Portland Real Estate Market Report: Interest Rates Steady, Demand High 5/2021

Last week, the Bureau of Labor Statistics released the jobs report for April, and it was a huge blow. According to the report, the U.S. added 266,000 jobs last month. In any normal era, that would look pretty positive. But in the time of Covid-19, it’s a different story. Experts had predicted that we’d add about 1 million jobs, based on the expectation that vaccine roll out would have more people comfortable enough to reenter the workforce. Instead, we saw the slowest growth since January.

So how does the jobs report affect the Portland real estate market, you might be wondering? The answer has to do with the Federal Reserve and its plans as we reopen – theoretically – the economy. Back in March, Fed Chair Jerome Powell made clear that he doesn’t intend to raise rates or change monetary policy drastically until 2022 at the earliest. And he’s stuck by that statement, even when the job reports have been more optimistic. The Fed plans to keep pumping the economy with cash and incentives until we are more solidly out of the woods than we are now. Let’s take a look at where the Federal Reserve stands now, and how that might affect the housing market.

How the Federal Reserve Does and Doesn’t Affect Mortgage Rates

To be clear, the Federal Reserve does not set mortgage rates directly. Mortgage rates rise and fall due to a complicated set of macroeconomic factors, making it hard to ascribe changes to any one circumstance. But the Fed does set monetary policies that affect mortgage rates indirectly, particularly when it comes to funding government-backed mortgages, which put downward pressure on mortgage rates.

And the pandemic qualifies as one time when their influence is evident. Economists and reporters speculated that Fed Chair Powell might soon ease off his support of government-backed mortgages. The thinking went that if the jobs report signaled strong economic bounce back, monetary policy might reflect that change. However, this didn’t come to pass. First, on April 28th, the Fed issued guidance to Fannie Mae and Freddie Mac to continue buying government-backed mortgages at the same volume. That suggests that Powell stands by his assertion not to move too fast when it comes to changing monetary policy. Then came April’s infamous jobs report. If Powell ever was considering big changes, those disappointing numbers certainly squashed that idea.

All of this points to the likelihood that mortgage rates will hold steady. They’ve been climbing slightly recently, with the national average now at a little over 3%. But don’t expect to see huge spikes anytime soon. And folks might need that stability, with inventory shortages (vs. buyer demand) causing home prices to soar in Portland and across the nation.

Has Portland’s Inventory Bottomed Out?

Yes, just like many other parts of the country, Portland’s inventory crisis persisted in April and shows no sign of letting up. Our latest monthly RMLS data shows that the ratio of active listings to closed sales was 0.8 for April. That’s the same number we saw in March, and still a record low. That’s also despite the fact that new listings are up from March of 2021 by 17.3%. So it appears that the trend continues: even with more and more new listings, demand outstrips supply. Our numbers for May so far don’t evidence much change, either.

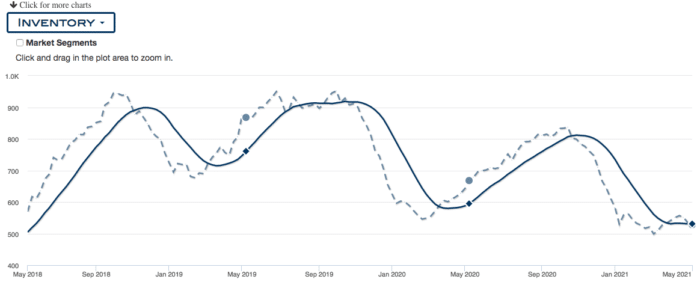

The above graph shows typical peaks and troughs for inventory in Portland. As you can see for 2019, and even in 2020 despite the pandemic, this time of year is generally when inventory starts to increase again. However, the beginning of May shows no signs of this pattern yet. Instead, inventory has remained at a steady low. Hopefully this signifies that inventory has bottomed out, and has nowhere to go but up. But we don’t see any evidence for that happening right away.

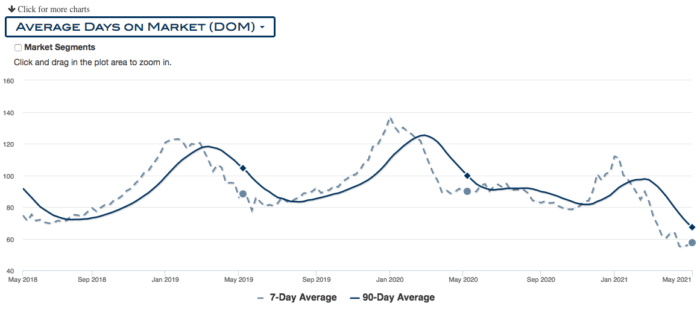

April’s average number of days on the market dipped as well – down to 27 from 37 in March. What’s unusual isn’t the drop – that’s also typical for this time of year – but how low the drop has taken us.

As you can see, typical yearly peaks and troughs make a pattern. (Note that you shouldn’t focus on most of 2020; for obvious reasons, that year disrupted the usual rhythm.) But you can see what starts out as a normal increase in early 2021 – before it dips into our current spot, which is significantly lower than comparable times in other years.

All of these statistics together support the notion that Portland’s supply simply is still not catching up to demand, no matter how many more homes come on the market.

Condos Closing the Gap, But Continue to Struggle Downtown

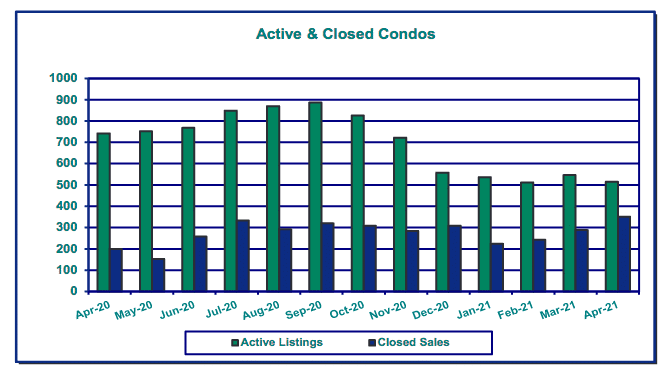

Our April RMLS report has some encouraging news for the condo market – or part of it at least. The disparity between active and closed condos sits at its smallest all year, and by a considerable amount.

Before anyone celebrates, though, we have to note that there’s a big difference between what’s happening in the suburbs and what’s happening in inner Portland. Those in the know will tell you that condos in downtown Portland aren’t faring so well. And looking at the average days on the market by zip code proves it.

Take zip codes 97205 – the zip of Pioneer Courthouse Square – and 97201 – the zip of Portland State University. The current average days on the market for these locations are 116 and 132 respectively. Now let’s take a trip out to zip code 97005, which is the heart of Beaverton. The average days on the market for condos there is only 28. How much of the lack of interest in inner city condos can be chalked up to Covid cabin fever is anyone’s guess. But it’s clear that condos in city center still struggle.

Your Best Bet? Work with a Top 1% Agent

Whether you’re looking to take advantage of the seller’s market or want the big guns behind you as you navigate your next home purchase, having a trusted agent is the place to start. Our agents know the market, and know Portland. We are available to make sure you get the most out of your next real estate move – whatever the market is doing. See our pay less and get more home selling services or read about our experienced buyer’s agents to learn more, and get ready to take the plunge!