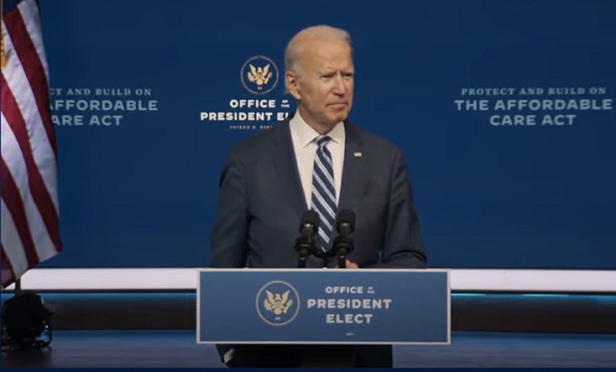

Joe Biden (Credit: Biden)

Joe Biden (Credit: Biden)

President-elect Joe Biden has included health insurance provisions in his American Rescue Plan package that he unveiled Thursday in Wilmington, Delaware.

The heart of the package are provisions that would speed up the COVID-19 vaccination effort; provide $1,400-per-person checks for typical households; expand unemployment benefits; and protect people with federally guaranteed mortgages from foreclosure until Sept. 30, 2021.

Resources

In a package fact sheet sent to reporters, the Biden-Harris transition team says the health insurance provisions in the package would preserve and expand health coverage.

“Roughly two to three million people lost employer sponsored health insurance between March and September, and even families who have maintained coverage may struggle to pay premiums and afford care,” the Biden-Harris transition team says in the fact sheet. “Further, going into this crisis, 30 million people were without coverage, limiting their access to the health care system in the middle of a pandemic.”

January 15, 2021 at 09:52 AM

January 15, 2021 at 09:52 AM