RFP Best Practices

Posted by Tyler Kirkland, AIF®, PPC®, Director of Business Development and Client Engagement on August 10, 2018

Let’s get on the same page…

A Request for Proposal, or RFP, is a document that a business, non-profit, or government agency creates to outline the requirements for a specific project. They use the RFP process to solicit bids from qualified vendors and identify which vendor might be the best-qualified to complete the project.

You see, the primary plan fiduciary has a duty to control and account for all investment-related fees and expenses. There are three components underlying this duty. They must decide:

- Who is getting paid

- How much they are getting paid

- Whether such payments are fair and reasonable for the services provided

Fair and reasonable is generally examined according to a relative to a standard. In other words, the fees and expenses are evaluated relative to the charges that would be incurred if the same services were supplied by a leading competitor.

This is why a formal “request for proposals” or “RFP” process is suggested to select service providers and, as much as possible, to make apple-to-apple comparisons.

An RFP allows you to clearly state service requirements, call for clear disclosure of fees, and document the factors that were weighed in making the selection.

Where do I go from here?

Establish a successful RFP process and remember, it is not enough to set it and forget it. After service providers are selected (through a process, of course) they must be monitored. Practice 1.5, from the Prudent Practices® for Investment Advisors Handbook, calls for comparative reviews of service agreements to be conducted and documented approximately every three years.

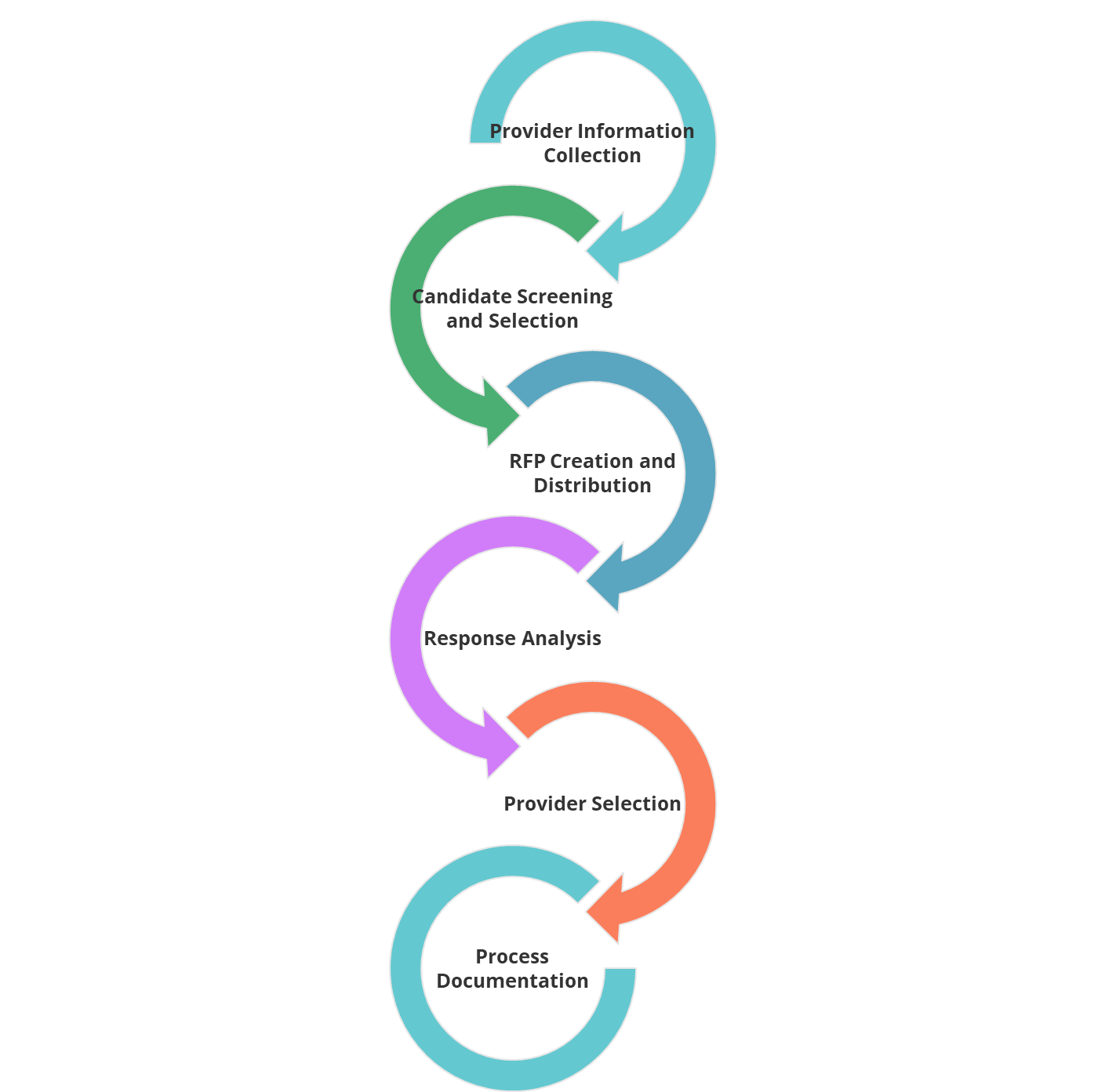

We suggest using a methodology similar to the one depicted below.

- A consultative process is used to understand the specific requirements and needs of a plan

- These requirements are screened through an extensive database of provider capabilities and possible viable candidates

- Once service provider candidates are chosen, an online request for proposal is created, featuring investment, pricing and additional information requirements customized to fit the specific needs of the plan sponsor

- After a provider selection is made, a report is created and archived to document the entire selection process

Don’t you forget about me!

It is not always about the Benjamins

A common mistake when conducting RFPs is focusing on price. Take a step back and look at the big picture. If a provider is priced higher than a peer, it does not mean they should be down for the count. Take a look at the services relative to peers. Remember sometimes you get what you pay for. It is important to keep in mind your client’s needs when considering providers.

With RFPs, less is more

Inviting too many respondents can overwhelm sponsors. It is imperative to the process to do some initial screening and invite only those who meet a majority of your plan’s needs or wants.

Friends, how many of us have them?

Only inviting providers you know is a detriment to your clients and could ultimately reflect poorly on you. Your clients should experience and evaluate providers that first and foremost meet their needs. This is not a time for tunnel vision.

The rules of engagement

You must. MUST. MUST establish ground rules. While it is not all about pricing, pricing can be significantly impacted if you let some providers include their proprietary target date funds or CIT investments.

Consider using an online vendor search and RFP tool

When done correctly, a prudent RFP process takes time, and time is money (as we all know).

Using an online vendor search and RFP tool can aid in your efficiency by providing:

- A faster process

- Electronic vendor responses

- Quick replication of your vendor instructions and key question

- Leverage of pre-collected questions and vendor answers to whittle down your list of candidates

- Online research of vendors and features

- Simplified presentation generation

- An apple-to-apples pricing presentation

The final countdown

Regular review of all vendor contracts helps foster an ongoing, mutually beneficial relationship.

At the end of the day you want to spend more time with firms that are the best fit for your plan and plan sponsor (and less time with those firms that don’t meet your needs). Keep in mind that sometimes the ultimate result is securing updated pricing and services from your current provider.

A prudent RFP process will allow operational efficiency and an overall greater client experience. Your plan sponsor probably has not done a full RFP before, so this is your opportunity to add additional value and get to know you clients better.

Interested in seeing an online RFP solution in action?

Request a demo from our team!