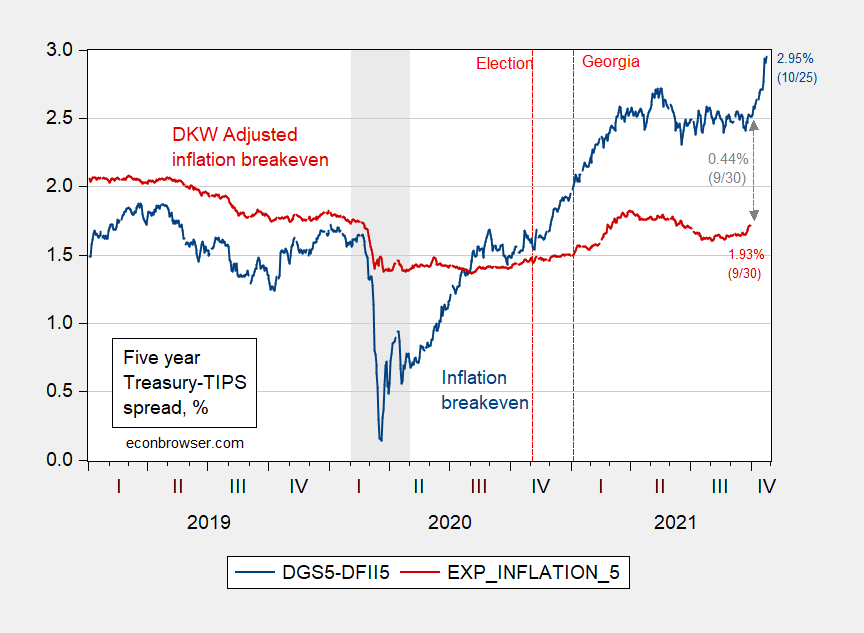

The five year Treasury-TIPS spread has, inarguably, shot up:

Figure 1: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red), all in %. NBER defined recession dates shaded gray (from beginning of peak month to end of trough month). Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 10/7, NBER and author’s calculations.

What to make of this development?

The gap between the unadjusted and adjusted spreads was 0.44 ppts as of 9/30. If that gap — the combination of inflation risk and liquidity premia — had stayed the same, the implied inflation rate would be 2.5% over the next five years. (Of course, there’s no particular reason why the composite premium would have stayed constant…)

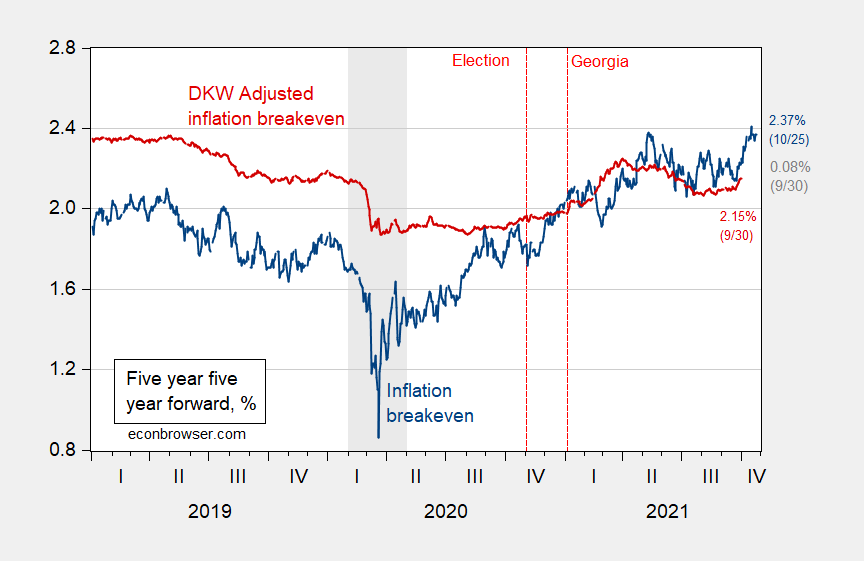

Analysts often look at the the five year five year forward as an indicator of inflation over the five years five years from now. If one applies the same logic about premia to the usual calculation, then one obtains Figure 2.

Figure 2: Five year five year forward spread (blue), five year five year forward spread calculated using inflation risk premium and liquidity premium per DKW (red), all in %. NBER defined recession dates shaded gray (from beginning of peak month to end of trough month). Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 10/7, NBER and author’s calculations.

Two observations:

- The “adjusted” spread requires estimating inflation risk and liquidity premia, so one might worry about all sorts of errors being introduced. For what it’s worth, the adjusted spread forecasts actual inflation better than the unadjusted does (although the sample is small), as discussed in this post with an exchange with Joseph E. Gagnon and Madi Sarsenbayev of the Peterson Institute.

- The spread predicts CPI inflation. The Fed pays attention to the PCE deflator. Over the last 35 years, CPI inflation has averaged about 0.43 ppts more than PCE inflation.

If one believed in the DKW adjustment (and that adjustment held constant over the past four weeks), and the gap between CPI and PCE inflation remains roughly constant, that would place average PCE inflation over the next five years at about … 2%.

