eDiscovery Daily Blog

It’s Fall! Has eDiscovery Business Confidence Fallen?: eDiscovery Trends

The Complex Discovery eDiscovery Business Confidence Survey is in the last quarter of its third year and the results are in for the Fall 2018 eDiscovery Business Confidence Survey! As was the case for the 2016 Winter, Spring, Summer and Fall surveys, the 2017 Winter, Spring, Summer and Fall surveys and the 2018 Winter, Spring and Summer surveys, the results for the Fall survey are published on Rob Robinson’s terrific Complex Discovery site. How confident are individuals working in the eDiscovery ecosystem in the business of eDiscovery? Let’s see.

As always, Rob provides a complete breakdown of the latest survey results, which you can check out here. As I’ve done for the past few surveys, I will provide some analysis and, this year, I’ll take a look at all surveys conducted to look at trends over time. So, this time, I will look at the results for all twelve surveys to date.

The Fall 2018 Survey response period was initiated in early October and continued until registration of 85 responses by the beginning of this week. As Rob notes, this limiting of responders to 85 individuals is a change from previous surveys and reflective of an adjusted survey participant listing based on GDPR implementation by Complex Discovery and sensitivity to the increasing number of industry surveys.

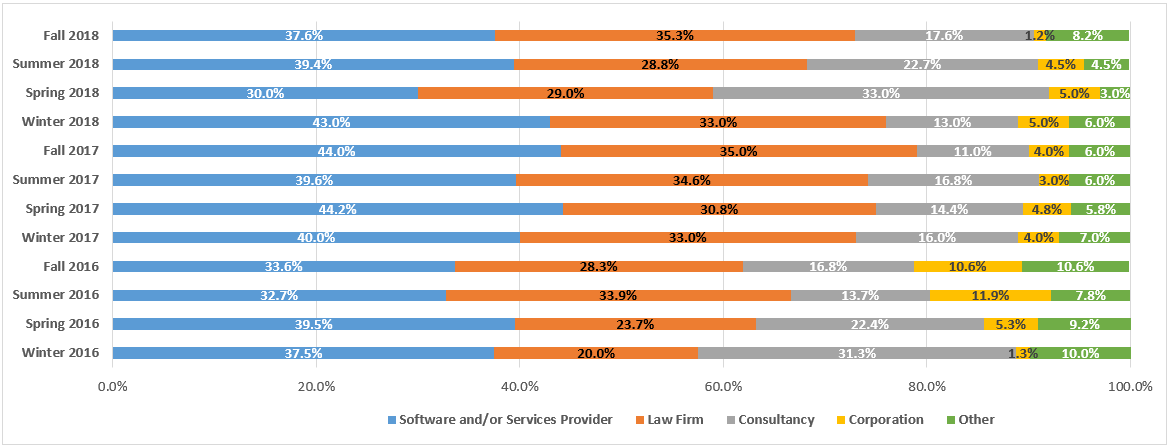

As Usual, Providers are the Largest Group of Responses: Software and/or Services Provider respondents stayed on top, accounting for 37.6% of all respondents. Law Firm respondents were close behind at 35.3% and Consultancy respondents were again third at 17.6%. So, once again, if you count law firms as providers (they’re technically both providers and consumers), this is a very provider heavy survey with 90.6% of total respondents. Here’s a graphical representation of the trend over the twelve surveys to date:

Not surprisingly, this is another provider heavy survey. So, how confident are providers in eDiscovery business confidence? See below.

