George Nichols III says one thing the insurance community can do to address racial wealth inequality in the United States is to encourage more Black consumers to buy life insurance.

“I don’t think there’s a better way to build wealth than a life insurance policy,” Nichols said last week, at a special session on race and insurance that was organized by the National Association of Insurance Commissioners (NAIC).

Nichols is the president and chief executive officer of the American College of Financial Services. He has been the marketing director for Blue Cross and Blue Shield of Kentucky, the Kentucky insurance commissioner, the president of the NAIC, and an executive vice president at New York Life Insurance Company.

Nichols said that he held those positions partly because a Paul Patton a former Kentucky governor, and Seymour Sternberg, a former New York Life CEO, helped him. He said that shows the power of another tool for increasing diversity and reducing inequality: CEO sponsorship.

Resources

- Links to NAIC summer meeting resources, including links to resources related to the special session on race and insurance, are available here.

- An earlier article about Nichols’ views is available here.

Instead of simply “mentoring,” or advising, talented job candidates, agents and employees from underrepresented groups, CEOs and others in positions of authority need to actively push for talented people from those underrepresented groups to get key opportunities — just as they have always pushed for talented favorites to get key opportunities, Nichols said.

Once a Black individual does get into a leadership position, “you’ve got to be a voice,” Nichols said. “You’ve got to be an advocate for other Blacks, to lift them up in the organization.”

The NAIC held its summer national meeting in a virtual format, on the web, because of the effects of COVID-19 pandemic on travel and in-person meetings.

The Kansas City, Missouri-based group for insurance regulators added the session on race and insurance to the virtual summer meeting agenda in response to the national wave of outrage over the death of George Floyd. A Minneapolis police officer knelt on Floyd’s neck, for 8 minutes and 46 seconds on May 25, while being videotaped, until Floyd suffocated and died.

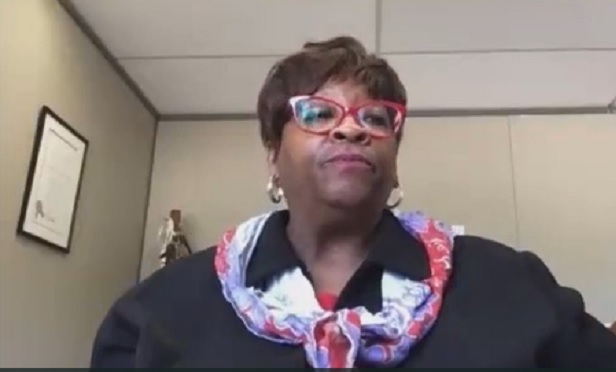

Chlora Lindley-Myers, who is the director of the Missouri Department of Commerce and Insurance and the NAIC’s secretary-treasurer, said during an introduction to one panel of speakers included in the special session that she has been working on issues related to race and insurance for about 30 years.

Regulators have succeeded at rooting out direct forms of discrimination, she said.

But “subtle, less obvious forms of discrimination remain, or take their place,” she said.

The History

Leroy Nunery II, a strategic advisor who created a major 2017 report on African American insurance professionals for Marsh, said that insurance has long played an important role in the U.S. Black community, and that some of the earliest issues of The Crisis Magazine, the official publication of the National Association for the Advancement of Colored People, featured ads placed by Black-owned mutual insurance companies.

Nichols, the American College president and former NAIC president, said that U.S. insurers also played a role in institutionalizing discrimination against Black people, by selling them life insurance policies that cost 30% to 40% more than the policies sold to comparable white people and provided only 60% as much coverage.

The Civil Rights Act of 1964 prohibited that kind of race-based pricing, but, over the years, many insurers kept the prohibited race-based pricing arrangements in place, Nichols said.

Nichols noted that regulators looked into that problem several times and that, finally, when he was the NAIC’s president, insurers eliminated the provisions and agreed to $556 million in settlements.

Today, Nichols said, the American College and life insurers are trying to address the effects of that kind of discrimination by taking steps to promote financial literacy among Black families; improve executive development programs for members of underrepresented groups; and hire more members of underrepresented groups at all levels.

The Regulators

Regulators also talked about their perceptions of discrimination, and about what they can do to improve the situation.

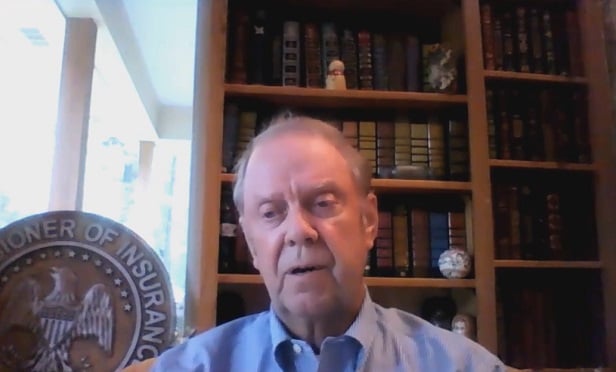

Mike Chaney, Mississippi’s elected insurance commissioner, who is a Republican, said he feels as if he has only limited ability to shape the actions of large insurers.

He said he has tried to encourage insurers to recruit more minority agents, and that he has tried to make sure that insurers aren’t using artificial intelligence and “big data” to discriminate unfairly against older people, members of minority groups, or other people.

“A lot of this data is coming from third parties, and we’re not sure it’s correct,” Chaney said. “But it’s being used.”

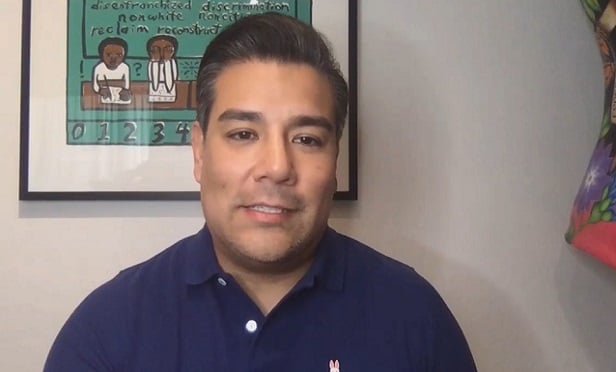

Ricardo Lara, the California insurance commissioner, said his department has been looking at the possibility that activities that don’t appear to involve race could lead to unfair discrimination.

The department found, for example, that auto insurance affinity group discount programs may lead to white people getting lower prices than Black motorists with similar driving records, Lara said.

— Read How the First Black CFP Built His Practice, on ThinkAdvisor.

— Connect with ThinkAdvisor Life/Health on Facebook, LinkedIn and Twitter.

August 17, 2020 at 02:46 PM

August 17, 2020 at 02:46 PM

Slideshow

Slideshow