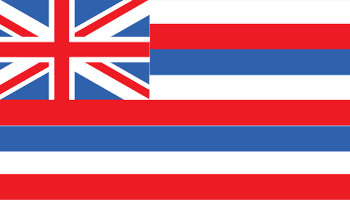

(Honolulu, HI, USA – January 14, 2022) - After an abrupt ending to the 2021 legislative session, legislators in Hawaii hope to pick up where they left on and eliminate state taxes on the purchase of gold, silver, platinum, and palladium.

Last year, sponsored by Rep. Okimoto (36-R), House Bill 1184 passed out of the House Committee on Economic Development unanimously and received a do-pass recommendation from the House Finance Committee.

Without notice, the passage of Biden's federal coronavirus relief package halted state legislative sessions all over the country. However, building on last year's momentum, sound money advocates in Hawaii are hopeful about chances of passage in 2022.

Under current law, Hawaii citizens are discouraged from insuring their savings against the devaluation of the dollar because they are penalized with taxation for doing so. House Bill 1184 removes the disincentives to holding gold and silver for this purpose.

Removing the tax on the purchase of gold and silver coins, bars, and rounds would especially benefit small-time savers and investors, who, unlike the wealthy, have more limited options to obtain precious metals investments. House Bill 1184 would help level the playing field.

Here are a few reasons why House Bill 1184 would benefit Hawaiians and Hawaii:

- Studies have shown that taxing precious metals is an inefficient form of revenue collection. The results of one study involving Michigan show that any precious metals tax proceeds Hawaii gains are likely surpassed by the state revenue lost from conventions, businesses, and economic activity that are driven out of the state.

- 42 states have removed some or all taxes from the purchase of gold and silver. Hawaii currently stands against the vast majority of its peers.

- Taxing precious metals is unfair to certain savers and investors. Gold and silver are held as forms of savings and investment. Hawaii does not tax the purchase of stocks, bonds, ETFs, currencies, and other financial instruments.

- Levying taxes on precious metals is inappropriate. In many states, purchases of computers, shirts, and shoes carry taxes because the consumer is "consuming" the good. Precious metals are inherently held for resale, not "consumption," making the application of taxes on the purchase of precious metals inappropriate.

- Taxing precious metals is harmful to citizens attempting to protect their assets. Purchasers of precious metals aren't fatcat investors. Most who buy precious metals do so in small increments as a way of saving money. Precious metals investors are purchasing precious metals as a way to preserve their wealth against the ravages of inflation. Inflation harms the poorest among us, including pensioners, Hawaiians on fixed incomes, wage earners, savers, and more.

In 2016, the state of Louisiana experimented briefly with slapping taxes on precious metals purchases. They quickly reversed course only one year later -- and reinstated the exemption on precious metals -- because businesses and coin conventions were closing their doors, and state tax revenues.

Meanwhile, 42 states have removed some or all taxes from the purchase of gold and silver.

The Sound Money Defense League and Money Metals Exchange strongly support and are actively working with lawmakers in Hawaii to ensure the passage of this important measure. Tennessee, Mississippi, Kentucky, and Alabama are just a few of the other states fighting their own sound money battles in 2022.

About the Author:

Jp Cortez is a graduate of Auburn University and a resident of Charlotte, North Carolina. He is the Executive Director of the Sound Money Defense League, an organization working to remonetize gold and silver through nationwide legislative efforts. Follow him on X (Twitter) @JpCortez27.