News

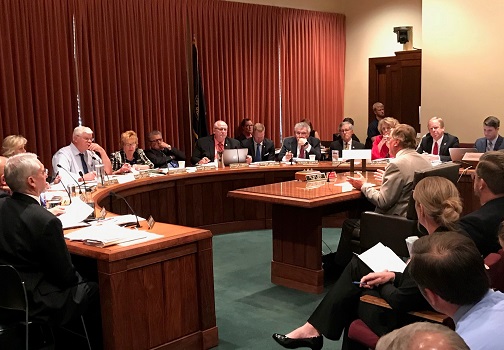

Property tax reform is focus of Nebraska hearing

A proposal to increase the state sales tax rate to help fund property tax relief was the focus of a legislative hearing Wednesday at the Nebraska State Capitol.

The Revenue Committee bill would also make changes to the way schools are funded.

Among those testifying was Art Nietfeld, a farmer from Gage County, who said he supported the proposal. Nietfeld said his property taxes have doubled in the last nine years. “My Nebraska property taxes take roughly one-half of my net income from cropland in an average year, and roughly all of my income on pasture,” Nietfeld said.

Farmer Craig Bolz of Palmyra said the proposal doesn’t go far enough. Bolz said the first 20 bushels of his crop production goes to real estate taxes. “Right now, today, I should be planting corn. Right now. But this is way more important than planting corn. Because if we don’t get something done here, there ain’t no reason to plant any more corn,” Bolz said.

In an interview with Brownfield, Nebraska Farm Bureau president Steve Nelson said they were neutral on the bill. Nelson said there are aspects of the bill they like, but they don’t support using money in the state’s Property Tax Credit Fund to fund the proposal. “We believe we should maintain the Property Tax Credit Fund and then add other sources of revenue to help offset property taxes,” Nelson said.

Nebraska Farmers Union president John Hansen agreed that the Property Tax Credit Fund needs to be maintained. “Ag is going to be very, very slow to give that mechanism away when it’s the only thing that we’ve done so far that’s actually provided any real property tax relief in an acceptable fashion,” Hansen said.

At a news conference earlier in the day, Nebraska Governor Pete Ricketts repeated his strong opposition to the Revenue Committee’s proposal. “This idea that you can tax and spend to be able to get more tax relief is false,” Ricketts said. “It has been tried and failed in the past. We ought not to continue to repeat the mistakes of the past.”

Most of the testimony presented during the nearly seven-hour hearing was in opposition to the proposal. Many school officials and education groups expressed concerns about the impact it would have on school funding.

The committee adjourned without acting on the proposal.

Convert the property tax system to sales tax system. Everyone who benefits from services pays regardless of

income. This is the only way that everyone will take a good look at spending and restrict it when necessary. Accountability will be improved and services will be improved.