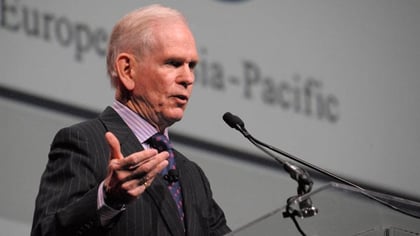

Renowned investor Jeremy Grantham, who correctly predicted the Japanese asset price bubble in 1989, the dot-com bubble in 2000 and the housing crisis in 2008, is “doubling down” on his latest market bubble call.

“This bubble will burst in due time, no matter how hard the Fed tries to support it, with consequent damaging effects on the economy and on portfolios,” writes Grantham in his latest market outlook, titled “Waiting for the Last Dance.”

It is an “epic bubble” fueled by “extreme overvaluation, explosive price increases, frenzied issuance and hysterically speculative investor behavior,” writes Grantham. But the fabled investor who co-founded Grantham, Mayo, & Van Otterloo (GMO) and is now dedicated to fighting climate change, says this current bubble is different from previous ones.

Those bubbles combined accommodative monetary policy with strong economic conditions; this bubble is occurring in a “wounded economy,” though one supported by easy Federal Reserve policy, with market prices much higher than they were pre-pandemic when the economy was stronger and the jobless rate fell to a historic low.

“Today the P/E ratio of the market is in the top few percent of the historical range and the economy is in the worst few percent,” writes Grantham. “Investors are relying on accommodative monetary conditions and zero rates extrapolated indefinitely …. This game surely is the ultimate deal with the devil.”

In addition, says Grantham, the “final leg” of recent asset bubbles have topped 60% in the 21 months before they peaked, or twice the “normal rate of bull market ascents.” The S&P 500 currently has gained almost 70% in the past nine months — and the Nasdaq 100%.

These major indexes could still climb higher from here, says Grantham, but his “best guess is that the bubble will burst in late spring or early summer,” whenever there is a “broad rollout” of the COVID-19 vaccine. He recommends investing now in value and emerging market stocks, which have both been underperforming U.S. growth stocks for years.

January 05, 2021 at 03:15 PM

January 05, 2021 at 03:15 PM