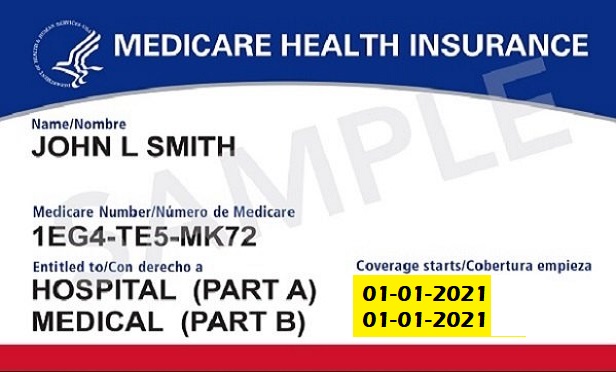

(Credit: Centers for Medicare and Medicaid Services)

(Credit: Centers for Medicare and Medicaid Services)

As advisors know, clients tend to group major decisions about their financial future — including choices about healthcare — around certain significant milestones. The conclusion of a presidential election and the start of a new administration presents such a touchstone, as knowing which party will occupy the White House can provide greater clarity on our national policy direction.

With the Biden administration expected to place a high priority on healthcare, that will be especially true in 2021.

As many clients are taking a fresh look at their healthcare options, the current post-election period presents a key strategic opportunity for advisors to grow and strengthen their practices through a well-known — but frequently overlooked —service option: providing Medicare plans and related support.

To be sure, the Medicare landscape can be complex for advisors who are new to the space.

In addition to “original” Medicare, retiree clients also can choose from a wide range of Medicare Advantage plans, the insurance policies offered by private insurers that cover all Medicare-covered services.

Further, the amount of coverage retirees need can vary widely from household to household depending on their health status and financial resources.

With the U.S. population of 65-and-over prospects and Medicare “clients” growing rapidly, there is a significant need for advisors who can help retirees and pre-retirees navigate their Medicare options as part of a holistic service experience.

Advisors who develop a sophisticated understanding of the space and a service model to match will be well-positioned to recruit and retain retiree and pre-retiree clients over the next decade.

Unfortunately, many advisors have not received the support they need from their wealth management partner firms to properly address the Medicare opportunity.

Below are some of the key points advisors should consider regarding Medicare services, as well as the infrastructure and operational capabilities that wealth management firms should offer to effectively support advisors in this area.

Time to Broaden Perspective

Many advisors continue to see their mission solely as providing investment guidance, with healthcare-related advice being tangential to their service model.

With healthcare costs and the number of over-65 clients in the United States both experiencing massive growth, however, there is no way around it: No discussion about a client’s financial outlook will be complete if it excludes the question of how to pay for healthcare.

From this perspective, adding Medicare services to an advisor’s practice simply makes sound business sense.

December 17, 2020 at 05:30 PM

December 17, 2020 at 05:30 PM