It’s Weird and Exciting Being Under 5/24 – Time for a New Chase Credit Card Strategy

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

We’ve always said if you’re new to miles and points, you should start with Chase credit cards for your first few applications. That’s because once you’ve opened 5 or more cards from any bank in the past 24 months (except for certain small business cards), you won’t be approved for most Chase credit cards, like:

- Chase Sapphire Preferred Card – This was the first travel credit card I got many years ago, and it’s still in my wallet – it’s the best card for beginners.

- Ink Business Preferred Credit Card – I have this card, too – applying for it didn’t affect my 5/24 count because it’s a business credit card and doesn’t show up on your personal credit report.

- Southwest Rapid Rewards Plus Credit Card – This was in my wallet a few years ago and I’m thinking of applying again, because for a limited time through February 11, 2019, it comes with a promotional Southwest Companion Pass valid through December 31, 2019 and 30,000 points after meeting minimum spending requirements – it’s a fabulous deal.

This is commonly referred to as the “5/24 rule” and puts a cramp in the style of folks who’ve been at this hobby for a while (including me!). I’d been carefully timing my card applications over the past year or so and focusing on business credit cards so I can qualify for Chase credit cards again, but had lost track a bit. So when I recently did a quick count of the cards I’ve opened in the past 2 years, I realized I’m now 1/24 (meaning I’ve only opened one personal card in the past 24 months).

I’ll tell you, I feel like a newborn in this hobby! But this has gotten me revisiting my Chase credit card strategy now that I’m eligible to apply for up to 4 personal cards before hitting 5/24 again.

Here’s the roadmap I’m planning to make the most of my next few Chase credit card applications.

New Year, New Chase Credit Card Strategy

Read our post about the Chase 5/24 rule

Read our post about how to check your Chase 5/24 status

Being well under 5/24 feels really good – it’s like a whole new world of travel opportunity has opened up. The only personal card I’ve opened in the past 24 months was during my epic car and furnace breakdown of December 2018 (still a little miffed about all that!) so I’ve essentially got 4 personal card “slots” in the next ~23 months to fill before hitting 5/24 again.

I’ll share my logic around the cards I’ll apply for next – but remember, your strategy will depend on how long you’ve been in the hobby and your travel goals. If you’re new to miles and points, check out Scott’s post with 5/24 strategies for beginners.

Chase cards are my favorite because my family gets a ton of travel from the Chase Ultimate Rewards points I earn from cards like the Chase Sapphire Preferred and Ink Business Preferred. And they have valuable hotel and airline branded cards like the World of Hyatt Credit Card and the IHG Rewards Club Premier Credit Card.

