Year in Review. Top 10 Real Estate News Stories in 2022

As we move further from the unforeseen ways the world was reshaped in 2020, notably the real estate market, there have been lasting impacts, such as in the way we list and sell homes, and many other ripple effects as the market adjusts. 2022 was yet another historic year in the real estate market, with record breaking highs and record breaking drops. We will recap the top 10 news stories.

1. Mortgage Rates are at a (Recent) All-Time High

The biggest story affecting the real estate market in Portland last year was the sharp increase in interest rates due to federal hikes, which likely won’t be lowering anytime soon. As inflation continued to impact the cost of groceries, gas, airfare and many other consumer goods, the Federal Reserve approved the largest interest rate hike in 28 years – three-quarters of a percentage point. (By raising prices still higher through increased interest rates, the Fed aims to curb consumer demand and ultimately bring inflation down.)

According to the U.S. Bureau of Labor Statistics, consumer prices at the end of the year had risen 6.5% since December of 2021. And as we shared halfway through 2022, projected mortgage rates as high as 7% did in fact become a reality in October and November, when they peaked at 7.08% – the highest interest rate in more than 20 years. Rates settled to 6.58% for 30-year fixed-rate loans (up from 3.3% in 2021) and 6.06% for 15-year loans by the end of December, but rates are likely going to stay high until inflation is under control. The Federal Reserve hiked its interest rate seven times last year and indicated it will continue to raise rates in 2023, which in turn puts pressure on banks to increase mortgage rates.

2. Portland Real Estate Supply and Demand is Shifting

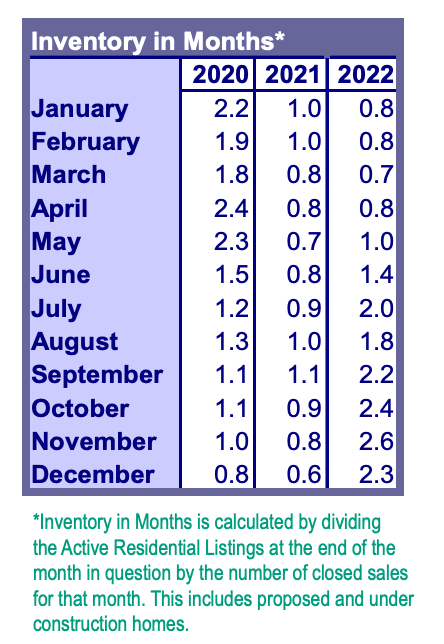

The average Portland home sale price increased 6.8% from $571,900 in 2021 to $610,900 at the end of 2022, according to a report by RMLS. Prices rose more than double digits in the first half of 2022, then fell in the second half to create the single digit gain. While prices fluctuated, buyer demand dropped off. As seen by the chart below, existing inventory is taking longer to sell. This is true even as less homes are entering the market (sellers can see the writing on the wall). But, be sure to keep reading before you give up on your real estate plans for 2023.

The factors of rising prices, higher interest rates and low inventory combined are putting a strain on new home ownership and affordability here in Portland and across the nation.

3. Housing Affordability is a Central Issue

According to RMLS, new listings this past December decreased 32.9% compared to December of the previous year. This inventory shortage leads to higher home prices, and the addition of high interest rates and wages that are not rising to meet inflation has led to an affordability crisis. Portland does remain more affordable than some West Coast cities, as we shared in our housing affordability assessment last spring, however these factors continue to deter potential homebuyers in Portland as well as the rest of the country.

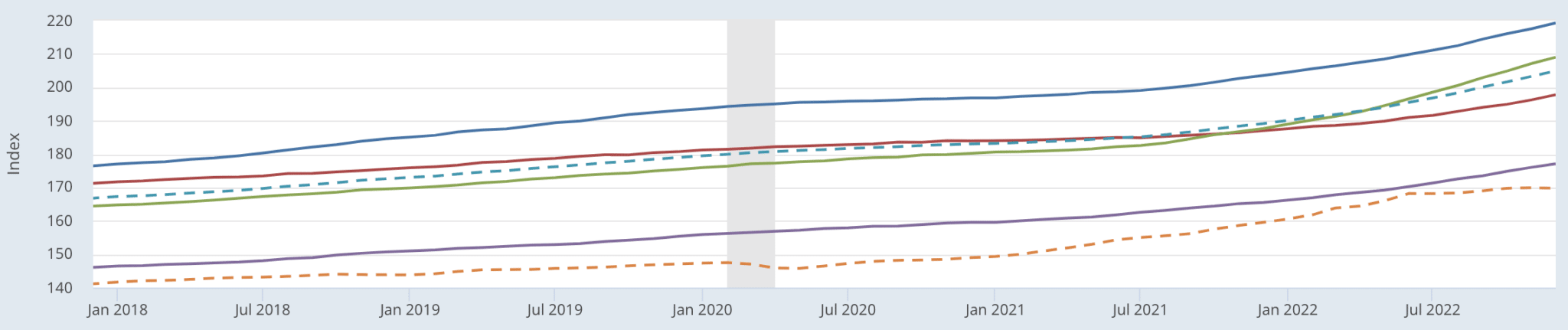

Rising costs extend to renters as well. According to data from the U.S. Bureau of Labor Statistics, rent prices are outpacing inflation. The average cost of rent has risen 23% over the last five years, while inflation has increased 20%, as shown on the graph below. At the end of the year, the cost to rent in Portland ranged from $1,250 for a studio to $1,797 for a two-bedroom, and these upward price trends are only expected to continue.

