A couple of years ago, Greg wrote a post called The new true value of Southwest points. How to get up to 1.9 cents per point in value. I was re-examining that post in preparation for what I planned to be an entirely different post today, until I realized something: the COVID-19 pandemic has indirectly (and I expect temporarily) decreased the value of Southwest Rapid Rewards points. I do not mean that in the sense that flights have been canceled and most of us have been making an effort to stay home and stay safe (obviously also true), but rather that the CARES act’s removal of some taxes has actually decreased the value of Southwest points to some extent. To be clear, this post is not meant as a critique or even as a commentary on CARES, nor am I advocating near-term travel. I just found it very interesting to see how the value of points has changed unexpectedly.

Note: After publishing this post, it was brought to my attention that Gary at View from the Wing had noted this coming devaluation upon the introduction of the CARES act. See his post here.

The fluctuating value of Southwest points: International fares

Greg’s post on the new true value of Southwest points pegged our Reasonable Redemption Value at 1.5c per point while showing how to get up to 1.9c per point from Rapid Rewards.

The precursor to that post was that Southwest had recently changed the value of their points. Since that time in 2018, Southwest flights have cost 78 points per dollar on the base fare. That rate is consistent whether buying a wanna get away, anytime, or business select fare. In other words, if you could find a flight with a base fare (before taxes) of $100, it would cost 7,800 points. Stephen had used that figure to calculate the value of Southwest points at 1.28c each (since 7,800 points buys $100 of airfare). However, Greg showed that the math isn’t quite that simple.

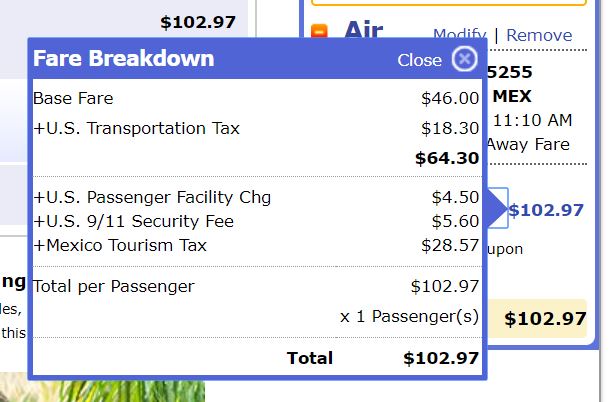

It’s worth reading that entire post, but the gist of it is that pre-pandemic, Southwest points were worth significantly more when buying flights to certain international destinations because Southwest charged less in taxes when using points than they do when you use cash. The specific example Greg gave was this one, where a flight to Mexico City had cost $102.97, of which $56.97 was taxes and fees.

When paying with points for the same flight, Southwest did not charge the US Transportation tax or US Passenger Facility Charge. Due to the very cheap fare, those taxes (a total of $22.80) made up a very significant portion of the total price of $102.97. Using points saved you the cost of those taxes and increased the value of points accordingly. In that example, the flight could have been booked for 3,588 points plus $34.17, so the points (3,588) were saving you $68.80 ($102.97 – $34.17), yielding a value of 1.91c each.

- $102.97 (full cash fare) – $34.17 (taxes paid on award) = $68.80 (savings when booking an award ticket)

- $68.80 / 3,588 points = 1.91c per point

However, the situation has changed. The US has suspended several flight taxes until January of 2021 as part of the CARES act, which means that Southwest points for flights to Mexico (and other international destinations) are worth less today since the (now) $18.90 tax on an international segment is currently suspended.

