The rate at which black swans are showing up in the world should scare the hell out of people. But, unfortunately, everyone seems to be lost in the highly complex technology of I-phones, computers, social media, and the telly to notice that something is definitely wrong. The current situation reminds me of a famous scene in the Monty Python movie, The Holy Grail, where a guy is banging a bell and saying, “Bring out your dead.” Let me explain.

The scene in the movie takes place in England or Europe during the Black Plague, and due to the staggering amount of deaths, carts were used to pick up the bodies throughout the city. Yes, this is indeed a macabre subject matter, but Monty Python takes a serious situation and turns it into a comedy. However, the point I am trying to make is this… death is a very tragic and emotional part of life that impacts family members, friends, and coworkers. But, in this Monty Python scene, there is so much death, that it almost becomes numb to everyone.

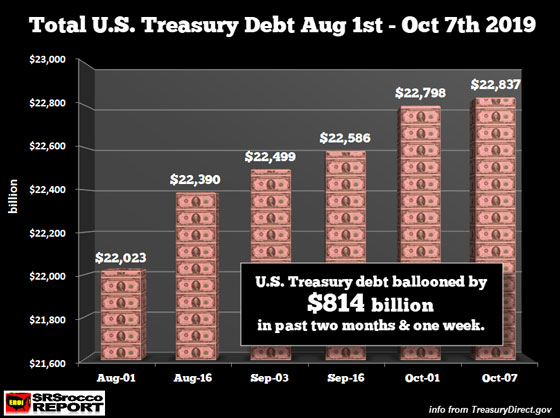

And, that is precisely what I see now in the public. There are so many warning signs, or black swans, that no one seems to notice. Everyone has become… QUITE NUMB to it all. So, when the U.S. Government adds $814 billion of new debt in a little more than two months, the public yawns as this is no big deal:

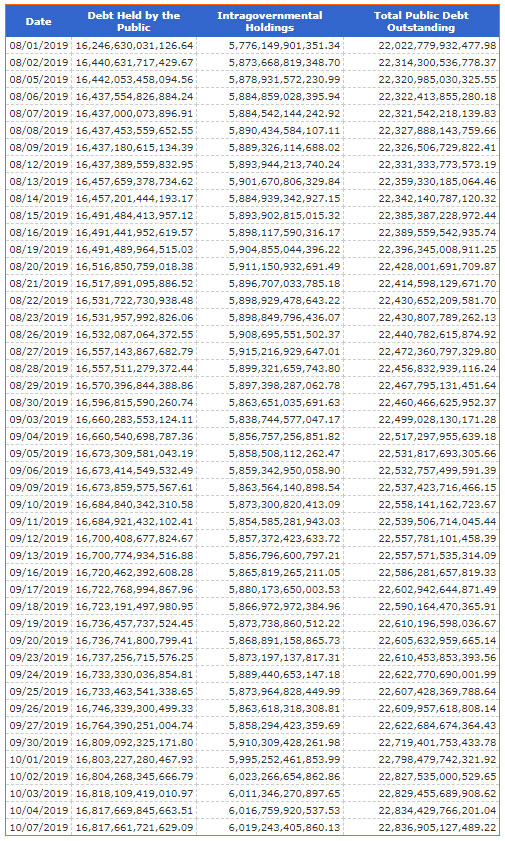

Since the beginning of August, the total U.S. federal debt has increased from $22,023 billion to $22,837 billion. Thus, the U.S. public debt has increased by nearly 4% in just two weeks! Here is the debt table from TreasuryDirect.gov website since August 1st:

For the first half of the year, the U.S. debt balance remained right around the $22 trillion level. However, after the Whitehouse and Congress struck a deal on July 22nd, the debt ceiling was raised, and as we can see in the table above, the U.S. debt jumped $291 billion in one day (August 2nd). The U.S. government was making up for borrowed funds since the beginning of the year.

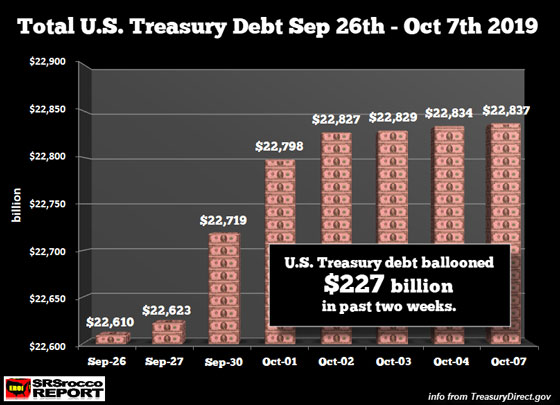

If we look at the next chart that shows an increase in U.S. debt over the past two weeks, it jumped another $227 billion:

The big spike up in U.S. debt by $96 billion on Sept 30th was due to the end of the fiscal year. Regardless, the 2019 U.S. budget deficit rose to $984 billion, the highest in seven years.

The federal budget deficit is big by historical standards, and federal debt is expected to rise significantly in the years ahead, to the largest size relative to the economy since World War II. Economic growth is also expected to slow slightly in the years ahead.

Federal Reserve Chairman Jerome Powell and other mainstream economists have said the government’s fiscal course is not sustainable.

That quote was from the article linked above. The relevant sentence in that quote states that top economists and the Fed Chairman do not believe the government’s fiscal course is sustainable. This seems to be the overall theme of my article. Nothing seems to be sustainable, but we keep moving forward as if we are heading into a new futuristic Jeston’s world:

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.