2018 was a gangbuster year for VC-funding into startups, reaching levels not seen since the height of the dot-com and genomics era.

According to recent data from the NVCA/Pitchbook, VC across all sectors topped $130B invested across nearly 9000 deals – the first time the industry has broken the $100B barrier since 2000. In Pharma and Biotech, it was the biggest year in the history of the industry, reaching $17B across ~700 deals.

The superficial headlines on the venture funding climate are great: everything is awesome!

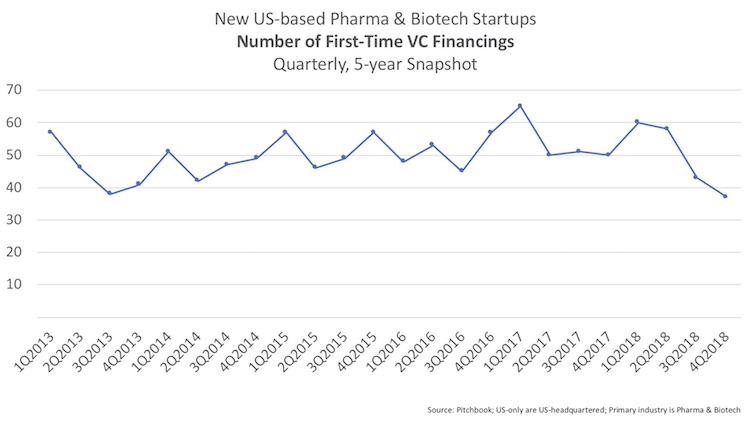

But the quarterly trendline in Pharma & Biotech reveals two concerning signs that caught my attention and are worth tracking.

2018 ended in a fog of caution. Not unexpectedly, given the volatility and turmoil in the public capital markets, 4Q 2018 witnessed the single biggest drop in quarter-on-quarter venture funding in five years, both in the US and globally, a nearly 40% drop. It represents a full 50% decline from the all-time-high quarterly funding of 2Q 2018. These are striking quarterly changes in the private venture capital flows which are typically less volatile (e.g., spring 2014 and 2H 2015 “corrections” in public markets saw more modest ~20% changes in quarterly venture funding).

Incremental drop in new startup formation. As noted before, new startups in biopharma, as measured by the number of first-time VC financings, have largely been flat for years with a quarterly rate of 40-60 deals. But 4Q was only 37. Now these data evolve as the Pitchbook data gets refined, but that’s quite a few less than the 60 first-financings of 1Q 2018. There were also 37 first-financings in 4Q 2009, a tough time for startups, as a comparison.

But don’t ring the alarm bells yet.

I’d argue this is a normal response to public market angst we saw since September as venture investors and companies raising capital reflected on the climate.

Further, the absolute amount of capital that flowed into new deals in 4Q 2018 was still huge relative to the historic trends: at over $3.3B, the 4Q was a top quartile VC fundraising total over the past decade. So capital is still very much flowing, and strong companies are still raising money at robust valuations. And the first few weeks of 2019 revealed stellar fundraising totals – with over $1.5B through JPM week.

But these are both metrics worth tracking to monitor the relative strength of the private markets.

Two other things to track: with Chinese and foreign investors participating in at least 50% of all biopharma venture financings in 2018, the impact of CFIUS needs to be considered: will CFIUS merely slow the fundraising process, or will it choke off foreign capital? In addition, rumors of a slowdown in corporate venture funding (some CVC funds may be shutting down) could also alter the sources of capital.

Fortunately for the industry, VCs had a great year in 2018 for raising new funds with over $55B was raised for more than 250 investment vehicles – that’s likely $6-7B of fresh powder for biopharma on top of existing capital sources, one of the largest annual refresh amounts ever in the life sciences.

We are one of the firms that raised new funds – having recently closed the Atlas Venture Opportunity Fund I at our hardcap of $250M. Looking forward to putting that to work in the pursuit of new medicines.