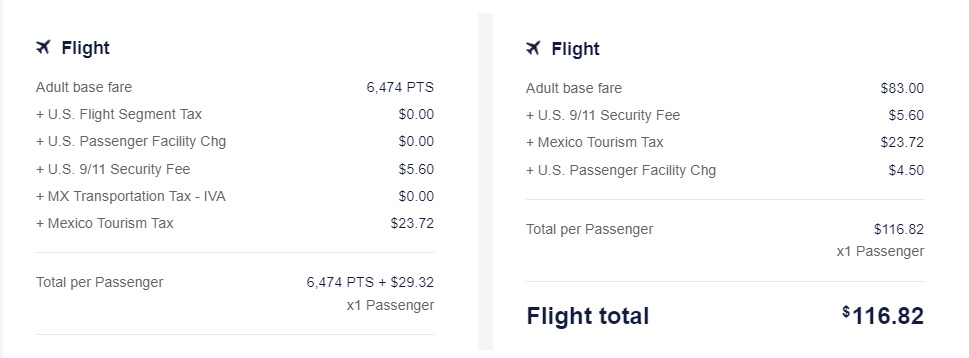

For example, take this flight from Los Angeles to Los Cabos, Mexico. You’ll see that the cash fare (on the right side) no longer includes a US transportation tax, but rather just the US 9/11 security fee, Mexico Tourism Tax, and US Passenger Facility Charge.

Using points for a flight to Mexico now only saves you the US Passenger Facility Charge ($4.50) in terms of additional taxes & fees saved. Again, this is a temporary situation as I expect the additional taxes will return in 2021.

In this new example to Los Cabos, using 6,474 points saves you $87.50 (since you still pay $29.32 in taxes on an award ticket). That yields a value of 1.35c per point, which is significantly less than Greg had previously calculated because you are no longer saving ~$18 in taxes (since nobody is paying that tax until 2021).

- $116.82 (cash fare) – $29.32 (taxes paid on award) = $87.50 (savings when using points)

- $87.50 / 6,474 points = 1.35c per point

The fluctuating value of Southwest points: domestic fares

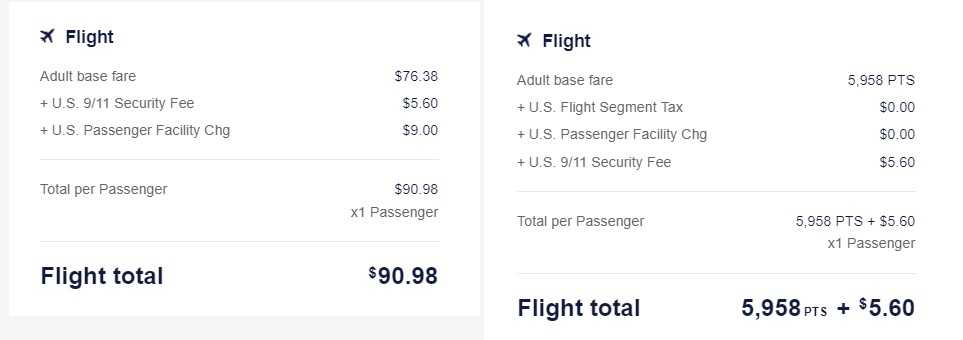

Because of the CARES act suspension of some taxes on international flights, the best value for Southwest points is once again to be found on domestic itineraries. Take this itinerary from St. Louis to Albany as a side-by-side comparison:

The base fare is $76.38 or 5,958 points (which works out to 78 points per dollar, as we would expect). Since you will still pay $5.60 in taxes if you use points, here is the math to determine the value of Southwest points in this instance:

- $90.98 – $5.60 = $85.38 in savings when using points

- $85.38 / 5,958 points = 1.43c per point

However, the math isn’t quite that simple for every flight. In the above example, notice that the paid fare includes a $9.00 US Passenger Facility Charge. You do not pay that fee on an award ticket.

The US Passenger facility charge is $4.50 per segment up to 2 segments each way (i.e. up to $9 each way). Therefore, direct flights will yield lower value in terms of cents per point.