The five year five year forward, which is often taken as long term CPI inflation, is then 2.3%; implied PCE inflation is then 1.9%…

https://fred.stlouisfed.org/graph/?g=FKhV

January 15, 2018

(Consumer Price Index and Personal Consumption Expenditures Price Index) less food & energy, 2007-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=FKi6

January 15, 2018

(Consumer Price Index and Personal Consumption Expenditures Price Index) less food & energy, 2017-2021

(Percent change)

So, if you hit the Max on that FRED graph, this happened in the memorable 1990 recession too?

Why not reassure people though, by paying inflation as interest on individual Fed CBDC accounts, to encourage savings directly in potentially inflationary times?

https://fred.stlouisfed.org/graph/?g=IdRE

January 15, 2018

(Consumer Price Index and Personal Consumption Expenditures Price Index) less food & energy, 1990-2021

(Percent change)

I can’t take any model seriously which suggests inflation expectations only dropped 40bp in the midst of a global pandemic, which had some wondering if the entire human race was at risk. Assumptions on top of assumptions and before long you’ve built something meaningless.

Have you factored in how much MORE powerful/effective fiscal policy is vs monetary policy?? Why do you think some of the best economists of the world recommended that?? Not to mention the fact you were already knocking at the door of ZLB. Did you think depositors were going to start paying commercial banks for the use of their own money??

Sadly, small depositors already do. Low balance fees. Non-use fees. Plaid shirt fees. It’s Thursday fees.

Largely true. But there’s a segment of those folks who could avoid a lot of those fees by joining an NCUA member credit union

Like my Mom did. It’s her favorite bank…-ish thingie.

: ) Wise lady

The only real world observation we can make is that bond traders require a composite spread to cover expected inflation and the risk of unexpected inflation. (I’m ignoring the liquidity premium which is pretty small.) Then economists pretend to be able to decompose this composite spread by divining the brains of bond traders to figure out how much is expected inflation and how much is the risk of unexpected inflation. It is almost a metaphysical question. It would be an interesting question to put to a real bond trader.

I’m no inflation hawk but I am rather dubious of the claim that a sudden rise in the spread of 0.5% has nothing to do with expected inflation which is static and only to do with risk of unexpected inflation. How do you know the difference?

https://fred.stlouisfed.org/graph/?g=qfm7

January 15, 2018

TIPS 5-year spread, * 2017-2021

* Breakeven inflation rate (difference between rate on nominal Treasury Notes and on Treasury Inflation-Protected Securities)

https://news.cgtn.com/news/2021-10-26/China-achieves-quantum-computational-advantage-in-2-mainstream-routes-14FY8wSPOa4/index.html

October 26, 2021

China achieves quantum computational advantage in two mainstream technical routes

A Chinese research team has successfully designed a 66-qubit programmable superconducting quantum computing system named “Zuchongzhi 2.1,” significantly enhancing the quantum computational advantage.

This remarkable feat makes China the first country to achieve a quantum computational advantage in two mainstream technical routes – one via photonics quantum computing technology and the other via superconducting quantum computing technology, the team noted.

The study was led by renowned Chinese quantum physicist Pan Jianwei and was published online on Monday Beijing Time in the journal Physical Review Letters and Science Bulletin. *

In December 2020, the researchers built the quantum computer prototype, “Jiuzhang,” through which up to 76 photons were detected, achieving quantum computational advantage.

Quantum computational advantage, also known as “quantum supremacy,” indicates an overwhelming quantum computational speedup that is currently infeasible for traditional computers.

Gaussian boson sampling (GBS) based on photons and random quantum circuits sampling based on superconducting qubits are two major technical schemes to demonstrate a quantum computational advantage in experiments.

In May this year, the researchers designed a 62-qubit programmable superconducting quantum processor named “Zuchongzhi,” achieving two-dimensional programmable quantum walks on the system.

The quantum computing system of “Jiuzhang” can carry out large-scale GBS 100 trillion times faster than the world’s fastest existing supercomputer. Meanwhile, with an improved average readout fidelity of 97.74 percent, “Zuchongzhi 2.1” can perform large-scale random quantum circuits sampling about 10 million times faster than the fastest existing supercomputer.

“This indicates that our research has entered its second stage to start realizing fault-tolerating quantum computing and near-term applications such as quantum machine learning and quantum chemistry,” said Zhu Xiaobo, a member of the research team.

* https://journals.aps.org/prl/abstract/10.1103/PhysRevLett.127.180501

its an interesting study. the chinese are making considerable progress in quantum computing. if the usa does not invest more in the technology, it will fall behind. that said, this was not an example of quantum supremacy. that has not yet been generally demonstrated. mostly because we do not have a good combination of hardware and algorithm. but it is on its way. that said, my pet peeve is the fields continued use of the term qubit. it should be a qbit. but i seem to be in the minority on this issue.

at any rate, for those interested in investing in quantum computing, the first pure quantum computing play recently came out as ionq. for any other exposure, you need to buy through the big boys (ibm, google, etc). i hear a couple others may also come out through a spac (righetti is another one). i am not a long term fan of ionq, as it uses trapped ion technology. but in the near term, it is the most stable and best approach. i dont think it scales very well to the more useful >1000 qbit range. i have said on this blog before, quantum computing will be a huge player in computing over the next decade plus. get in on the ground floor if you can.

ok, enough of my wallstreetbets rant for now.