I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

I have the premium American Airlines co-brand credit card from Citibank. I even put $40,000 of spend a year on the card, because as an American AAdvantage Executive Platinum member I want the 10,000 elite qualifying miles that provides.

Earning those miles helps me be less loyal to American. Whenever I needed to travel domestically I used to just go to aa.com and buy a ticket. I’m no longer loyal. Last month I had a few Southwest and United segments. Next month I have a few Delta segments and I have some Virgin America booked next month too.

Since American is the largest legacy airline at my airport I’ll still wind up earning 100,000 mile status — but qualifying miles from spending makes that easier.

And since I do fly American a lot I want club lounge access. The card comes with an Admirals Club membership, and up to 10 no annual fee authorized cardmembers on the account get club lounge access as well. That’s no additional cost to give lounge access to a spouse, parents, in-laws, siblings, anyone you trust with the card.

Entrance to American Airlines Admirals Club Austin

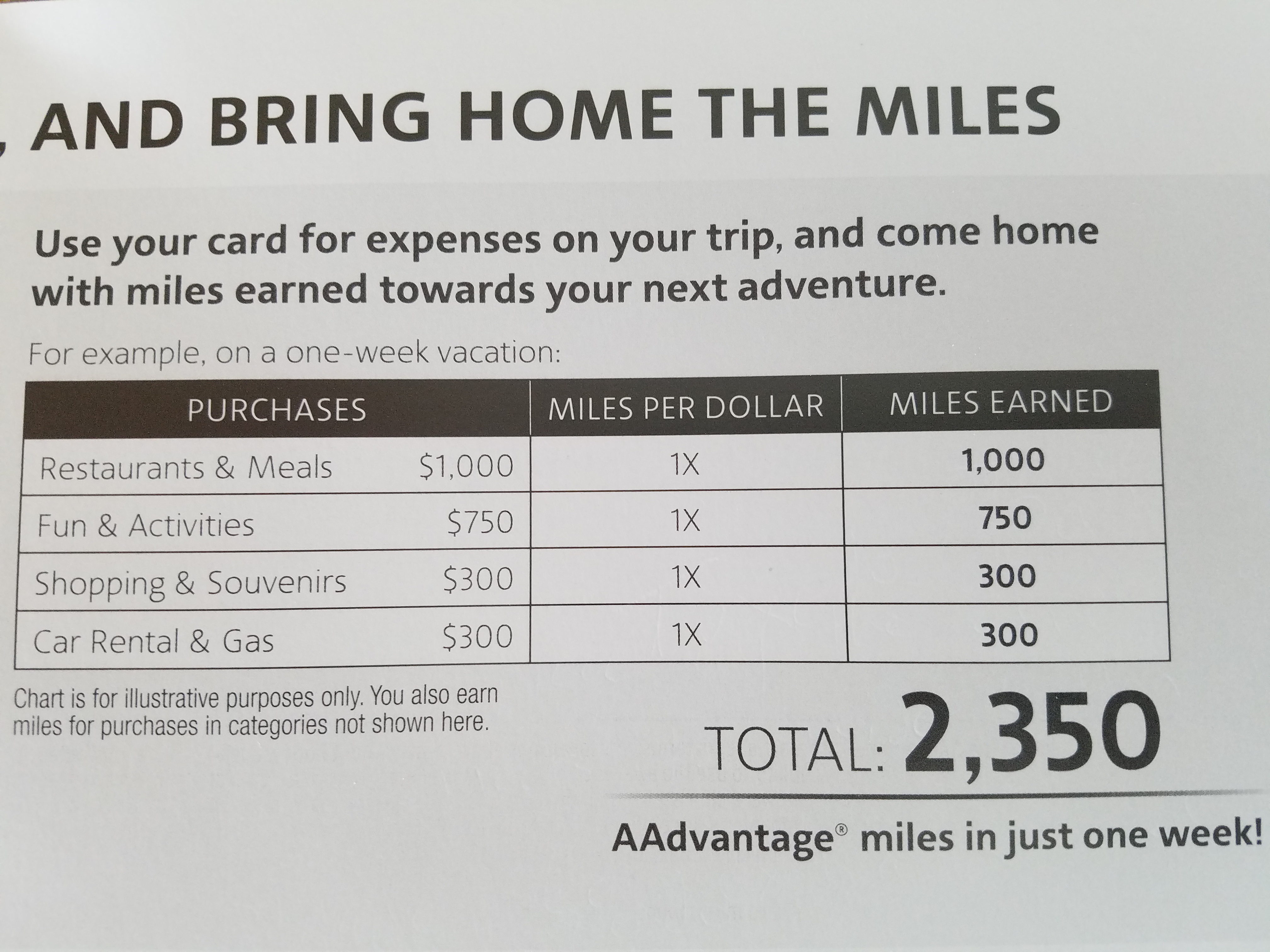

I got a direct mail piece from Citibank, though, encouraging me to use the card for spending on vacation. Here’s the case they made:

If I spend $2350, I’ll earn 2350 miles!