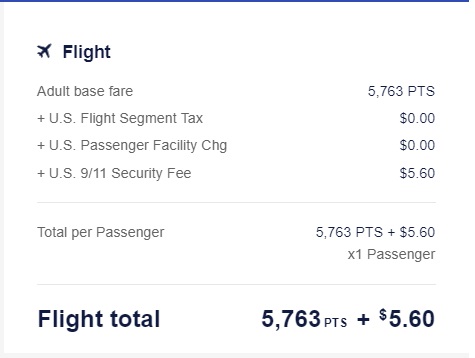

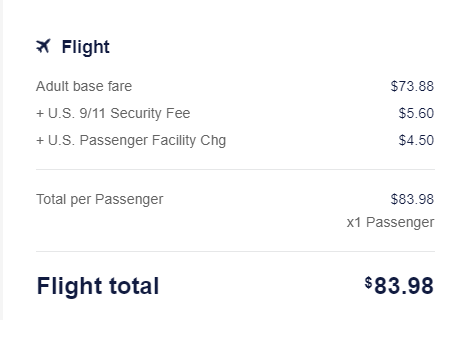

Take an example with a single segment (nonstop flight) from New York (LaGuardia) to Atlanta:

That same flight could alternatively be booked with 5,763 points and $5.60.

Thus the value of Southwest points in this instance is:

Thus the value of Southwest points in this instance is:

- $83.98 – $5.60 = $78.38 saved when using points

- $78.38 / 5,763 = 1.36c per point

Given the fact that this is a single-segment itinerary, the value is essentially the same as the Mexico flight since the base fares are similar and you’re only saving $4.50 (US Passenger Facility Charge) by using points in either instance.

However, since the US Passenger Facility charge is added per segment (up to two segments), adding an additional segment beyond Atlanta, if you can find such an itinerary for the same price, will yield slightly better value for Southwest points.

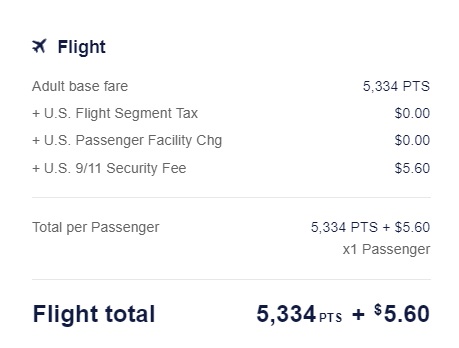

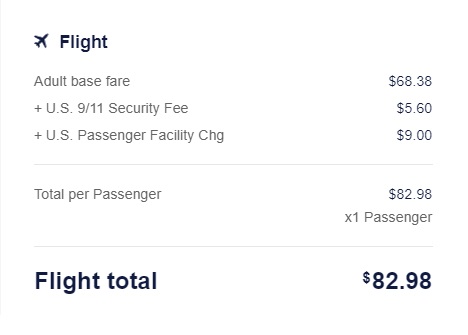

For example, here is the cash price for an itinerary from New York LaGuardia to Orlando (which incidentally connects in Atlanta):

In this case, the cash price is actually a buck cheaper. The points price is also cheaper at just 5,334 points and $5.60.

This time, the value per point is a bit different:

This time, the value per point is a bit different:

- $82.98 – $5.60 = $77.38 saved when using points

- $77.38 / 5,334 points = 1.45c per point

The key then in getting the most value out of points is still essentially the same thing that Greg proved two years ago: fares where the taxes that become “free” make up the highest percentage of the base fare yield the highest per-point value. Unfortunately, I think the only taxes that are free on an award ticket for travel until 2021 will be $4.50 per segment up to $9.00 each way. The key in finding the opportunities for the greatest value per point is finding really cheap flights where $4.50 or $9.00 make up the highest possible percentage of the fare.

