Related: 7 Factors That Could Shape the Annuity Market Going Forward

The Setting Every Community Up for Retirement Enhancement Act, known as the Secure Act, made sweeping changes to the U.S. retirement system, including raising the required minimum distribution age to 72, when it was enacted in December 2019. But lawmakers weren’t done.

The Securing a Strong Retirement Act, nicknamed the Secure Act 2.0, having passed the House Ways and Means committee, is now awaiting a full vote in the House and builds on some of those changes, including raising the RMD age even further, to 75.

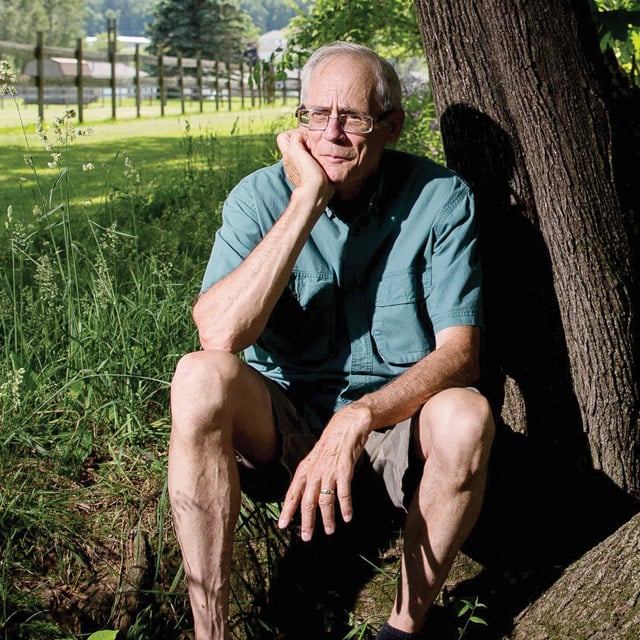

“Most of SECURE 2.0 expands upon the SECURE Act by going into new areas such as allowing more plan Roth contributions, indexing and added catch up contributions,” IRA and tax expert Ed Slott explains. “It adds new 10% penalty relief for early distributions for domestic violence, reduces the 50% RMD penalty to 25% and then to 10%, and reduces the severe impact of the prohibited transaction penalty. It also fixes the statute of limitations problem for Form 5329 where plan and IRA distribution penalties are reported.”

We asked other retirement experts to provide their insights as well. In the gallery above are what they thought of four proposed changes (here is a fuller list).

— Check out Top 11 Fastest-Rising Costs for Older Americans on ThinkAdvisor.

May 25, 2021 at 11:34 AM

May 25, 2021 at 11:34 AM

Slideshow

Slideshow