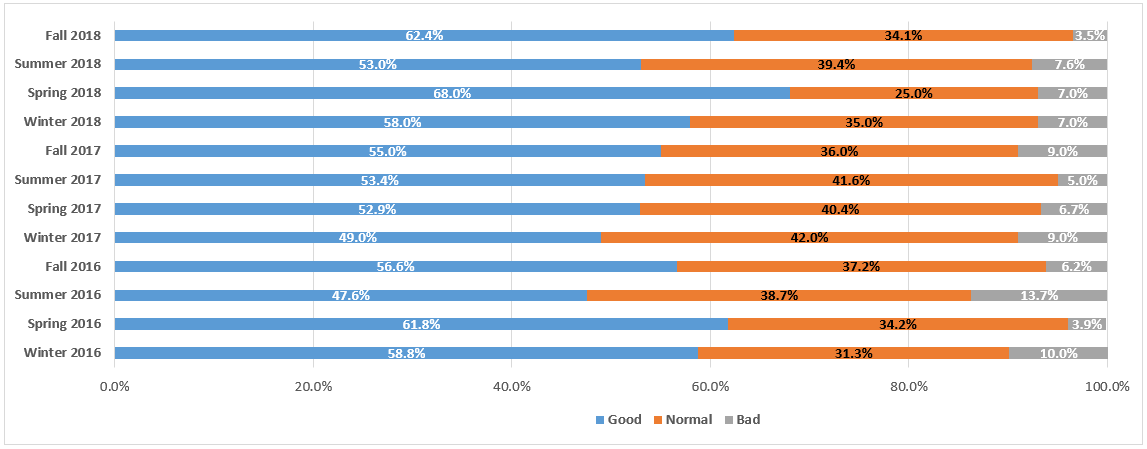

Over 62 Percent of Respondents Consider Business to Be Good: Now that’s a bounce back! This time, 62.4% of respondents considered business to be good, over 9% (9.2%, to be exact) more than the 53% we had last quarter. And, 7.4% more than last Fall (55%). Only 3.5% of respondents rated business conditions as bad, a record low! Last Fall, it was 5.5% higher (9%). So, current business conditions appear to be strong, based on the respondents’ results. Here is the trend over the twelve surveys to date:

So, how good do respondents expect business to be in six months? See below.

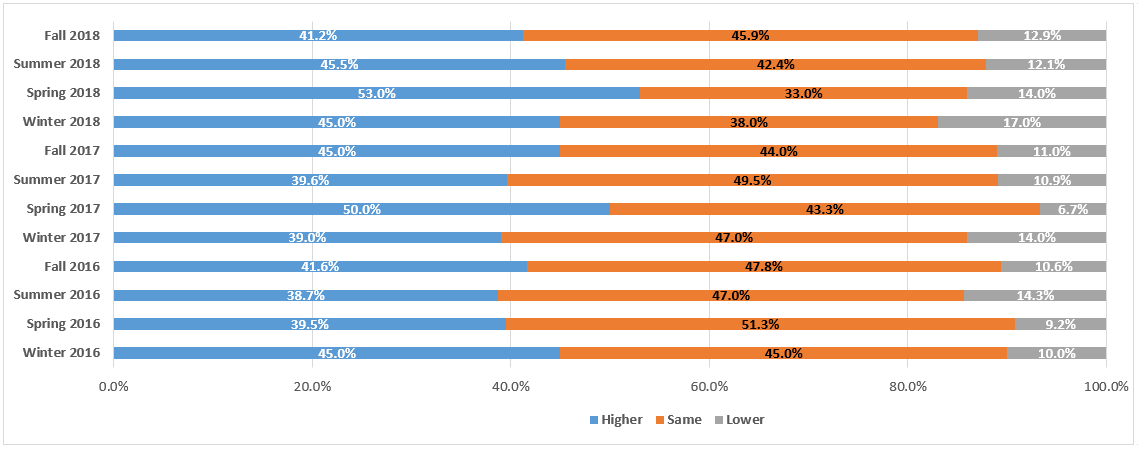

However, Revenue and Profit Expectations Are Mixed: While nearly all respondents (96.5%) expect business conditions will be in their segment to be the same or better six months from now (one percentage point better than last quarter’s 95.5%), but the percentage expecting business to be better dropped to 44.7%. Revenue (at combined 94.1% for the same or better) is 1.7 points higher than the last quarter. Profit expectations (combined 87.1%) dropped nearly a point from last quarter, but with those expecting higher profits dropping another 4.3 points from last quarter (which was already a 7.5 point drop from the previous quarter). And, the percentage of those expecting higher profits is lower than than either of the last two years during the Fall. Here is the profits trend over the twelve surveys to date:

Still, the overall profit sentiment average is stronger than the past two years, for what that’s worth.

