2020 has seen an increase in U.S. population mortality from a variety of factors, including the COVID-19 pandemic. Many of us know someone who died in 2020, myself included, as I lost my mother earlier this year.

While there still have been general mortality improvement and advancements in health in recent years, the total number of deaths is still quite high. Unfortunately, the United States is about to reach a record 3 million deaths for the year. For reference, the country first reached 2 million deaths in 1983 — and that was a new mark at the time.

As I reflect on the research and available data on mortality, I’m reminded of the important work demographers, researchers and actuaries are doing to help understand what is driving these changes in the mortality improvement rate and the increase of deaths. But it is also important to keep in mind these are not just numbers — they are real people — and finding solutions to understand and study mortality improvement over time is what drives me and my colleagues.

As a research actuary, we analyze data so that mortality improvement can be applied with socioeconomic considerations. That’s a key issue on my mind: Finding ways to help educate and inform in making a difference here.

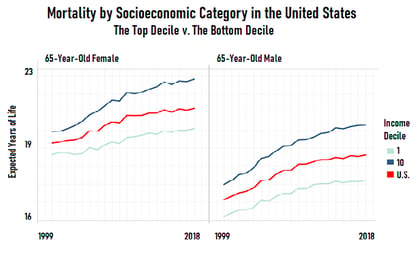

Life expectancies at birth and older ages correlate with socioeconomic factors. Life expectancy at birth has declined for both men and women in the lowest decile (from 73.5 to 73.1 years for men and from 79.0 to 78.8 years for women), with no progress since 2010. And, unfortunately the gap is widening: The distance between the highest and lowest economic categories is growing. Mortality rates around age 45 to 50 years are 50% higher in the lowest decile, and 50% lower in the highest decile. It is important to take notice of this gap, and consider efforts that can be done to help address it.

(Related: U.S. Death Gap Grows: Demographer)

December 24, 2020 at 01:02 AM

December 24, 2020 at 01:02 AM

R. Dale Hall, FSA, CERA, CFA, MAAA, is managing director of research at the

R. Dale Hall, FSA, CERA, CFA, MAAA, is managing director of research at the