In the previous post about the new true value of Southwest points, Greg showed that while the actual value for Southwest points would vary a bit, he figured our Reasonable Redemption Value at 1.5c each based on a domestic round trip that cost $366, where he had calculated the cost per point at 1.51c. I found a flight costing the same ($365.96), but the value per point was now lower:

- $365.96 – $11.20 = $354.76 saved by using points

- $354.76 / 26,268 points cost = 1.35c per point

In my example above, that flight had 2 segments in each direction, so using points saved $18 total in US Passenger Facility charges round trip. If it had been a direct round trip ($9 in US Passenger Facility Charges), the value per point would have been very slightly lower.

Bottom line

Southwest points are worth a bit less today than they were two years ago; ironically, it isn’t a devaluation from Southwest but rather an alleviation of taxes in response to the COVID-19 pandemic that is to blame. To be clear, I am not making a statement on the CARES act with this post — I simply hadn’t realized the correlating affect on points until now and found it interesting. I do not propose we yet change the Reasonable Redemption Value of Southwest points because the situation with waived taxes is temporary. When the schedule opens into January 2021, I expect we will once again see Southwest points yielding similar value to what Greg showed a couple of years ago. We’ll watch that — if that isn’t the case, we will adjust our RRVs accordingly. Overall, this temporary change is unlikely to make a major difference for most Southwest Rapid Rewards members; after all, I don’t expect that most members will hunt for an indirect routing to their destination in order to eke out an additional eight hundredths of a cent per point. However, I found it interesting that (theoretically) making flights cheaper for everyone by removing some taxes reduces the value of Southwest points for the time being. I’m still happy to have a Companion Pass in my household and a decent stash of Southwest points and I am unlikely to sharpen the pencil quite this closely when booking my own trips with points, but at the same time I find it interesting to know where there are opportunities to get better value for Southwest points (and which options yield worse value) as that could help maximize opportunities as they arise.

![[Back] Costco offering 10% off Southwest gift cards again Southwest-Gift-Card](https://frequentmiler.com/wp-content/uploads/2023/12/Southwest-Gift-Card-218x150.jpg)

[…] the government temporarily eliminating some taxes) points tend to be worth 1.35 to 1.45 cents each (see this post for details). With this sale, points are worth around 1.7 cents per […]

[…] points. That’s a rate of 1.28c per point. Considering the fact that Southwest points are generally worth about 1.4c per point (and sometimes as high as 1.9c per point) and are worth at leas…, that’s a great deal. At the very least, you should gain some value when converting to […]

Nick, I generally enjoy your deep dive posts, and often enjoy learning some of the subtleties you inevitably uncover. And I know you didn’t ask for feedback, but the point youre trying to make here, that “southwest points are worth a bit less today…” is at best misleading. I mean, yes, the cpp has decreased with the international flights, but correct me if I’m wrong: The same amount of southwest points + cash will purchase the same flight to mexico. It seems that you’re asserting that a discount (in this case, tax relief) devalues a currency (rr point). And I know that normally, reasonable redemption values have to be based on the cash that’s replaced. But I think it’s a fallacy to base an increase or decrease in value based on a new amount of cash that’s replaced, instead of what good/service it provides, especially in the case where the currency can’t readily be exchanged for cash. In other words, you can’t exchange rr points for cash (like you can with UR and MR), so if a flight requires the same amount of points and cash as it did before, there’s no devaluation of RR points.

You raise a good point and a fair perspective that I think demonstrates how this game is not as simple as it seems. When you get into the weeds, there becomes a lot of room for debate. Part of me agrees with what you’re proposing. Almost.

For the record, feedback and differing opinions are always welcome!

But I’ll disagree with you to some extent because you didn’t want me to lay down and die without a fight, right?

Theoretically, the value of your cash has increased by one measure (and that’s the goal of tax relief here, right?). Let’s imagine this from a totally unrealistic perspective and hypothetical example: Let’s say the flight costs $100 today and you have exactly one $100 bill in your wallet.

