The False Claims Act imposes treble damages for any losses the federal government “sustains because of” fraud. But how do courts tell when the government suffers losses “because of” fraud? This question can prove surprisingly complex in mortgage fraud cases under the FCA, and it does not arise in other mortgage litigation, such as cases pursuing repurchase remedies under a pooling and servicing agreement.

Until recently, federal circuit courts appeared divided on the causation standard for mortgage fraud claims under the FCA. But a recent Fifth Circuit decision in United States v. Hodge clarifies the standard and brings the circuits into alignment. By allowing proof of causation at a higher level of generality, it also paves the way for the government and private relators to bring FCA claims in cases with large numbers of misstatements.

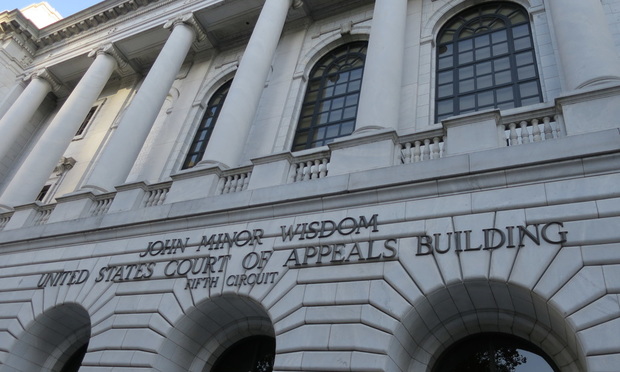

U.S. Court of Appeals for the Fifth Circuit in New Orleans/photo by Mike Scarcella / ALM Media

U.S. Court of Appeals for the Fifth Circuit in New Orleans/photo by Mike Scarcella / ALM Media