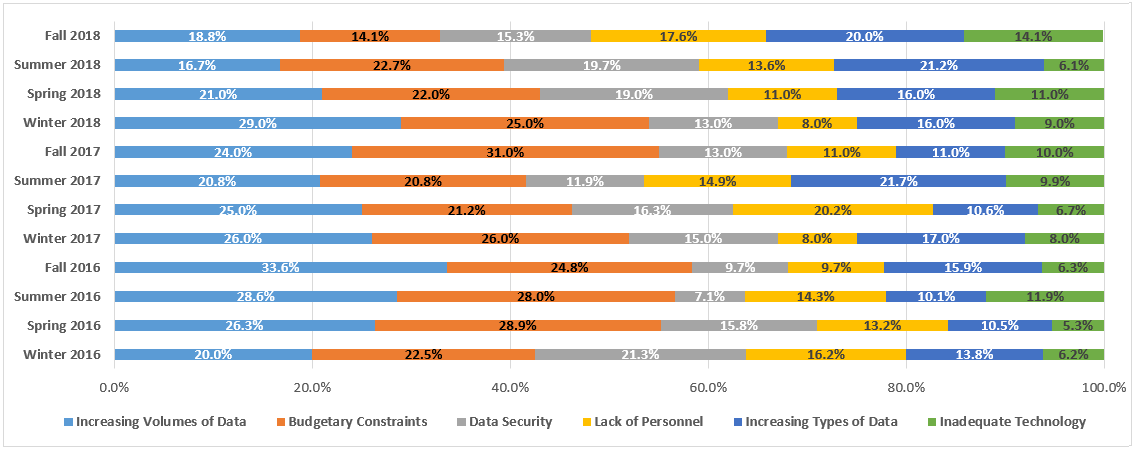

Increasing Types of Data Considered to Be Most Impactful to eDiscovery Business: For only the second time, Increasing Types of Data was top impactful factor to the business of eDiscovery at 20%. Increasing Volumes of Data was second at 18.8%, followed by Lack of Personnel at 17.6% and then Data Security at 15.3%. Amazingly, Budgetary Constraints and Inadequate Technology brought up the rear at 14.1% (which was the lowest ever result for Budgetary Constraints by far – and it’s budget season!). The graph below illustrates the distribution over the twelve surveys to date:

With all of the emphasis on various data sources, it’s not surprising that increasing types of data is trending upward over the past few quarters.

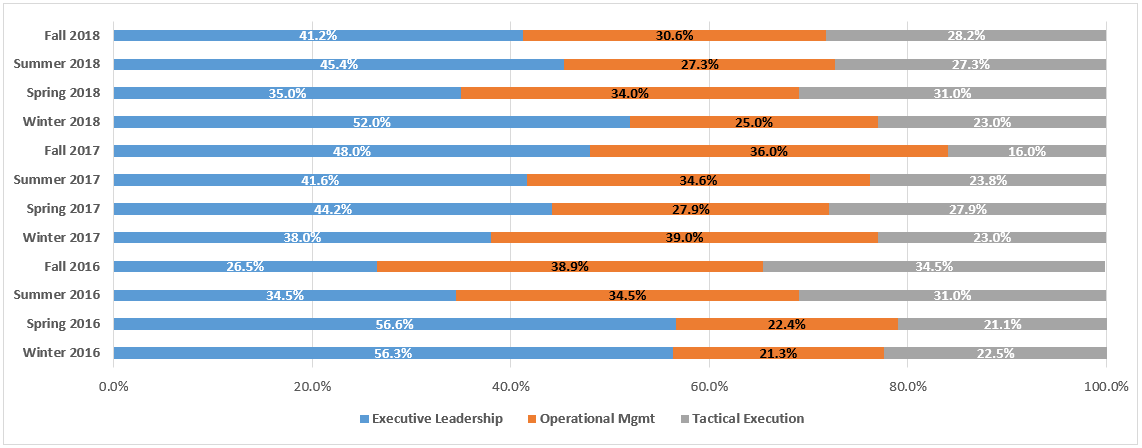

Executive Leadership is still, um, the Leader: The Executive Leadership respondents were on top again at 41.2%. Operational Management respondents were second at 30.6% and Tactical Execution respondents brought up the rear at 28.2% (still higher than last time). Here’s the breakdown over the twelve surveys to date:

The variance in distribution continues each quarter, demonstrating that it’s not the same people giving the same answers each time.

Again, Rob has published the results on his site here, which shows responses to additional questions not referenced here (including three brand new questions asked for the first time!). Check them out.

So, what do you think? What’s your state of confidence in the business of eDiscovery? Please share any comments you might have or if you’d like to know more about a particular topic.

Sponsor: This blog is sponsored by CloudNine, which is a data and legal discovery technology company with proven expertise in simplifying and automating the discovery of data for audits, investigations, and litigation. Used by legal and business customers worldwide including more than 50 of the top 250 Am Law firms and many of the world’s leading corporations, CloudNine’s eDiscovery automation software and services help customers gain insight and intelligence on electronic data.

Disclaimer: The views represented herein are exclusively the views of the author, and do not necessarily represent the views held by CloudNine. eDiscovery Daily is made available by CloudNine solely for educational purposes to provide general information about general eDiscovery principles and not to provide specific legal advice applicable to any particular circumstance. eDiscovery Daily should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.