With all the hand wringing going on in the media and coming from the current crop of political candidates about “health care,” I get really frustrated and upset.

When I first entered the insurance business, a product called “health insurance” existed. While the product was far from perfect, there were many companies and variations in product design. Yes, people with pre-existing medical problems had a very difficult time finding an insurance company that would cover those medical conditions.

(Related: The Amount of Life Insurance You Own Is a Symbol of Your Status)

The subtle shift from health insurance to health care happened over the 30-year period between 1990 and today, especially in New York state.

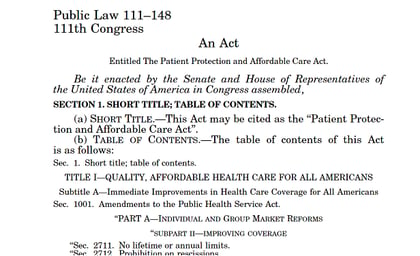

I see the Affordable Care Act as not so much an attempt to give all Americans a comprehensive total package of health care as it was a way to break the back of the largest form of health insurance in the country: the coverage provided by people’s employers. Obamacare, with its many mandates and requirements, was a government grab to end the tax deductibility of health insurance premiums enjoyed by businesses, which some people felt was too rich of a tax break that cost the federal government huge amounts of revenue.

This quirk of the tax code arose back in the 1940s, as a response to the wage and price controls that existed at the time. With Obamacare, employers have been incentivized to stop offering health insurance, knowing that all comers can find coverage through the exchanges in every state. And the legislators in Washington hoped that, as the tax deductibility of health insurance dried up, more revenue would flow into the tax system

If you recall, Obamacare penalized people for not having health insurance through a tax hit. Employers that had more than 50 employees also had their share of tax penalties if they did not offer health insurance the way the government said it had to be done. This was a government “heads, I win; tails, you lose situation.”

October 30, 2020 at 04:35 AM

October 30, 2020 at 04:35 AM

Jerry Cohen

Jerry Cohen