In case you haven’t noticed, private equity firms have displaced hospitals and health systems as the major acquirers of community oncology practices. These financial firms have assembled significant oncology practice management companies that are primed for purchase by drug channel participants.

Below, I review recent M&A trends and then examine the strategic objectives behind the acquisition of private-equity-backed OneOncology by AmerisourceBergen (Cencora) and another financial buyer. As I explain, AmerisourceBergen (Cencora) gains significant strategic advantage from this transaction, which echoes a historical McKesson deal.

The Federal Trade Commission’s (FTC) has a newfound interest in the roll-up transactions that are creating practice management companies. Nonetheless, I expect this consolidation activity to continue—enabling a new round of vertical integration in the drug channel.

FYI: Today’s article is adapted from Section 6.3. (Future Trends for Buy-and-Bill Channels) of our new our 2023-24 Economic Report on Pharmaceutical Wholesalers and Specialty Distributors, now available to download at special launch pricing.

VERTICAL INTEGRATION 1.0

Over the past 15 years, there has been a significant shift in specialty drug administration from community physician practices to hospital outpatient facilities. This shift has occurred primarily because hospital and health systems have been acquiring physician practices, a.k.a., vertical integration.

As I discuss in The Inflation Reduction Act: 10 Predictions About Market Access and Drug Channels, the Inflation Reduction Act of 2022 (IRA) will provide powerful incentives for further vertical integration and may accelerate physician practices’ consolidation into health systems and hospitals. The ever-expanding 340B Drug Pricing Program will also play a key role in this consolidation.

In Section 6.3.1. of DCI’s new 2023-24 wholesale report, we discuss the six key economic and non-economic factors that have motivated hospitals’ vertical integration activity. We also describe the implications of these changes for wholesalers’ specialty distribution subsidiaries.

CONSOLIDATION + VERTICAL INTEGRATION 2.0

Today, however, the physician market is being transformed by both private equity firms and the activities of large, vertically integrated healthcare organizations.

Consider the activities of vertically integrated organizations that combine insurers, PBMs, specialty pharmacies, and providers. These organizations have acquired, launched, and/or invested in businesses that deliver medical care. Examples include: CareMore Medical (Elevance); CenterWell Senior Primary Care Family and Conviva (Humana); Evernorth Health Services (Cigna); VillageMD (Cigna), Oak Street Health (CVS Health); and OptumCare (UnitedHealth Group). Many of these companies are also expanding into such areas as home health and hospice care. These provider operations often receive reimbursement from one or more of their other commonly-owned businesses.

In addition to the activities of the vertically integrated organizations, there has also been a significant uptick in private equity acquisitions of physician practices across multiple specialties. DCI estimates that from 2013 through 2022, about 1,900 physician practices were acquired by private equity firms. (See Exhibit 127 in DCI’s new 2023-24 report.)

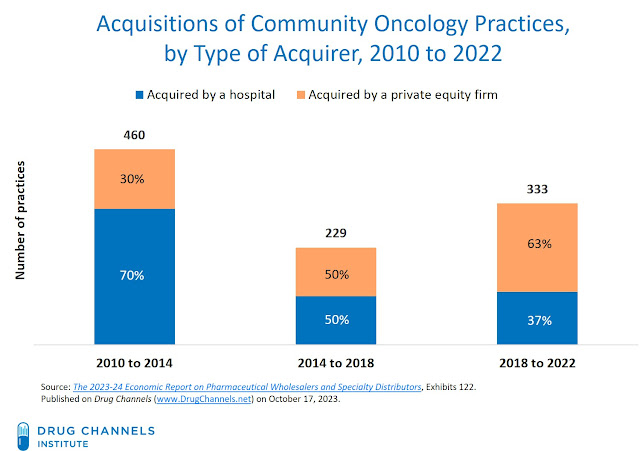

During this period, oncology practices accounted for about one-quarter of all private equity acquisitions of physician practices. From 2010 to 2014, hospitals and health systems accounted for more than two-thirds of community oncology practice acquisitions.

But from 2018 to 2022, private equity firms became the major buyers, accounting for nearly two-thirds of these transactions. (See the chart below.) Despite this uptick, about two-thirds of hematologists and oncologists are now employed by practices that are partially or fully owned by a hospital or health system. (source)

[Click to Enlarge]

In most cases, the financial buyers are using roll-up strategies, which involve building a large practice management business by acquiring and funding one or more platform practices and then buying addon practices. Examples of private-equity-backed oncology practice management companies include American Oncology Network, Integrated Oncology Network, OneOncology, and Verdi Oncology.

VERTICAL INTEGRATION 3.0?

Private equity firms buy companies to later sell them. Hospitals and the large vertically integrated organizations are likely buyers. But there are other, more intriguing channel buyers—as the actions of the large wholesalers illustrate.

Consider OneOncology, which launched in 2018 with $200 million in funding from General Atlantic. The three founding practices—Tennessee Oncology, New York Cancer & Blood Specialists, and West Cancer Center—had over 225 oncology providers and more than 60 care locations. Over the next four years, OneOncology acquired 12 additional practices, which grew the company to more than 560 physicians.

In 2023, General Atlantic sold OneOncology for $2.1 billion to a joint venture formed by AmerisourceBergen (Cencora) and private equity firm TPG.

By acquiring ownership in OneOncology, AmerisourceBergen (Cencora) achieves multiple strategic objectives. The company:

- Safeguards its role as the prime vendor distributor. That’s because OneOncology is aligned with Oncology Supply as its primary distributor and with ION Oncology Practice Network for GPO services.

- Protects its revenues. By forward-integrating into ownership of an oncology management company, neither a manufacturer nor a competitor can disrupt the business relationship. That’s why vertical transactions should be a wakeup call for manufacturers that dream of “cutting out the middleman” and selling directly to physician practices.

- Enables market share expansion. The transaction was structured as a joint venture in which AmerisourceBergen (Cencora) has 35% ownership. The presence of TPG ensures additional capital for further acquisitions, which will further increase AmerisourceBergen’s (Cencora’s) scale in oncology and specialty distribution.

Et tu, Cardinal Health?

ENTER THE FTC

ICYMI, the FTC and the Department of Justice (DOJ) recently issued draft Merger Guidelines by which these agencies will evaluate the anticompetitive effects of mergers and acquisitions. If these guidelines are finalized, they will increase the number and type of transactions that the agencies will legally challenge.

For example, Guideline 9 states: “When a Merger is Part of a Series of Multiple Acquisitions, the Agencies May Examine the Whole Series.” This suggests that the FTC and DOJ will more closely scrutinize the actions of financial buyers that attempt to consolidate fragmented physician markets via a series of roll-up transactions.

Last month, for example, the FTC sued U.S. Anesthesia Partners and private equity firm Welsh, Carson, Anderson & Stowe, alleging that the companies “executed a multi-year anticompetitive scheme to consolidate anesthesiology practices in Texas.”

The current FTC has a dismal track record at blocking mergers. So, I expect private equity firms to continue bundling provider businesses for strategic buyers. Like their fruit-based siblings, these deals promise real fun, rolled up in one.

P.S. On Thursday morning (10/19/23), I’ll be speaking at the Association for Value-Based Cancer Care meeting in New York City. My topic: “The Battle for Oncology Margin in U.S. Drug Channels.” Please say hello if you see me there!

No comments:

Post a Comment