News

Property tax relief remains Nebraska Farm Bureau focus

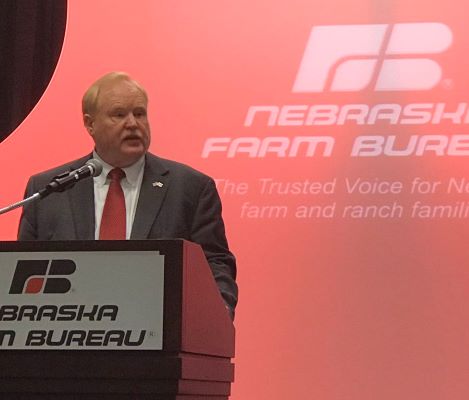

It’s estimated that Nebraska tax revenues could exceed forecasts by more than 100 million dollars in the coming year. Nebraska Farm Bureau president Steve Nelson says all of it needs to go towards property tax relief.

“One of the things that I find very frustrating is listening to the legislature worry about whether they’ll be able to give millions of dollars of Nebraska taxpayers’ money away to lure companies to our state via business tax credits—when, in fact, people who are already living here are being hammered by property taxes,” Nelson says.

The state also needs to find different ways to fund K-12 schools, Nelson says.

“We can no longer afford to put the full burden of funding education on property taxes. Not only is it bad policy, it’s the wrong way to treat Nebraska’s students,” he says.

“The state of Nebraska has to take more responsibility in treating all students more fairly in the way we contribute to the cost of education. It’s wrong that the state assumes a great responsibility of funding education for some students, while taking a walk on others because of where they live. Yet that’s exactly how our state aid system is working for agriculture, and it must change.”

Nelson made those comments in his annual address at the Nebraska Farm Bureau meeting here in Kearney.

Add Comment