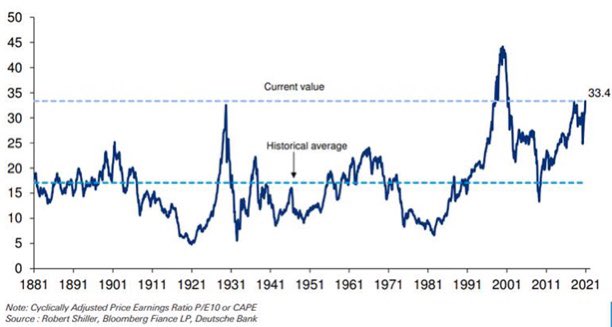

Nobel prize-winning economist Robert Shiller, whose CAPE ratio is often used to illustrate the overvaluation of stocks, says that stock market valuations today are not excessive despite today’s high CAPE ratio.

The measure looks at the P/E of a stock or stock index over 10-years to smooth out earnings fluctuations and adjust for business cycles, which explains its name: the cyclically adjusted price-to-earnings ratio.

In a recent blog on Project Syndicate, Shiller, explains what many have been saying in recent years — that extremely low interest rates justify today’s stock prices.

“The level of interest rates is an increasingly important element to consider when valuing equities,” writes Shiller.

He goes on to explain another calculation: the excess CAPE yield (ECY), which is the inverse of the CAPE ratio (now 33), or 3%, minus the 10-year interest rate, adjusted for 2% inflation over the past 10 years, or -1%.

Using the 3% CAPE yield and subtracting the -1% real interest rate results in a 4% excess CAPE yield, which indicates that equities are much more attractive than bonds yielding 1% or less in nominal terms.

December 01, 2020 at 08:14 PM

December 01, 2020 at 08:14 PM