Federal officials have started phasing in risk-adjustment machinery changes that could eventually revamp the Medicare Advantage plan game board.

The Centers for Medicare and Medicaid Services (CMS) — the arm of the U.S. Department of Health and Human Services that oversees the Medicare Advantage program — outlined the changes Monday, in a small part of the Medicare Advantage program advance notice for 2022.

The changes could eventually lead to lower premiums and out-of-pocket costs for Medicare Advantage plans that enroll a higher percentage of people with severe kidney disease, mental health problems, and problems with use of drugs or alcohol.

The changes could lead to higher premiums, and higher out-of-pocket costs, for enrollees in plans that tend to attract people with healthy kidneys, and few problems with drug or alcohol use.

Resources

- A link to the 2022 Medicare Advantage advance notices folder is available here.

- An article about the final Medicare Advantage rate announcement for 2021 is available here.

CMS usually issues the Medicare Advantage program advance notice in January or February. It put out a portion of the notice package early to implement a provision in the 21st Century Cures Act that calls for changes in the Medicare Advantage risk-adjustment program.

Plan issuers are supposed to charge the same rates for sick people and healthy people.

The risk-adjustment program is supposed to provide extra subsidies for plans that end up with more than their fair share of sicker enrollees.

Critics have argued that plans tend to try to boost risk-adjustment subsidy eligibility by making enrollees look sicker than they are, by using intensive health screenings to identify and record chronic health problems that might otherwise have gone unnoticed.

Insurers say they’re simply trying to do a good job of identifying and managing enrollees’ health risk.

In addition to giving more weight to certain kinds of health problems, such as mental illness, CMS says it’s shifting toward relying entirely on patient encounter data in patient risk scoring, and ending the practice of supplementing the patient encounter data with diagnoses from hospital inpatient records.

Medicare Advantage Basics

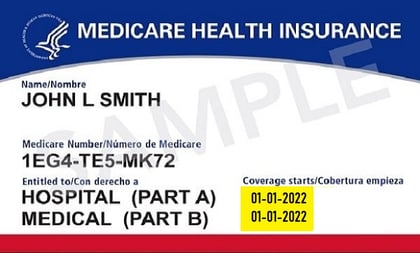

The Medicare Advantage program gives private insurers a chance to offer people eligible for Medicare plans that look, to the enrollees, like an alternative to “Original Medicare.”

About 23 million of the 62 million people who are eligible for Medicare have Medicare Advantage plan coverage, according to the CMS Medicare enrollment dashboard.

September 15, 2020 at 02:29 PM

September 15, 2020 at 02:29 PM