If we measure the value of your cash by the good/service it provides, then your cash became more valuable thanks to the tax relief. Your hundred dollar bill is more valuable today because today it can buy you a flight to Mexico whereas in February it could not have bought you a flight to Mexico (since it would have cost $118.90 with the international segment fee). So your cash buys something now that it couldn’t before. That’s fundamentally how we determine the value of currency, right? (By what it can buy in terms of milk, eggs, bread, etc — usually the metric is basic human needs, but the concept is that currency is worth what it can be traded for).

By that perspective and assuming that unrealistic scenario, you would be right that the value of the points in terms of the product they can buy did not change (and all that I’ve written so far I believe reiterates the point you were making).

However, as you point out, we ordinarily determine the value of points by the amount of cash they replace (and therefore the amount of cash that stays in our pocket), which is a little different than judging based on what product they buy. That makes more sense when you’re dealing with something (flights) that has such a variable and subjective value in the real world versus staples like bread and milk that have a more constant value. You are correct that you can’t trade RR points for cash — but how much cash they keep in your pocket should be the measure of their value. Essentially, when that tax was there, you were able to trade your points for $18 cash that stayed in your pocket.

In February, your points replaced (just for argument’s sake) $118. Today they replace $100. You are correct that if you measure value the way we typically do currency (by the thing it can buy), then the value would be the same (you get a flight to Mexico either way). But if you value the points by the cash they replace / the cash that stays in your pocket, they replace a bit less cash today than they did before. We had previously measured the value of the points this way — based on the amount of cash they replaced — in determining their value. And that made sense — using points in February was saving you that extra $18 over using cash. We had to count that in the value since points provided real cash savings. To not count that would be to miss part of the value. We therefore also have to remove that value from the equation when the points no longer replace it.

And I think you actually agree with me to that point because you said that you follow that the cpp value has decreased. Your contention is that while the points replace less cash, they buy the same product they did before. Again, I won’t disagree with you in the theoretical world (in the real world, I’ll disagree in a minute). But if we don’t value points by the cash they replace, I think things get murky.

This gets a little abstract or at least difficult to wrap your mind around, but it reminds me of the fallacy of your points being worth “double” when you have the Companion Pass. Let’s say you want to buy a flight that costs 10K points or $150 for a single passenger and you have the Companion Pass. Are your 10K points worth $300? While $300 is the value of the product you receive (two $150 seats), the fact of the matter is that 10K points do not replace $300. They replace $150 — because your alternative to using points was using $150 cash to buy those two seats (since you have the Companion Pass, that second person is free whether you use cash or points). To say that the $150 in your pocket is worth $300 would obviously be wrong — even though your one hundred fifty bucks buys a product with a three hundred dollar price tag (the two seats), the fact of the matter is that you effectively have a discount you can apply repeatedly. We have to value the points based on the cash they replace.

And so you’re right that my argument here is that the points replace less cash today than they did before. In the theoretical world, they would buy the same product as before, but save you less cash in doing so. I can see your argument in that theoretical context that you don’t care how much cash stays or goes but rather what “stuff” you can buy (the flight). So in that theoretical bubble, I can concede that points replace less cash but buy you the same thing so this mini “devaluation” doesn’t matter if your measure of value is the thing (flight).

But now let’s jump to the real world: most (or all or even more than) the $18 in taxes has likely been migrated to the base fare. The flights to Mexico are a perfect example. See Greg’s old screen shot of the flight to Mexico City. The total was $102.97 — about $14 less than the $116 fare I showed from Los Angeles to Los Cabos. Yet his example flight cost 3,588 in points versus 6,474 for the Los Angeles to Los Cabos flight. The price in terms of the number of points you need to use has nearly doubled for a flight that only costs about 14% more.

Look to the base fare for the disparity — Greg’s base fare was $46 and mine was $83. I haven’t tracked prices closely enough to know that Southwest bumped up the fare in response to the decrease in taxes (and in reality, we know that prices have more likely decreased lately and that I’m looking at flights in two totally different markets), but I digress: it requires many more points today to buy a fare of similar cash price before the taxes were alleviated. Let’s run the numbers:

Today: 6,474 + ~$29 buys $116 fare.

