I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Bill payment service Plastiq lets you pay people by check and they charge your credit card. You earn miles, and if you use you a BankDirect checking account then it’s a good way to also earn American Airlines miles ‘on the float’ because the money stays in your checking account longer.

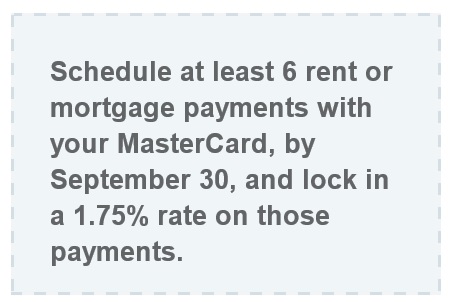

Plastiq has a promotion where instead of their normal 2.5% fee for processing payments, they’ll charge you just 1.75% for rent or mortgage payments.

To qualify for this lower rate,

- Schedule 6 or more rent or mortgage payments into the future

- Set up payment with a MasterCard

- Make sure to do this by September 30 when the promotion expires

Plastiq may hold up a first payment slightly, requiring you to verify that a payment actually qualifies. I’ve seen them ask to see a lease or an invoice for payments before. And they’re mailing checks, that takes time, so be sure to make payments sufficiently far in advance of when they’re due.

Charging rent or a mortgage is a good way to meet spending requirements on a MasterCard. Consider the Citi Prestige Card, IHG® Rewards Club Select Credit Card, or Citi® / AAdvantage® Executive World Elite™ Mastercard® whose offer to earn 60,000 miles ends August 31.

At 1.75% you even come out ahead charging your rent or mortgage to a 2% rebate card.

You may also want to meet a spending threshold, for instance by putting $40,000 earlier this year on my Citi® / AAdvantage® Executive World Elite™ Mastercard® I earned 10,000 elite qualifying miles. That helped me requalify for American’s Executive Platinum status by mid-June. (I always think I’m going to fly less in the coming year, but I never do…)

Also, the Citi AT&T Access More card codes as 3x ThankYou points on online purchases including Plastiq.

@ Dan – and beyond that, a typical retention offer is an extra 1x TYP for 6 months up to 50k (I got this about 6 months into having the card so well in advance of the annual fee posting)

H/T : Frequent Miler 🙂

@Gary actually, no. I wrote this before his post went up. Hat tip the email Plastiq sent to all of its customers, which came through 30 minutes before their PR rep emailed it to me.

p.s. “Gary” above also comments as Yawn, Lame Person, Wow, Jim and Mark K .. apparently reading this blog often but is quite self-loathing about it.

I stand corrected then.

What happens if you schedule six payments and the first one or two go through and you end up cancelling the rest? Or can you even cancel?

I was thinking about this, but to me there’s really no MC that has decent point earning. Could use Barclay Arrival Plus at 2.1% but even with 6 $4000 payments I’d only come out like $70 ahead. I’m doing this type of thing on my Delta Platinum cards but in that case I earn 1.4x Delta miles AND get status. I can get 1.4x on the first $10k Hawaiian MC, but then the rest of the payments are wasted at 1x miles. American is MC but their points earning is pathetic at 1x on everything except American spend. And I just haven’t been impressed with Thank You points since they got rid of all of their airline transfer partners.

There have been a number of interesting posts recently about using international partners to book awards on US carriers, but I wonder how often these are really available? I was looking for a trip and while Delta had plenty of space, they weren’t issuing any of it to partners.