IA: What’s been your broker-dealer’s greatest challenge due to the pandemic?

Lon Dolber, American Portfolios: Generally, for the last four years, the biggest challenge is cybersecurity and information security. When you go to digital transformation, you’re going to be allowing a lot more people into your world, and that’s a significant challenge.

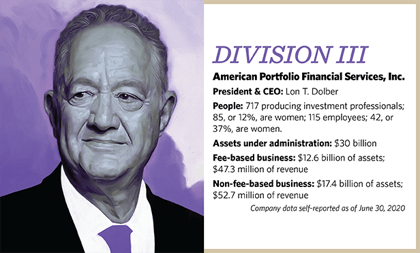

We have roughly 115 employees, over 700 advisors and about 700,000 end customers. That’s a very big ongoing challenge — monitoring all these systems.

We’ve developed the ability for people to work remotely, but also for the end client to get into the client portal. This helps the advisor … but cyber/information security becomes a very big issue.

For monitoring, we outsource some of it to Secureworks for our whole network. For the network perimeter, you don’t control what the end customer is doing. … Your control is limited as you go further out.

We realized with all the work we’re doing that we needed the help of an outside company to monitor our systems and to deal with all the cloud alerts we’re getting.

If you’re in the cloud, you’re constantly getting alerts and you’ve got to analyze those alerts. But do you have the bandwidth and the resources to do it?

There’s also simple things like two-factor authentication. We instituted that some of the time, and we’ve centralized logins, etc.

Ryan Diachok, Geneos: Cybersecurity is a big challenge. But we’ve been on top of that for the past few years, to the point where we’ve been doing the remote monitoring of our advisors and home office [staff].

Like others said, we didn’t make a big announcement about our home office staff working from home. We had multiple advisors say to us, “If you wouldn’t have told us, we wouldn’t have even known you guys were primarily remote.”

There have been challenges with some administrative things that can’t be done remotely. We have a handful of employees rotating in and out of our office. I think we’ve done a good job of taking the proper safety precautions, and our employees have been very comfortable with how we’ve done that.

How are we going to do branch inspections? And there’s the issue of not being able to have conferences this year and have that interaction with our advisors. We have to … be more innovative in how we [do some activities and in how we] communicate and connect with our clients.

Dolber: What am I going to do with my 45,000 square feet [of office space]? Are we going to transform the way we think about going forward, as far as our physical plant?

We are. We’re going into a hybrid scenario where we’re going to allow employees to elect whether they want to go, with conditions and rules, and whether they want to work remotely. And I’m sure the regulators are going to weigh in on this.

John Burmeister, Lion Street: We have until March 2021 to get branch audits done.

Diachok: We’re lucky that we have in-house branch auditors and … a couple are in different parts of the country. We’ll work through it, and maybe FINRA will give a little relief on this.

Burmeister: Yes. Our compliance team has been doing branch exams during this time. We’re documenting what we’re doing and how we’re doing the examination and the interaction. The interaction with the offices has actually been quite comforting and has gone from a standard branch exam to almost business consulting, because they’re trying to find out the right ways to operate in the new environment.

This is a relationship business, so how do you communicate in today’s environment? The use of Microsoft Teams has been phenomenal for us internally. There’s a lot more FaceTime communication — you ping someone and do a visual call. The chat feature has been working tremendously, too.

When I look at the statistics for the usage of these kinds of systems, it’s just gone through the roof. That’s how we’ve been able to account for not having [real] face-to-face communications. It’s not just with our home office employees, but it’s also with our advisors.

August 26, 2020 at 06:40 PM

August 26, 2020 at 06:40 PM