Before: 3.588 + $34 buys $102 fare.

Difference: 2,886 points. Let’s value those at the low 1.35 each — that’s a difference of $38.96 in points. For a fare that costs $14 more. OK, I’m leaving out the extra five bucks Greg paid in taxes — so let’s subtract $5 worth of points out of the 2,886 point difference — the difference is still big enough to easily see that points do not buy you the same thing today in the real world since in the real world the base fare now makes up a larger percentage of the total cost (and therefore requires you to use more points to replace a similar amount of cash).

Let’s imagine that the $116 fare included $18 in taxes — that would force the base fare down to $65, which would require 5,070 points (78 points per dollar toward the base fare). Now the difference in terms of points would be:

5,070 – 3,588 = 1,482 points

The difference becomes slimmer if you also figure in the $4.50 passenger facility charge.

The absence of the taxes means that a flight of similar total cash price costs much more in terms of the number of points. To me, that means the points buy you less today.

If I had an example flight that today cost the same $102.97 that Greg’s did, let’s work it backwards: $102.97 – $29.32 (Mexico tax) – $5.60 (9/11 fee) = $68.05 base fare x 78 points per dollar = points price of 5,307 points. A flight that costs the same amount of cash ($102.97) would now cost almost 2K points more.

I think that means the points are worth less, no?

I look forward to being told I’m wrong.

Thanks for the long reply, Nick, haha I wasn’t expecting that kind of response, but I do appreciate the discourse and defense of your position. I still disagree with you though:

First, your statement: “And that made sense — using points in February was saving you that extra $18 over using cash. We had to count that in the value since points provided real cash savings. To not count that would be to miss part of the value. We therefore also have to remove that value from the equation when the points no longer replace it.” I still say that the tax credit replaces the $18, there is no gain or loss of actual money, and therefore we shouldn’t remove that value from the points. Your argument seems to be (and if I’m misinterpreting it, I apologize) that in the real world, Southwest realizes that they no longer are required to charge an extra $18 in taxes, so they now have the ability to increase the base fare by as much, and no one is the wiser (except for the likes of us). Admittedly, I don’t search for award travel nearly as much as you. In fact, I think you and Greg are some of the savviest in the community in this area (at least that I’m aware of). But, I don’t think it’s worthwhile to cherry-pick example flights from 2018. I mean, look through the comments in this thread and tell me that the same amount of southwest points buys less in the current conditions:

https://www.doctorofcredit.com/psa-check-southwest-hotel-bookings-for-price-drops/

It seems to me that southwest points buy way more flights than they ever have (admittedly, not necessarily flights you want to be taking at the moment). Whatever value you want to assign to them, again, disregarding cpp, appears to have increased.

Regarding the companion pass, consider me in the fallacy camp of believing that my points are worth double (assuming that I always want to fly with a companion; haha I guess that’s hardly true for anyone). Whatever I decide to value them at, they now allow me to acquire (again, under the right circumstances) twice the amount of the good/service. And, again, this centers on the fact that we can’t trade the points for cash. I get what you’re saying about ‘the cash that stays in our pocket’, but I think for most of us in this hobby, you’re talking about cash that is going to stay there regardless. In other words, at least a decent percentage of us (I imagine the people who would actually read such an article as this fall into this category) have plenty of points to travel, and would hesitate to use actual cash for something we’re accustomed to getting by way of points. So, I guess for me, there’s no actual money involved here, and it appears via the data points in that article, that many are able to acquire more flights than they could have previously.

“I’ll disagree with you to some extent because you didn’t want me to lay down and die without a fight, right?” – That was funny, Nick!

