Big news today from Capital One! As Nick detailed earlier today, Capital One “miles” now transfer 1 to 1 to several airline and hotel programs. They’ve also added a few new transfer partners including Citi’s (previously) secret weapon: Turkish Miles & Smiles. See Nick’s post for full details. In this post, I’ll share my quick reactions to these developments…

Capital One “Miles” finally earn their name (and my T.V. is safe)

When Jennifer Garner acts all smug about earning double miles everywhere, I usually want to throw a brick at the T.V. Just because Capital One has insisted on calling the points earned on their credit cards “miles” didn’t mean they were equivalent to airline miles! Not at all! Before Capital One added the ability to transfer “miles” to airline and hotel programs, their “miles” were really more like pennies, but pennies that could only be spent on travel. There was no way to get outsized value from their rewards. Capital One took a big step in correcting this when they first added transfer partners. It was finally possible to get outsized value. But, until now, the transfer ratios were all 1,000 to 750 or 1,000 to 500. In other words, even though the Venture Card earns 2 Capital One “miles” per dollar, it previously earned, at most, 1.5 airline miles per dollar. Now, though, Capital One has introduced several 1 to 1 transfer partners! Finally, Jennifer’s double-miles-everywhere smugness is warranted!

My 100K Venture approval is so much sweeter!

My recent approval for the 100K Venture Rewards offer, is worth so much more now! After spending $20K on my new card, I’ll have 140,000 Capital One “miles”. With the old 1,000 to 750 transfer ratio, that would have meant that I could transfer 140K “miles” to 105K airline miles or Wyndham points. That wasn’t bad, but now, 140K really means 140K (for several valuable transfer partners)! See: Finally approved by Capital One!

My take on each 1 to 1 transfer partner

Here are my quick thoughts about each of the one-to-one (as of 4/20/21) transfer partners:

- Wyndham Rewards: Capital One previously transferred 1,000 to 750 to Wyndham but will now transfer 1 to 1. And Capital One has the only transferable points program that transfers to Wyndham. A month ago, I would have said that this is a nice, but not exciting addition. Now, with the addition of Vacasa Vacation Rentals, though, this is exciting! Chase Ultimate Reward’s super power is the ability to transfer 1 to 1 to Hyatt. Capital One’s super power now is 1 to 1 transfers to Wyndham. If forced to choose between the two, I’d still take Hyatt every time, but since I have points in both programs I’m very happy to have Wyndham transfers in my arsenal. See: Wyndham Vacasa: Great Value is Real!

- Avianca LifeMiles: LifeMiles is a very strong program for booking Star Alliance awards. Unfortunately, their online award booking tool is

severelylimited, their customer support is not exactly top-notch, and they have relatively high change fees. Still, it’s possible to get incredible value booking awards through LifeMiles. See: Avianca LifeMiles sweet spots for award flights. - Cathay Pacific Asia Miles: Asia miles is a solid option for booking OneWorld awards (e.g. flights on American, Alaska, Japan Airlines, Qatar, etc.). Also, if booking awards on Cathay itself, you’ll often find better award availability. For ideas for how to squeeze the most of these awards, see: Cathay Pacific Asia Miles mixed cabin award pricing. First class for less.

- Etihad: Etihad has a number of great sweet-spot awards which are great when you have the need for those specific routes. I see this as a very good addition, but not as widely useful as Wyndham, LifeMiles, or Asia Miles. See: Etihad Guest Sweet Spots for award tickets in business class or economy.

- Qantas: Qantas has a distance-based award chart with which it is possible to dig up some good values. Like Etihad, I see this as less widely useful than Wyndham, LifeMiles, or Asia Miles, but there are times Qantas can be the best choice. See: Qantas sweet spots for award tickets.

- AeroMexico, Finnair, and TAP Air Portugal: There may be good uses for these miles, but I’m not aware of them.

- Choice Privileges (to be added later this year): I’m not particularly interested in this option because 1) Choice often sells their points at a discount for less than a penny each; and 2) It’s possible to indirectly buy Choice points for less than a penny each by booking and cancelling points & cash awards.

Turkish not 1 to 1, but still an awesome addition

In addition to the 1 to 1 transfer partners listed above, Capital One has also added two new 1,000 to 750 transfer partners: Turkish Miles & Smiles, and British Airways Avios. Of the two, Turkish is the most exciting to me. Of course, if you have Citi ThankYou Points, you can transfer to Turkish 1 to 1. Otherwise, some of Turkish’s sweet-spots are so good that even at less than 1 to 1 transfers, it’s possible to get fantastic value. Do note that working with Turkish to book, change, or cancel flights can be extremely frustrating unfortunately. See: Complete Guide to Turkish Miles & Smiles.