But there could still be good news on the horizon: home prices have started to drop and the city of Portland is taking steps to increase inventory that will positively impact housing affordability.

4. The Residential Infill Project Expands Affordable Housing

Phase one of Portland’s Residential Infill Project (RIP1), allowed single-family homeowners to add more than one Accessory Dwelling Unit (ADU) to their property in 2021, extending to include duplexes, triplexes, and fourplexes that fall within size constraints. In 2022, the project expanded to phase two (RIP2), which will allow even higher-density structures in areas previously zoned for single-dwelling housing. Approved structures include multi-family units, townhomes and “cottage clusters”: multiple units situated around a common green space.

With the RIP, Portland has become the largest U.S. city to end “single-family zoning”, and many are optimistic the reform will create more homeownership opportunities for more Portlanders by increasing the availability of affordable housing. Others are concerned about the changes that infilling will bring to the city, but as RIP project manager Morgan Tracy noted, it won’t happen all at once, but slowly over time as sites for new home construction become available.

5. Low Inventory plus Low(er) Buyer Traffic Reduces Housing Prices

After the summer of 2022, prices began to slowly decline through the end of the year as buyer traffic dropped even faster than inventory in the fall. The market response to a diminishing pool of buyers is decreasing housing prices. Prices have recently stabilized in Jan. of 2023 and will likely tick up slightly in the spring, before they fall again in the second half of 23. Learn more about the seasonal impacts on Portland’s housing market, including the best time to buy and sell a home here.

6. Oregon Home Energy Score Program Expands

Portland was only the second city in the U.S. to adopt a home energy program as part of its larger goal to lower carbon emissions 80% by the year 2050. The Home Energy Score (HES) program was enacted in Portland in 2018, with Milwaukie (2020), and then Hillsboro (2021) establishing their own programs a few years later. This past June, the Corvallis City Council voted to approve its own energy score policy after a few years of research and gathering community feedback. Its new policy is set to take effect on April 1, 2023.

When the Portland HES was introduced, it became law that before (most) homes are put on the market, sellers must complete home energy assessments and publicly share the resulting score and report. Eugene, Oregon currently has a voluntary energy score program in place, but city officials are exploring the potential of mandating scores. Now Eugene just may be the next Oregon city to adopt an energy score requirement.

If you are preparing to list your home, having a trusted resource to help you navigate the new requirements is invaluable. That’s why we recommend OrderHomeEnergyScore.com, an experienced provider that has been scoring homes in Portland since the beginning. They also offer competitive prices and their online scheduling is quick and easy.

7. Population Growth in Portland is Reversing

In June, we reported on the simultaneous population decline within Portland and growth in the surrounding suburbs. According to PSU’s Population Research Center, Multnomah County experienced a -0.29% decrease in population from July 2021 to July 2022. The Portland metro “tri-county area” is made up of Multnomah, Clackamas and Washington counties. The entire cities of Portland and Gresham are contained within Multnomah County (remaining suburbs are found within Clackamas and Washington) – which shows just how significant this shift in population is.

| County | 2022 Certified Population Estimate | Population Growth / Decline |

| Multnomah | 810, 242 | -0.29% |

| Clackamas | 430, 421 | 0.84% |

| Washington | 606, 378 | 0.25% |

As shown in the table above, while Washington county did not experience a loss in population, its growth has slowed remarkably to .25% over 2021, when it had a higher growth percentage of .69%. This data supports the trend over the last few years of buyers preferring the suburbs over Portland proper.

8. Portland is 4th in the Nation for Highest Property Taxes

Last month we discovered that Portland had moved from its position as the city with the fifth highest property taxes in the nation to fourth highest, at 2.62%. In November’s general election, voters chose to renew measures and pass new bonds that will be funded by property taxes. For better or worse, we can depend on these legislative measures combined with the way Portland taxes are structured to continue to raise property taxes year after year. For more on how Portland property taxes are calculated, here is a helpful article from Oregon Live.

9. Market Trends Predict 2023 will be a Golden Year for Buyers

A big question year after year is whether the housing market will experience a crash similar to the crash in 2008-2011. In December we projected that housing prices will most likely continue to drop (overall) in 2023. With interest rates finally expected to start dropping in 2024, home prices will soar, possibly making 2023 the best time –for perhaps another decade – to buy a new home or invest in Portland real estate. To learn how this might be the best time to invest in Portland real estate, read the full article here.

10. Local Realtor Wins Five Star Professional Award 10th Year in a Row

Okay, this is not a major news headline. But personally, in 2023, I’m celebrating 20 years selling homes in Portland, Oregon. I’m thankful for being awarded the title of “Top Realtor” in the Portland Metro area by Five Star Professional. This past year marked my 10th year in a row to be honored with the award, which is based on client interviews and sales minimums.

My team would love to talk with you about your 2023 real estate plans. Please contact our top 1% sellers team at 503-714-1111. And if you are ready to buy a new home, our top 1% buyers team is ready to help you find it. Call us today at 503-773-0000 for a no-obligation appointment. We’d love to connect.