, especially two years out. The probability that inflation will be larger than 6 percent next year is estimated to be 31.6 percent. 7) If the Fed were behaving as historically estimated, it would raise the interest rate to about 3 percent by the end of 2021 and 3.5 percent by the end of 2022 according to the forecast. This would lower inflation, although slowly. By the middle of 2022 inflation would be about 1 percentage point lower. The unemployment rate would be 0.5 percentage points higher.

Similar content being viewed by others

Notes

Some specifications take \(u^*\) to be time varying. This is not done here. It’s hard to avoid subjectivity in the choice of how the natural rate varies over time.

“Price level” will be used to describe p even though p is actually the log of the price level.

Note that if \(u^*\) follows a linear time trend, this will be picked up by the inclusion of t in the equation.

Note that there is a large change in the estimate of the coefficient of the time trend when \(\pi _{t-1}\) and \(p_{t-1}\) are added. The time trend is serving a similar role in this equation as the constant term is in equation (5).

Because the equations are linear, it does not matter what values are used for PIM as long as the same values are used for both simulations. Similarly, it does not matter what values are used for UR as long as each value for the second simulation is one percentage point higher than the corresponding value for the base simulation. Also, unless UR is exactly at the NAIRU, the base simulation for equation (5) will either have an accelerating or decelerating inflation and price path. The computed differences in this case are differences from the accelerating or decelerating path. For equation (5) with \(\pi _{t-1}\) added, the base simulation will have an accelerating or decelerating price path. For this reason results are presented in Table 2 only out 120 quarters.

The peaks are 1955.2, 1963.3, 1966.1, 1973.1, 1992.4, and 2010.4, where the first line is extended back to 1952.1 and where from 2011.1 on the annual growth rate was taken to be 1.50 percent. The annual growth rates between the six peaks are 3.40, 2.73, 2.54, 1.56, and 2.01, respectively.

The output gap in the US model is defined as \((YS-Y)/YS\), where Y is the actual output of the firm sector and YS is a measure of potential output. YS is computed from peak to peak interpolations of \(\log Y\) over the 1952.1–2021.1 period. The peaks are 1953.2, 1966.1, 1973.2, 1999.4, 2006.4, and 2019.1, where tre the first line is extended back to 1952.1 and the last line is extended forward to 2021.1. The annual growth rates between the six peaks are 4.09, 3.67, 3.24, 2.65, and 1.83, respectively.

The values of S&L transfer payments were higher during the pandemic as S&L governments passed on some of the increased GIA to persons. Since only normal growth is assumed for real GIA for the forecast, only normal growth was assumed for S&L transfer payments to persons.

If the initial estimate of an equation suggests that the error term is serially correlated, the equation is reestimated under the assumption that the error term follows an autoregressive process (usually first order). The structural coefficients in the equation and the autoregressive coefficient or coefficients are jointly estimated (by 2SLS).

References

Candia, Bernardo, Oliver Coibion, Yuriy Goroodnichenko. 2021. The Inflation Expectations of U.S. Firms: Evidence From a New Survey. NBER Working Paper 28836, May.

Coibion, Oliver, Yurly Goroodnichenko, Saten Kumar, Mathieu Pedemonte. 2020. “Inflation Expectations—a Policy Tool?” Journal of International Economics 124.

Fair, Ray C. 2000. Testing the NAIRU Model for the United States. The Review of Economics and Statistics 82: 64–71.

Fair, Ray C. 2018. Macroeconometric Modeling: 2018, fairmodel.econ.yale.edu/mmm2/mm2018.pdf.

Fair, Ray C. 2020. Variable Mismeasurement in a Class of DSGE Models: Comment. Journal of Macroeconomics 66.

Fair, Ray C. 2020. Some Important Macro Points. Oxford Review of Economic Policy.

Fuhrer, Jeffrey C. 1997. The (Un)Importance of Forward-Looking Behavior in Price Specifications. Journal of Money, Credit, and Banking 29: 338–350.

Summers, Lawrence H. 2021. The Biden Stimulus is Admirably Ambitious. But It Brings Some Big Risks, Too. The Washington Post, February 4.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Fair, R.C. What do price equations say about future inflation?. Bus Econ 56, 118–128 (2021). https://doi.org/10.1057/s11369-021-00227-2

Published:

Issue Date:

DOI: https://doi.org/10.1057/s11369-021-00227-2