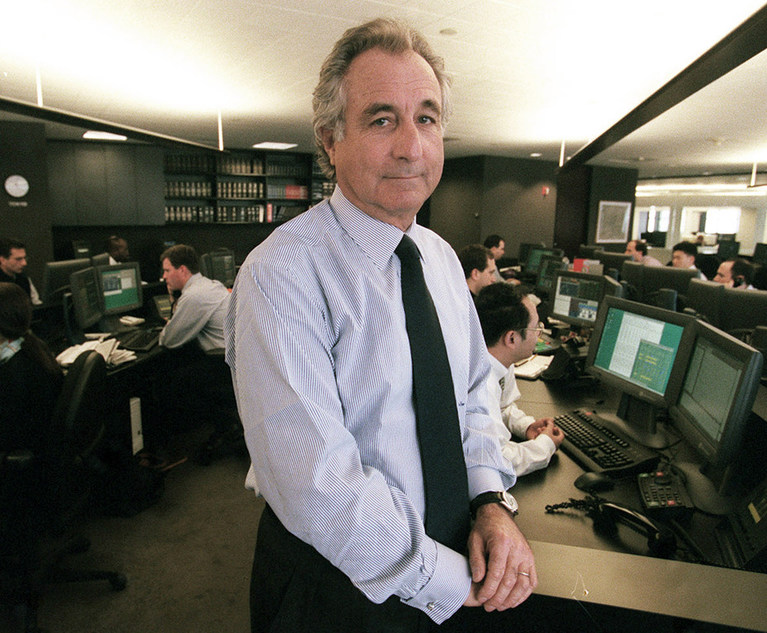

“[L]ack of good faith in a SIPA [Securities Investor Protection Act] liquidation applies an inquiry notice, not willful blindness, standard, and that a SIPA trustee does not bear the burden of pleading the transferee’s lack of good faith,” held the U.S. Court of Appeals for the Second Circuit on Aug. 30, 2021 in In re Bernard L. Madoff Investment Securities, LLC, 2021 WL 3854761, 91 (2d Cir. Aug. 30, 2021) (Madoff). Reversing the district court’s imposition of federal securities law in this fraudulent transfer action, the Second Circuit applied federal bankruptcy law when holding that good faith is an affirmative defense under sections 548(c) and 550(b)(1). It rejected the district court’s requiring the trustee to” bear the burden of pleading the transferee’s lack of good faith,” Id. at 17, refusing to depart “from the well-established rule that the defendant bears the burden of pleading an affirmative defense.” Id. at 57.

The Madoff decision makes the following essential points:

- A SIPA liquidation is to be conducted like a Chapter 7 bankruptcy liquidation;

- The federal securities laws do not apply in a SIPA liquidation;

- Federal bankruptcy law, not securities law, governs fraudulent transfer litigation in a SIPA liquidation (“… no reason to depart from the meaning of the good faith defense under [Code] Section 548 and 550 as it is applied in an ordinary bankruptcy [case].”). 2021 WL 3854761 at 15.

- “… SIPA does not compel departing from the well-established burden-of-pleading rules … [meaning that] the initial or subsequent transferee bears the burden of pleading good faith.”

- “[P]lacing the burden to plead good faith on the initial and subsequent transferees does not contradict the goals of SIPA.” , at 18.