What You Need to Know

- The House and Senate bills would help independent contractors unionize.

- Some insurance agents have sued to become employees and access company benefits.

- NAIFA says turning into an employee could affect a financial professional's tax status.

The National Association of Insurance and Financial Advisors is working to change a U.S. House bill that could classify many insurance agents, insurance brokers and financial advisors as employees, rather than as independent contractors.

The association is asking members to help it lobby to add an exemption for financial professionals to the “Protecting the Right to Organize Act” bill and a Senate PRO Act companion bill.

The Basics

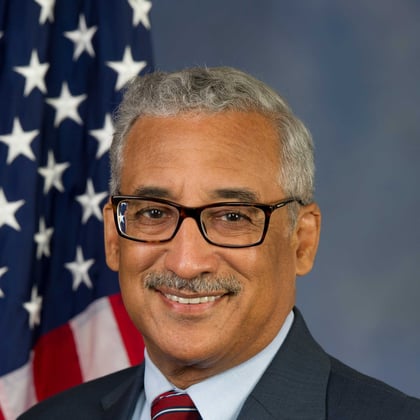

Rep. Bobby Scott, D-Va., chairman of the House Education and Labor Committee, introduced the House version of the PRO Act bill, H.R. 842, together with House Speaker Nancy Pelosi; Rep. Frederica Wilson, D-Fla.; Rep. Andy Levin, D-Mich.; Rep. Pramila Jayapal, D-Wash.; and Rep. Brendan Boyle, D-Pa.

Sen. Patty Murray, D-Wash., the chair of the Senate Health, Education, Labor and Pensions Committee, and Senate Majority Leader Chuck Schumer, D-N.Y., introduced the Senate companion bill, which does not yet have a bill number.

The worker classification provision in the bill is similar to California’s AB 5 labor law, which was meant to keep Uber, Lyft and other new, “gig economy” employers from treating workers with little autonomy as independent contractors. Freelancers in other sectors have complained that the law interferes with their ability to operate as freelancers and might force them to take staff jobs, against their will.

What the PRO Act Bill Would Do

Some agents have sued insurers for the right to be classified as employees, to get access to the kinds of retirement benefits and other benefits typically reserved for an insurer’s employees.

NAIFA contends that, for many insurance producers and financial advisors, being reclassified as an employee could cause problems.

March 01, 2021 at 11:52 AM

March 01, 2021 at 11:52 AM