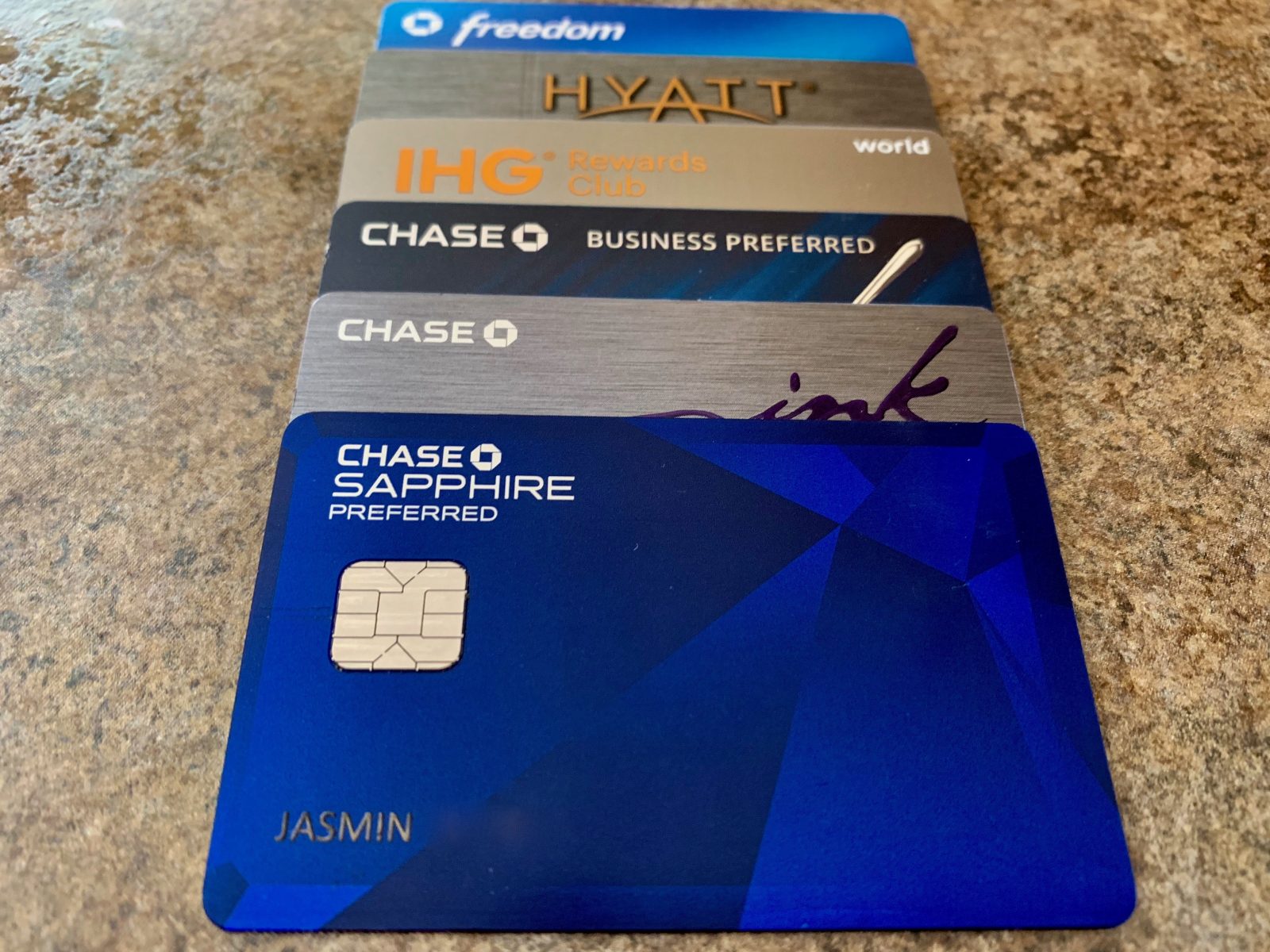

At the risk of sounding like a kid playing got it, got it, need it, got it with trading cards … here are the 6 Chase cards I currently got have in my wallet:

- Chase Sapphire Preferred Card – My oldest card! But I’m thinking of retiring it this year <sniff!> – more on that later.

- Ink Business Preferred Credit Card – This is my most recent Chase card which I applied for in the fall of 2018 – remember, Chase business cards do NOT appear on your personal credit report so this didn’t affect my 5/24 count.

- Ink Business Cash Credit Card – Yes, you can have more than one Chase Ink card at a time. I’ll never get rid of this because it has no annual fee so it’s free to keep forever.

- World of Hyatt Credit Card– I have the older version of this card and use it mostly for Hyatt stays. I’ve kept it for years because the anniversary free night at a category 1 to 4 Hyatt hotel makes the annual fee more than worth it.

- IHG Rewards Club Premier Credit Card – I’ve kept the previous version of the card since 2013 – it also comes with an annual free night at IHG hotels costing 40,000 points or less.

- Chase Freedom – This no-annual-fee card is in my wallet for good. I earn tons of Chase Ultimate Rewards points every year by making the most of the 5X bonus categories which rotate every quarter.