There is another key value of SW points (and cash fares for that matter) that has bubbled to the surface with COVID — Southwest’s cancellation policy. I know that is not the specific analysis in your post, but the flexibility of their program adds a huge value to the actual real time use and therefore value of the points. While other airlines had to come up with special (evolving, changing) terms for ticket changes and cancellations during this pandemic, there’s Southwest saying, “ho hum, just another day in how we allow our customers to cancel/reschedule”. I have 4 trips through the remainder of 2020 — all on Southwest (except for a couple with Alaska booked before 5/31 so fully cancellable). Not touching the big 3 that are allowing just free changes for flights booked now. What do you think?

Oh, absolutely. The Southwest cancellation policy certainly adds to their value to me, but that’s subjective (and their cash fares have decent – though obviously not quite equal — flexibility as well). That’s definitely a benefit with Southwest.

Love these kinds of deep dives even if they ultimately are of modest real world significance or don’t really affect decisionmaking that much. I don’t think this will change anything for most people in terms of how they value WN points when deciding whether to accumulate them, etc., but surely will matter a little bit for an individual purchase decision if the question is “should I use points or cash?”

But really where I think this is most interesting is in setting up ideas about whether there will be leveraged opportunities when converting travel funds to points becomes a thing. Seems like the answer might be “not really.”

That’s the post I was originally going to write. This made sense first.

I may be underthinking this, but I think maybe it will only matter if somehow the travel funds that are created and can be converted to points somehow retain the original ratio that applied to underlying booking. My guess is that the IT is going to be much simpler and that there is just going to be a straight ratio for conversion. That is, all travel funds will be equal for points conversion. I think if that’s right then it will be disappointing because there won’t be leverage opportunities but again I might be missing a step or complexity.

Southwest just opened their travel calendar through 1/4/2021 this morning. I had my companion pass expiration extended from 12/31/2020 to 6/30/2021. I just tried to use it this morning to book a companion flight on 1/2/2021 and got an error message on the payment page saying that my travel date is beyond the expiration date of the companion pass. It would be nice if their IT staff actually tested stuff before having it go live on their website.

Have you tried their Twitter team? I bet they can help you get your companion added

Thanks for the suggestion Nick. I’ll give it a try.

Nick, thanks for pointing this out. As a CP holder (that expires 12/31/21), … my main concern is if they’re going to do anything for folks like me (similar to the 6 month extension for CP holders that expire this year).

My instinct is that they probably won’t. I’m in the same boat for what it’s worth and I agree that their solution doesn’t do anything for you and I — I just don’t think they are likely to do anything more.

From the airline’s point of view, we were earning a 2021 Companion Pass based on 2020 activity, so we are “whole”. I get that you and I look at it as a 2020-2021 CP, but that’s not really what the airline is “selling” customers. The average (flying) customer wouldn’t ordinarily earn a CP until late in 2020, and they’ve made that a little bit easier to do. I think they’ve already taken their stance on the 2021 CP by making the path to get it a little bit easier this year. I don’t think they intend to also extend it for those customers who earn it this year. They’re extending this year’s pass (ones expiring on 2020) because those customers who earned it the old fashioned way likely got it in November or December and have missed out on half a year. Note that I think their solution on that still kind of stinks since those folks likely won’t get to use it this summer and now it’ll expire in June 2021, meaning they won’t really get next summer either (something I’ve noted in the past here). I think the person who earned it from a year of flying in 2019 really loses out the most.

I just don’t see Southwest making a special exception to cater to those who open multiple credit cards to sort of “game” it to get 2 years of CP. Again, I’m in that boat, so I share your wish that I could get this 6 or 8 months back / added on. But the realist in me says that they probably won’t do that. That’s a bummer for sure, but at the end of the day it’s not any more their fault that I haven’t been able to use it than it is mine. And given the pandemic’s affect on travel, I expect I’ll be doing a lot more domestic than international in the near term, so I’ll probably ironically get more use out of this companion pass than I have previous ones even if I only get 12 or 14 months to use it.