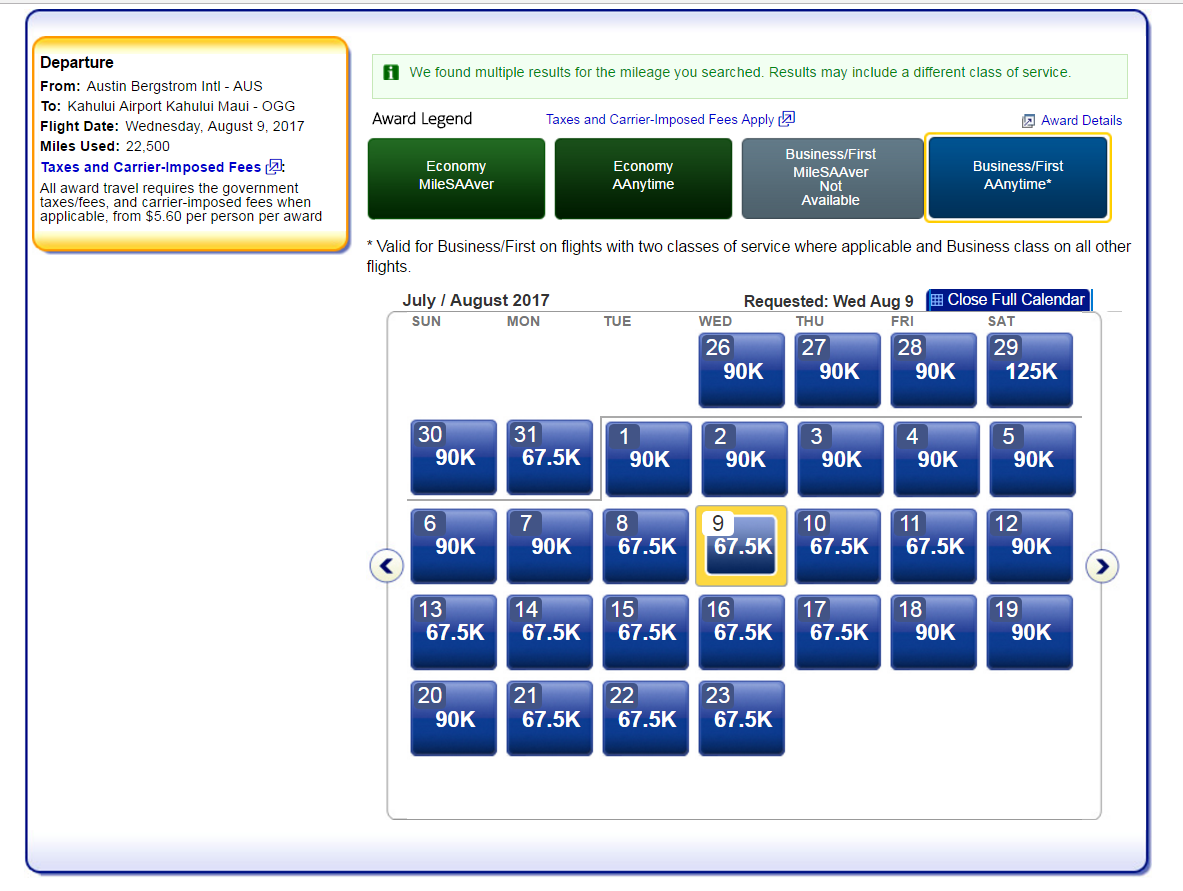

Let’s say I took a family of four from my home in Austin to Maui this summer in first class. Since American naturally does not have even a single day with on premium cabin saver award seat open for the month, I’d have to pay 67,500 to 125,000 miles per person each way. That’s 540,000 to 1 million miles roundtrip.

Those 2350 miles are sure going to help!

Advertising that you earn 1 AAdvantage mile per dollar spent just isn’t a compelling value proposition. The card has a strong signup bonus offer, it can earn elite qualifying miles, and it is the best way into American’s lounges. But it’s not a good card for ongoing spend otherwise.