A few notes:

- Unofficially, Chase doesn’t have a hard limit on the number of their cards you can have. For instance, Keith currently has 12 (!) Chase cards in his wallet, including 7 Chase Ultimate Rewards cards (Keith, man, there’s a support group for that!) 😉

- However, there IS a maximum total amount of credit Chase will extend you based on your income, credit score, and other factors. If you’re denied because you’ve hit that limit, many folks have had success getting approved by offering to move credit from their existing accounts.

- Alongside the Chase 5/24 rule, there are other restrictions specific to certain cards. For example, you can’t have more than one Sapphire-branded card at once, and you must wait at least 48 months after earning a Sapphire bonus before earning another Sapphire bonus.

- Anecdotal evidence suggests you won’t be approved for more than 2 personal Chase cards in 30 days, or more than 1 business card. And additional reports suggest no more than 1 business and 1 personal card in 90 days. I’ve always just spaced out my applications by at least 90 days to be safe.

With my current situation and rules to live by out of the way, here’s what I have in mind for my next few applications.

1. Within the Next Month – Chase Southwest Personal Card

Apply Here: Southwest Rapid Rewards® Plus Credit Card

Read our review of the Chase Southwest Plus Card

Apply Here: Southwest Rapid Rewards® Premier Credit Card

Read our review of the Chase Southwest Premier Card

Apply Here: Southwest Rapid Rewards® Priority Credit Card

Read our review of the Chase Southwest Priority Card

Admittedly, these cards weren’t at the top of my wishlist until the recent unprecedented limited-time Southwest offers came out, which include a promotional Southwest Companion Pass after meeting minimum spending requirements. A single card for a Southwest Companion Pass? I’m a sucker for an easy deal, so yes, please!

Until February 11, 2019, the Southwest Rapid Rewards Plus, Southwest Rapid Rewards Premier, and Southwest Rapid Rewards Priority card come with a Southwest Companion Pass valid through December 31, 2019 AND 30,000 Southwest points after spending $4,000 on purchases within the first 3 months of account opening.

Here’s why the Southwest Companion Pass is so valuable: A friend or family member flies with you for nearly free (just the cost of taxes and fees, ~$6 one-way for domestic flights) on paid and award tickets – an unlimited number of times for the duration of the pass. It’s like getting 2-for-1 travel, and any way I can save points or money with my 3 kids is a big deal.

But this is the real reason I’m so interested in these cards: Southwest will soon begin flights to Hawaii, and we’re planning a trip there for later this year. If I can take even ONE child over there for free, the points savings will likely be substantial.

Remember, you can only have one Southwest personal card at a time. I’ve had the Premier and Plus versions (but it’s been well over 24 months since I earned the bonus) so I qualify for any of these. I’ll likely pick up the Southwest Rapid Rewards Plus because it has the lowest annual fee.

If you’re keeping count, now I’ll be 2/24.

2. May 2019 – Chase Sapphire Reserve

Apply Here: Chase Sapphire Reserve

Read our review of the Chase Sapphire Reserve

“Wait!” you’re thinking. “You can’t get a Chase Sapphire Reserve because you already have the Chase Sapphire Preferred!“

You’re absolutely right. So this is a 2-step process:

- The annual fee is coming due on my beloved Chase Sapphire Preferred next month. I could cancel it, but that’d be foolish because it’s my oldest travel card and I don’t want to lose the long credit history and take a hit on my credit score. So instead, I’ll downgrade it to another Chase Freedom and preserve the account. And I’ll still have the Ink Business Preferred so I won’t lose the ability to transfer Chase Ultimate Rewards points to airline and hotel partners

- After a couple of months, I’ll apply for the Chase Sapphire Reserve and earn a welcome bonus of 50,000 Chase Ultimate Rewards points after spending $4,000 on purchases in the first 3 months of opening the account

I’m eligible for the offer because it’s been well over 48 months since I earned a Sapphire bonus. If that weren’t the case, I’d just be upgrading my Sapphire Preferred to the Sapphire Reserve (foregoing the bonus but with no increase to my 5/24 count) because I’ve been coveting the Reserve for a while – and getting it is part of my new strategy for family airport lounge access.