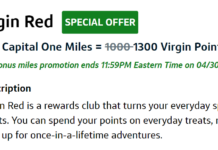

Where’s Virgin Atlantic?

Amex, Chase, and Citi points transfer 1 to 1 to Virgin Atlantic. Capital One doesn’t yet offer Virgin as an option at all. What’s the deal? Even though Virgin Atlantic recently devalued many of their Delta awards, there are still a number of incredible sweet-spot awards that can be booked with Virgin Atlantic miles. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight).

New Reasonable Redemption Value

Our “base” Reasonable Redemption Value (RRV) for transferable points programs is 1.45 cents per point. Because Capital One transfers were previously capped at 1,000 to 750, though, we reduced their RRV to 1.05. Now, with 1 to 1 transfers, Capital One gets the full 1.45 points per dollar treatment. This makes the Venture Rewards Card and similar Spark Miles Business Card two of the best cards for everyday spend since they earn 2 transferable points per dollar on all spend.

General Thoughts

I’m excited to see Capital One join Amex, Chase, and Citi as a first-tier transferable points program! While each of the other programs offer some significant advantage over Capital One, Capital One has some serious advantages of its own: Capital One is the only program where you can earn great rewards for everyday spend (e.g. 2X everywhere) and no foreign transaction fees and the ability to transfer to airline and hotel partners without having to sign up for more than one card. Capital One also has the only first-tier transferable points program that lets you move points to any other cardholder without restriction and without adding an expiration date to the points (as Citi does).

While personally, I wouldn’t want to rely only on Capital One “Miles” as a source of transferable points, it’s no longer necessarily a bad idea. Previously, I saw their program as one for those who primarily want the simplicity of a 2% back everywhere card but also wanted the ability to get outsized value through transfer partners even if it wasn’t something they were likely to do often. Now, it’s a credible program for those who primarily want to transfer “miles” to airline miles or hotel points. That’s a huge step forward!

Finally, I’m also excited for the future. Capital One seems to be aggressively enhancing their “miles”. I doubt that the latest news is the last we’ll hear. Hopefully they’ll add more partners (Alaska? Virgin Atlantic? Korean? Amtrak?) and convert more partners to 1 to 1 transfers (Air Canada? JetBlue? Accor?). Similarly, I’d love to see new companion cards that earn “miles” at higher rates within popular categories of spend. To be clear: I’m not hinting that these things are coming (I have no idea), I’m just optimistically hopeful. I can’t wait to see what’s next!

Not familiar with Capital one at all, but do they have RATS like Amex on buying GCs for SUB and do they give miles when purchasing $1k Simon VGC? Without bonus categories, it is very hard to earn a big sum of mile to make transferring to partners useful. Do they frown at Manufactured Spending like Altitude reserve?

I hit the 50k spend SUB (300k total Capital One Miles) on the Biz Spark card 2 years ago using giftcardmall and other MS routes. Maybe some organic spend, but definitely not more than 3k. No history with $1k Simon specifically, but no issues or clawback with pretty egregious and blatant MS.

Similar experience. Some do get shut down. They haven’t been among the most sensitive in my experience. YMMV.

And actually, TY points convert 1 to 1.1 Turkish miles if paired with a Rewards Plus card, up to 100k per calendar year. Just saying as it’s an easy thing to forget to take advantage of every year.

I still don’t intend to ever apply for a Cap1 card again after being denied last time. 🙂

I just canceled mine when they wouldn’t waive the annual fee like they had been doing in the past. They offer to “upgrade” you to the no fee Venture card, however, you still have to pay the annual fee this year. Have fun with Capital One.

OMG, I just had the same experience about this stupid thing with them this morning. I posted it in the FM facebook group. Basically, 3wks before my AF was due and called them and asked for downgrade to avoid the AF and the rep told me to call back after the AF is posted so it can be refunded.

So I just called this morning, after the AF posted over the weekend, spoked with 3 different rep, and the last one being senior account manager told me that I could only downgrade it and avoid the AF if I did it before it was posted, otherwise I would have to close the account… I was so mad because the other rep literally told me to wait. This guy doesnt even bother offer half a sincere apology and basically told me that: Im sorry you got the wrong information but either pay it or close it… I had no problem closing it right out. Their customer service is at a whole different level of incompetence and indifference.

Add me to the list! I called a few months ago after the fee posted (didn’t make sense to me to waive something that wasn’t there) and got the same response on downgrading, which truly makes no sense. I canceled instead within 30 days and was credited back the annual fee. I’m not that upset, it never felt like a long-term keeper, but would have been nice to have the no fee version to have another option.