What You Need to Know

- The agency wants to update the financial thresholds, which was not done when the SEC expanded the definition in August.

- The Republican commissioners said they were disappointed with the plan.

- Money market funds, ESG, gamification, a shortened settlement cycle and advisor custody are also on the agenda.

The Securities and Exchange Commission plans to further amend rules pertaining to the accredited investor definition as well as the agency’s whistleblower rules, according to its just-released Regulatory Flexibility Agenda filed with the Office of Management and Budget’s Office of Information and Regulatory Affairs.

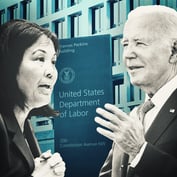

Republican SEC Commissioners Hester Peirce and Elad Roisman issued a joint statement Monday voicing their disappointment with the agency’s plan.

The SEC’s agenda states under “Exempt Offerings” that it plans to update the financial thresholds in the accredited investor definition.

In August 2020, the agency expanded the definition to allow investors to qualify based on defined measures of professional knowledge, experience or certifications, in addition to the existing thresholds for income or net worth.

Those thresholds remained unchanged: a net worth of at least $1 million excluding the value of primary residence, or income at least $200,000 each year for the last two years (or $300,000 combined income if married).

Sara Crovitz, partner at Stradley Ronon in Washington, told ThinkAdvisor Monday that the SEC’s “Exempt Offerings” plan is a “pre-rule” — i.e. not on agenda to be proposed but rather the SEC will ask for comment before issuing a proposal.

The SEC’s consideration is not “at all surprising,” Crovitz said. Democratic Commissioners Allison Herren Lee and Caroline Crenshaw “noted strong opposition to amending the definition of accredited investor without also amending numbers for inflation” when the commission adopted changes last year, Crovitz said.

Republicans ‘Disappointed’

“Not only are the Commission’s most recent amendments to each of these rules less than a year old, they have only been effective for a range of three to seven months,” Peirce and Roisman wrote.

“As far as we can tell,” Peirce and Roisman continued in their Monday statement, “the agency has received no new information which would warrant opening up any of these rules for further changes at this time. We are disappointed that the Commission would dedicate our scarce resources to rehashing newly completed rules.”

The two commissioners added that “a change in administration naturally brings changes in policy, and the Agenda reflects that shift in the form of new rulemakings, but reopening large swathes of work that was just completed without new evidence to warrant reopening is not normal practice. Past Commissions have generally refrained from engaging in a game of seesaw with our rulebook.”

Peirce said in late May during the agency’s meeting of the SEC Small Business Capital Formation Advisory Committee that “an entrepreneur who is plugged in to a network of financially sophisticated people should be able to go to those people for funding, even if they are not wealthy enough to meet our financial thresholds. We need to open additional doors to accredited investor status, such as educational credentials.”

The SEC, Peirce continued, “laid the groundwork for such an opening in our most recent accredited investor rulemaking,” passed last August. “Now we need to act on it, and the Commission specifically invited this Committee to ‘make further recommendations, including additional certifications, designations, or credentials that further the purpose of the accredited investor definition.’”

Money Market, ESG, Custody Rules Also in Play

The SEC’s Reg Flex agenda also states the agency plans to tackle new rules on money market funds, ESG, gamification, a shortened settlement cycle and advisor custody, but not Regulation Best Interest.

June 14, 2021 at 03:43 PM

June 14, 2021 at 03:43 PM