The Sapphire Reserve also earns an improved rate of 3X Chase Ultimate Rewards points per $1 on travel and dining worldwide, compared to 2X in the same categories with the Sapphire Preferred. So I’m looking forward to that, too.

After this, I’ll be 3/24.

3. Summer 2019 – Ink Business Unlimited Credit Card AND Capital One Savor Cash Rewards Credit Card

Apply Here: Ink Business Unlimited Credit Card

Read our review of the Chase Ink Business Unlimited

Apply Here: Capital One Savor Cash Rewards Credit Card

Read our review of the Capital One Savor

Chase business cards don’t add to your 5/24 count (because they don’t appear on your personal credit report), so the Chase Ink Business Unlimited is a freebie in that regard. You’re eligible for small business cards just by having a for-profit side gig like reselling (I do this), tutoring, freelance writing, or running an Airbnb. Most of us on the team have been approved for business credit cards, and none of us have multi-million dollar businesses or needed a formal business structure (you can apply as a sole proprietor just using your social security number).

Earning a $500 cash bonus (50,000 Chase Ultimate Rewards points) after spending $3,000 on purchases in the first 3 months of opening the Chase Ink Business Unlimited will give a nice boost to my Chase Ultimate Rewards points balance. And because I have annual-fee Chase Ultimate Rewards cards, I’ll be able to combine these points and transfer them to Chase travel partners like Hyatt and United Airlines to get more than $500 value from the welcome offer.

New count? Still 3/24.

Which brings me to the Capital One Savor. I haven’t applied for many cash back credit cards, but the Capital One Savor has really got me thinking. It’s got an easy $500 cash bonus after spending $3,000 on purchases in the first 3 months of opening your account, and the $95 annual fee is waived for the first year. Plus it earns unlimited 4% cash back on dining and entertainment, and 2% at grocery stores.

The 4% back on entertainment interests me the most, because for restaurants I’m already covered by my Citi Prestige® Card (open to new applicants again later this month) which now earns 5X Citi ThankYou points per $1 on dining, or the Chase Sapphire Preferred / Reserve cards (2X and 3X per $1 respectively). But getting an effective 4% discount on things like movies, amusement parks, museums, and concerts becomes a little more compelling when you’ve got 3 tween/teen kids in tow.

It’s not a Chase card, but I really like it.

And now I’ll be at 4/24 … time to put the brakes on.

I Won’t Eat Up All My Personal Card Slots – Because This Hobby Keeps Changing

After all this, I’ll take a pause on personal card applications.

Yes, there are a few more personal Chase cards I’m interested in. But none are so exciting that I’ll be heartbroken if I don’t get them this very second:

- United Explorer Card – This is a good card for folks who fly United Airlines frequently, but I do not – I can count on one hand the number of times I’ve flown United in the past decade. And the bonus has been higher. Harlan has a good take on why it’s best to hold on applying for this card unless you’re a frequent United Airlines flyer (it’s good if you want to unlock additional award seats or get a free checked bag on United when you pay with the card).

- British Airways Visa Signature Card – I had this card a couple of years ago (those points got my daughter and me to Dublin for her 13th birthday), and I love British Airways Avios points. It’s got a whopper welcome offer right now, but the minimum spending requirements are steep and I can’t see meeting them to unlock the full bonus.

- Marriott Rewards Premier Plus Credit Card – Another solid card, and I’ve had it in the past. The current offer just got updated, but it’s not the best it’s ever been. And I already earn Marriott points from my Starwood Preferred Guest® Business Credit Card from American Express, so it’s not high on my list.

So I’ll sit on my hands for a while after I reach 4/24. Banks (including Chase) are constantly competing to improve their offers or introduce new cards. And I don’t want to knock myself out of the running by being over 5/24 in case Chase brings out an incredible new offer … I was in that boat when the Chase Sapphire Reserve was first introduced and wasn’t able to get it. Lesson learned!

