Click here to see the original post from September 2023.

Drug Channels has just obtained new details on the size of the 340B Drug Pricing Program. I couldn’t wait to share the news, hence this special Sunday post.

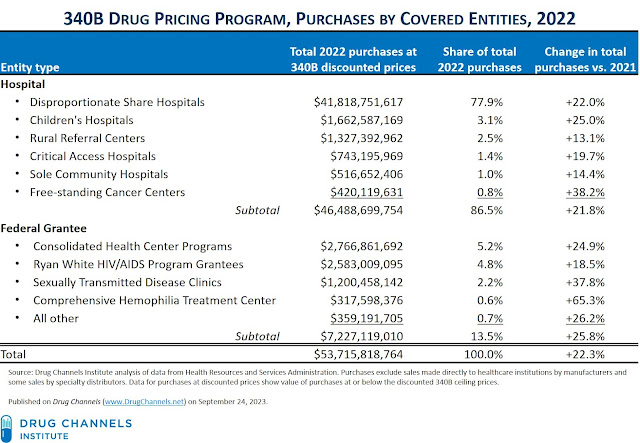

For 2022, discounted purchases under the 340B program reached a record $53.7 billion—an astonishing $9.8 billion (+22.3%) higher than its 2021 counterpart. The difference between list prices and discounted 340B purchases also grew, to $52.3 billion (+$2.6 billion).

Hospitals accounted for 87% of 340B purchases for 2022. Every 340B covered entity type experienced double-digit growth, despite drug prices that grew more slowly than overall inflation.

Another surprise: HRSA estimated that manufacturers' contract pharmacy restrictions reduced 340B purchases by only $470 million—or less than 1% of 2022's total purchases. That's far below the figure quoted by 340B lobbyists.

Once again, the data demonstrate that 340B advocates are wrong when they claim that manufacturers are “stripping critical resources from the nation’s health care safety net.” As I noted last year, only in the U.S. healthcare system can billions more in payments and spreads be considered a cut.

Read on for full details and analysis, including the opportunity to download your own copy of the raw data from HRSA.

I ♥ DATA

Apexus, the HRSA-designated Prime Vendor, reports purchases under the 340B Drug Pricing Program to HRSA and oversees most aspects of the program’s management.

I again had to file a Freedom of Information Act (FOIA) request with the Health Resources and Services Administration (HRSA) to pry out details of the ever-expanding 340B program. Below, I have reproduced the document that I received from HRSA.

This year, HRSA slow walked my May 2023 request by unexpectedly pushing my response date back to November. Thanks to some behind-the-scenes interventions, I managed to get the data two days ago. Curiously, the document below is dated “August 12, 2023.” To me, HRSA’s persistent lack of transparency seems distinctly like regulatory capture. But to be fair, perhaps they just have very slow computers.

Note that the data from Apexus include only indirect sales made via wholesalers. The $53.7 billion figure was less than the actual total of 340B purchases at discounted prices. That’s because the Apexus data exclude an unknown amount of manufacturer sales made directly to healthcare institutions as well as some sales by specialty distributors. HRSA notes this omission in its response.

Here are some other helpful references:

- For a deep dive into the pharmacy and PBM aspects of 340B, see Section 11.5. of our 2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

- Exclusive: For 2023, Five For-Profit Retailers and PBMs Dominate an Evolving 340B Contract Pharmacy Market (Our Taylor Swift themed analysis of this controversial element of the program.)

340BOOM

The chart below documents the 340B program's explosive growth.

[Click to Enlarge]

Observations:

- Discounted purchases made under the program totaled at least $53.7 billion in 2022—an increase of 22.3% over the $43.9 billion for 2021.

- The compound average growth rate (CAGR) of 340B purchases was 23.6% from 2015 through 2022. Over the same period, manufacturers’ net drug sales (excluding COVID-19 vaccines) grew at an average annual rate of only 3.6%. (See page 52 of IQVIA's Use of Medicines in the U.S. in 2023.)

- According to IQVIA, the wholesale acquisition cost (WAC) list price value of 340B purchases was $106 billion in 2022. (See The 340B Drug Discount Program Exceeds $100B in 2022.) That equates to more than 16% of pharmaceutical manufacturers’ total gross sales of brand-name drugs at list prices. (This figure also excludes COVID-19 vaccines.)

- In 2022, the list-to-340B gap—the difference between purchases at list prices and purchases at 340B discounted prices—grew to $52.3 billion (=$106 billion minus $53.7 billion). That’s $2.6 billion higher than the 2021 gap. This difference approximates the money collected by 340B covered entities.

- We estimate that the total value of pharmaceutical manufacturers’ gross-to-net reductions for brand-name drugs was $256 billion in 2022. (See Exhibit 189 of our 2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.) Therefore, manufacturers’ discounts under the 340B Drug Pricing Program accounted for about one-fifth of the total gross-to-net reductions for brand-name drugs.

FOLLOW THE 340B DOLLARS

HRSA also fulfilled my request for purchases by 340B covered entity type. The table below summarizes what happened in 2022.

[Click to Enlarge]

As you can see, every type of covered entity experienced double-digit growth in purchases under the 340B program in 2022 compared with 2021. Hospitals were again the primary beneficiaries of the 340B program, with 86.5% of total 340B purchases.

The response below includes the following statement: "HRSA estimates that at least $470 million of the total amount were purchases above the 340B ceiling price due to manufacturers restricting a covered entity’s ability to obtain the 340B discount when the entity dispensed the drug through a pharmacy under contract with the entity." In other words, the drama over controversial 340B contract pharmacies accounted for only 0.9% of the $53.7 billion in total 340B purchases. That figure is a small fraction of $8.4 billion in losses claimed by 340B Health.

Friendly reminder: Apexus is owned by Vizient, one the largest hospital group purchasing organizations. That’s right: The federal government outsources operations of a program that primarily benefits hospitals to an organization owned by hospitals. Hmmm.

REALLY?!?

The 340B Drug Pricing Program is now unambiguously the second-largest government pharmaceutical program, based on net drug spending. The Centers for Medicare & Medicaid Service projects that net spending under the Medicaid outpatient drug program will be a mere $45 billion for 2022. Yet unlike Medicare and Medicaid, 340B lacks a regulatory infrastructure, well-developed administrative controls, and clear legislation to guide the program.

Meanwhile, evidence of serious abuse continues to mount. Consider some recent examples of 340B hospitals behaving badly:

- Many Hospitals Get Big Drug Discounts. That Doesn’t Mean Markdowns for Patients., The Wall Street Journal

- How a Hospital Chain Used a Poor Neighborhood to Turn Huge Profits, The New York Times

- 340B Drug Discount Program: Information about Hospitals That Received an Eligibility Exception as a Result of COVID-19, United States Government Accountability Office

Fortunately, Congress has at last started to pay attention to this program—judging by six Senators’ recent request for information. Alas, it will be extraordinarily hard to reform the program, because everyone in the drug channel—hospitals, federal grantees, PBMs, pharmacies, plan sponsors, employers, insurers, wholesalers, technology vendors, consultants, and more—profits from the billions of 340B dollars that are sloshing around the system. Expect the out-of-control expansion to continue.

FOIA FOR U

Here is the complete document that I received from HRSA:

[Click to Download]

Careful readers may note that the sum of the figures in the HRSA document differs by $1 from the actual sum, which appears in my summary table.

No comments:

Post a Comment