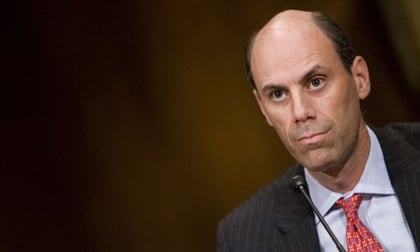

James E. Boasberg during his confirmation hearing in 2010. (Photo: Diego M. Radzinschi / ALM)

James E. Boasberg during his confirmation hearing in 2010. (Photo: Diego M. Radzinschi / ALM)

A federal judge on Thursday ordered the Trump administration to disclose the exact loan amounts and identities of all businesses that received funds as part of the pandemic relief program, rejecting the U.S. Justice Department’s arguments for keeping that information hidden or unspecified.

In a 40-page opinion, U.S. District Judge James Boasberg shattered the secrecy around the loan program, broadly striking down the Trump administration’s reasoning for concealing the names of businesses that received loans of less than $150,000.

Boasberg, a 2011 appointee to the federal trial court in Washington, found that exceptions under public records law for confidential and private information did not apply to what he called a “colossal outlay of taxpayer funds.”

“In these circumstances, the weighty public interest in disclosure easily overcomes the far narrower privacy interest of borrowers who collectively received billions of taxpayer dollars in loans,” Boasberg wrote.

The judge noted that “the PPP loan application expressly notified potential borrowers—admittedly in a form disclaimer—that their names and loan amounts would be “automatically released” upon a FOIA request.”

Under pressure from news organizations and others, the Small Business Administration earlier this year released the identities of recipients of loans exceeding $150,000, but the agency did not specify the exact amounts they received, instead giving a range. Dozens of major U.S. law firms received millions of dollars in PPP relief, the data showed.

Boasberg’s ruling on Thursday required the agency to reveal the exact amounts those businesses received under the Paycheck Protection Program and a separate program created by the CARES Act, a more than $2 trillion stimulus package passed in March.

November 05, 2020 at 03:17 PM

November 05, 2020 at 03:17 PM