The information for the British Airways Visa Signature Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

What About Personal Cards From Other Banks?

There’s an opportunity cost focusing on mostly Chase cards, because other banks like AMEX, Citi, or Capital One have or might launch exciting offers as well.

With Citi, I already have the Citi Premier Card and Citi Prestige, and I’m locked out of any of their personal American Airlines cards (except the American Airlines AAdvantage MileUp℠ Card) because I’ve closed the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® in the past 24 months. But I’ll be eligible again within the next year, so if there’s a hefty new offer I’ll consider it.

The information for the Citi AAdvantage Platinum Select, and Citi Prestige has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

I’m kind of scraping the bottom of the barrel with AMEX because I’ve had a lot of their cards (for example, I have or have had both Starwood cards, all of the AMEX Hilton cards, and most of the Delta cards) and they only allow one welcome bonus per card, per person, per lifetime.

And as for The Platinum Card® from American Express, I’m waiting for an increased offer. But if my airport had a Centurion Lounge, I might change my tune (doubt they’ll bring a Centurion Lounge to Rochester, New York anytime soon because we don’t even have a lounge – <cough> Priority Pass are you listening?).

Harlan’s tried to talk me into the U.S. Bank Altitude™ Reserve Visa Infinite® Card because it’s great for Costco purchases using Apple Pay (it earns 3X on mobile wallet purchases). While I love my Costco rotisserie chicken, earning 3X points on purchases there isn’t enough to convince me to apply for this card – for now, at least.

In any case, I’ll be protective of my last credit card slot that bumps me up to 5/24 again. We’ll see what this hobby comes up with this year!

Bottom Line

After being super careful with card applications over the past year and change, I’m at the point where I can apply for a few Chase cards again. Chase’s “5/24 rule” means they won’t approve you for most of their cards if you’ve opened 5+ cards from any bank (except certain business cards) in the past 24 months. And right now, I’m just 1/24.

So I’ve got 4 open personal Chase card slots to fill, and here’s what I’m thinking over the coming year:

- Apply for one of the personal Chase Southwest limited-time (until February 11, 2019) offers soon – the Southwest Rapid Rewards Plus, Southwest Rapid Rewards Premier, and Southwest Rapid Rewards Priority card come with a Southwest Companion Pass valid through December 31, 2019 AND 30,000 Southwest points after spending $4,000 on purchases within the first 3 months of account opening – then I’ll be 2/24

- Downgrade my Chase Sapphire Preferred to a Chase Freedom next month, then in May apply for the Chase Sapphire Reserve and earn a welcome bonus of 50,000 Chase Ultimate Rewards points after spending $4,000 on purchases in the first 3 months of account opening – then I’ll be 3/24

- Pick up the Chase Ink Business Unlimited in the summer of 2019 to earn a $500 cash bonus (50,000 Chase Ultimate Rewards points) after spending $3,000 on purchases in the first 3 months of account opening (it won’t add to my 5/24 count because it’s a business card) – and also snag the Capital One Savor which comes with a $500 cash bonus after spending $3,000 on purchases in the first 3 months of opening your account – then I’ll be 4/24

And then I’ll wait. There aren’t any other personal card offers that I don’t already have which I absolutely must get now. And I’d rather not waste a Chase personal card slot in case they introduce a crazy new welcome bonus or a brand new card. Because once I hit 5/24, I’ll be out of the running for most Chase cards until December 2020.

Of course, if Chase or other banks come out with can’t-miss offers, I might have to revise this strategy. And if you’re new to miles and points, don’t do what I’m doing! Instead, start with the Chase Sapphire Preferred or Chase Sapphire Reserve, then work from there depending on your travel goals (this guide has some good ideas around 5/24 strategy for beginners).

Are you in a similar position or coming up on being eligible for Chase cards again? How would you change this strategy to fit your personal travel goals?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!