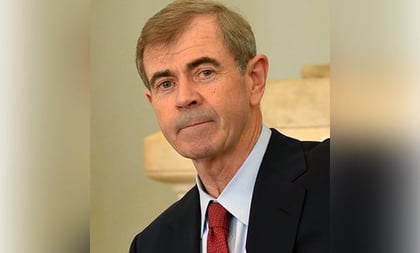

William Galvin, Massachusetts’ top securities regulator, stands ready to defend the state’s fiduciary rule as he begins to enforce the rule Tuesday.

“My office was the first and currently the only state to adopt a fiduciary rule for broker-dealers,” Galvin told ThinkAdvisor in a Monday email. “I intend to police this area to ensure that its important obligations are being met by industry. If challenged, my office is ready to defend this rule to the full extent of the law to protect Massachusetts’ investors against breaches of fiduciary duty and conflicts of interest.”

Galvin announced in late February that he had finalized the state’s fiduciary rule to impose “a true fiduciary conduct standard” in Massachusetts.

The new regulations took effect on March 6 but the enforcement date begins on Tuesday. The rule requires broker-dealers and their agents to provide investment advice and recommendations “without regard to the interests of anyone but the customer.”

George Michael Gerstein, partner at Stradley Ronon in Washington and co-chair of the law firm’s Fiduciary Governance Group, told ThinkAdvisor Monday that the standard of conduct for brokers and advisors “will continue to be flashpoint for federal and state regulators, even in the wake of Regulation Best Interest and the DOL’s 2020 [fiduciary] package.”

The “patchwork” of fiduciary rules — including those by the states — “is a compliance risk and should be evaluated carefully.”

August 31, 2020 at 05:06 PM

August 31, 2020 at 05:06 PM