A hotel chain’s response to the pandemic violated the ordinary course covenant in its impending $5.8 billion acquisition agreement, the Delaware Supreme Court decided Wednesday.

Upholding the Court of Chancery’s finding that a subsidiary of Mirae Asset Financial Group was entitled to back out of its acquisition of Strategic Hotels & Resorts properties, the decision is rare in that it focuses on the boilerplate part of an agreement that gives a buyer the right to back out of a deal if a seller deviates from its ordinary course of business, not the part that accounts for material adverse events.

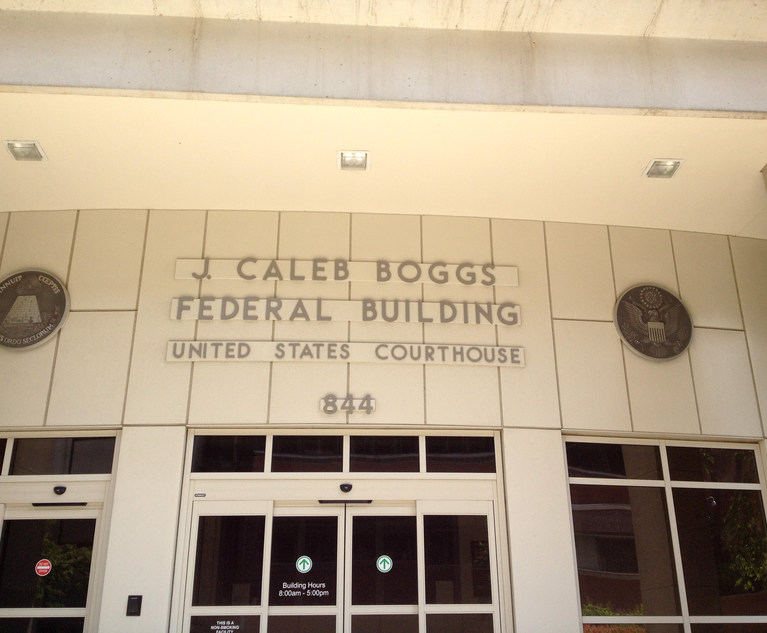

Intercontinental Hotel in downtown Miami, FL. Credit: Felix Mizioznikov/Shutterstock

Intercontinental Hotel in downtown Miami, FL. Credit: Felix Mizioznikov/Shutterstock