I frequently talk with loyalty programs and their co-brand card partners and it’s surprising how they haven’t always thought through this.

- A card company may offer a great signup bonus, and that can be extremely useful to focus consumers on the value of the card offer and get signups. But it doesn’t ensure the consumer will keep using the card going forward.

- There may be great benefits like lounge access, but then the card is just a lounge access card not something cardholders need to throw down for their spending.

- If you want to incentivize spend with a card, which is exactly what cobrand issuers, their partners, and payment networks are looking for then a valuable points currency coupled with fast earning align with that goal.

You can rely on brand affinity and habit, but only so far. And if you’re going to rely on habit you need to actually incentivize creation of the habit or reduce transaction costs for customers to use the card. Auto-populate a cardholder’s mobile wallet. Bonus them for making 3 transactions with Amazon in a month, once the median member adds a card to their Amazon account they aren’t going to swap it easily. The same goes for Uber or Seamless.

You don’t incentivize behavioral change by telling something they earn one AAdvantage mile per dollar with their credit card.

You are spot on, Gary.

I got the same piece of mail from Citi. Right into the trash can.

Next time I get a sales pitch on board where they say the signup bonus gives you a free RT domestic flight, I’m going to file a complaint for consumer fraud.

What would be the appropriate regulatory agency?

I have this card, which I wouldn’t have if I didn’t need lounge access. Trying to figure out if it’s worth just buying Club membership and using my Citi credit line on another card with them where I’d actually use the card.

We’ve switched all our family spend to the Sapphire Reserve.

Yes, they’re missing the mark. But I think you overestimate how badly they’re missing it. Don’t remember where I read it but it was this week…38% have used the same card for the past 10 years, something like that. Once people hit a habit they stick with it, and I’d guess that many people will see 2300 AA miles and think, wow, that’s pretty good in only one week. Sure, Chase is better at attracting those of us who will use different cards for different reasons, but we’re also the group that will pay off the statement balance each month (bad for card companies). A huge section of people will keep using their cobranded crappy card rather than what is the best earning potential. btw, it drives me nuts to see someone pull out their Skymiles AMEX for an everyday, non-bonused spend.

Amen Gary. Great points. Offering true incentives to on-going spend get my attention. The one you were given form Citi/AA was ridiculous.

It amazes me they waste time and money on stuff like that. I guess people fall for it.

Chase seems to offer a nice array of sticks with carrots.

And earning only one point per dollar on any card makes my head hurt UNLESS it eventually lands some sort of status(airline/hotel etc…) that gives (hopefully) outsized perks.

What a stupid mail ad. These are the reasons Capital One still attracts people to the Venture card even though most of us won’t touch it. Also, kudos to Barclays because the Aviator always seems to be running some kind of quarterly spend bonus promotion, even though they still have to combat the utter uselessness of AAdvantage miles.

If Citi does a study on how many AA miles they have to throw at savvy customers to incentivize usage, they may become aware of how worthless their AA-mile stockpile has become.

If the CSP offers 2x on dining, I would need the AA card to offer 3x before I used it. If Amex Everyday Preferred offers 3x on gas and 4.5x on groceries, I would need the AA card to offer 4x and 6x respectively. This is for the $100 AA card btw.

For the $450 Executive card, it needs to compete with the Amex Platinum and CSR. Because of this, the card should include Priority Pass, and 6x (maybe even 7x!) on AA purchases to make it worth my while.

I wish this was hyperbole, but AA miles are just that worthless. I can’t see them being competitive in head-to-head bonus categories. Maybe Citi can steal the Amex Everyday Preferred model by making it 1x for most spend, a lucrative bonus category for AA purchases, and a 25-50% bonus if you use it for 30 transactions a month.

I swap out the credit card on file with our Amazon account all the time. Takes 60 seconds.

Silos. The Citibank Sears card has been offering me 10x Thank You points on dining/gas/grocery for the past few quarters. Admittedly there is (an ever increasing) cap on the monthly bonus, but I definitely put that card front of wallet!

What, when you travel they don’t want to suggest that you might be able to earn miles on hotel spend? #marketingfail

And yeah, I agree with you Gary. The banks have yet to figure out how (or even the need) to get consumers to actually use the card on a regular basis. Giving me a free round trip for using the card for a couple of months is great and all, but after that?

Barclay’s does a lot better job of this with frequent targeted promos on spend.

Mailer made me think that there was another class of earners who was targeted for higher earnings, so it actually made me feel inferior. Ain’t that just like AA…