Today Celgene announced its acquisition of Delinia for $300 million upfront, and up to $475 million in milestones, adding to its growing portfolio of novel immunology medicines.

Delinia’s rapid trajectory over the past fifteen months has been exciting to watch: this young startup only came out of stealth mode in September 2016, announcing a $35M Series A financing (here) aimed at powering up its novel approach of selectively turning up T-regulatory activity. Its launch was well covered elsewhere (here, here, here). This unveiling came about roughly a year after the “seed” tranche got the company initially capitalized and moving forward.

Delinia’s rapid trajectory over the past fifteen months has been exciting to watch: this young startup only came out of stealth mode in September 2016, announcing a $35M Series A financing (here) aimed at powering up its novel approach of selectively turning up T-regulatory activity. Its launch was well covered elsewhere (here, here, here). This unveiling came about roughly a year after the “seed” tranche got the company initially capitalized and moving forward.

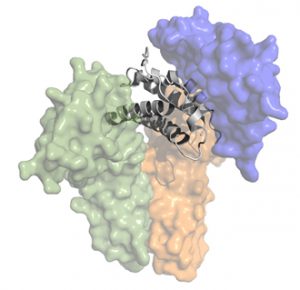

Instead of rehashing the scientific thesis of Delinia in this blog, I’ll recommend a September 2016 From The Trenches post titled “Re-Balancing Immunity via Regulatory T Cell Potentiation.” BioCentury also covered it nicely in October 2016 with “Turning On Tregs.” In short, the hypothesis of T-reg potentiation with an IL-2 mutein is incredibly compelling and well-validated by prior and extensive clinical work with low dose IL-2 (such as here, here, here). Delinia’s program has real potential to meaningfully impact the lives of patients with autoimmune disease.

A few things to note about the story.

We found a partner in Celgene who shared our conviction about this novel therapeutic approach. Celgene’s expertise in inflammation and immunology (I&I) made them an ideal partner to appreciate the potential of Delinia’s programs. Over the past decade, Celgene has built an impressive I&I portfolio of both internally-discovered and externally-sourced programs. Otezla (apremilast) is their flagship I&I medicine today (fastest psoriasis drug to hit $1B in sales from launch) and was discovered at Celgene; behind it are several additional homegrown programs earlier in development (e.g., immunomodulator CC-220 and anti-fibrotic CC-90001). Celgene’s I&I pipeline also has several high profile externally-sourced therapies, including mongersen/GED-0301 (via a license with Nogra Pharma) and ozanimod (via acquisition of Receptos). They’ve also been at the forefront of changing the autoimmune treatment paradigm, such as with the recent deal with Anokion on tolerance induction. The Delinia programs fit nicely into this growing portfolio, and complement several of these I&I approaches – which was a big driver for Celgene’s overall interest in the story.

As with any great story, the team was crucial to Delinia’s success. The startup’s scientific co-founders were Jeffrey Greve (CSO of Delinia) and Michael Rosenblum (UCSF), who brought unparalleled expertise in IL-2 and T-regulatory biology. Jeff is also an experienced protein engineer; before co-founding Delinia, he held roles at Atyr, Exelixis, and Bayer. CEO Saurabh Saha, an Atlas Venture Partner/EIR, formally jumped into Delinia earlier in 2016 after joining us from BioMed Valley Discoveries. The third executive team member was Lijun Wu, who joined in 2016 as SVP of Preclinical and Early Development; Lijun had several prior biotech experiences in the field of immunology.

Reflecting on this management team, it’s worth highlighting (as with past company stories) the importance of talent flows and connectivity in our industry. All of the three executive team members had prior Atlas links: Jeff was at Exelixis (an Atlas Fund III company), Lijun did a tour of duty at Resolvyx (Fund VI), and Saurabh was interim CMO at Synlogic (Fund IX) as part of working with us. Further, Jeffrey Tong, now an EIR in Third Rock’s West Coast office, was brought in as an independent Executive Chairman of Delinia; Jeff had previously worked closely with Dave Grayzel at Infinity for nearly a decade. Dave was the Atlas sponsor of the Delinia investment, and Delinia board member; he was instrumental in recruiting both Saurabh and Jeff to the story. The world of biotech is indeed small, and relationships matter.

The Delinia team executed a largely virtual program with a transcontinental footprint. Jeff Greve secured a small lab footprint at biotech incubator QB3 near UCSF in Mission Bay, San Francisco, and maintained close ties to Michael Rosenblum’s lab. Corporate headquarters were here in Cambridge in our startup incubation space, where Saurabh and Lijun shared an office. To stretch the time zones even further, Henrijette Richter of Sofinnova Partners, who was a great co-investor in this deal (and introduced us to the Delinia opportunity in 2015), was based in Paris.

Lastly, the team often extends beyond just the core group: semi-virtual biotechs like Delinia are reliant on their consultants and research partners: Charles River and SNBL for preclinical models, Catalent and KBI for drug substance and formulation, and LakePharma on the research-grade material side. These CRO partners were important to Delinia’s success, as was Mike Curtis, Atlas EIR and next door neighbor to Saurabh’s team, who provided his extensive CMC expertise. It’s great to be able to call attention to their stellar work.

Lastly, the team often extends beyond just the core group: semi-virtual biotechs like Delinia are reliant on their consultants and research partners: Charles River and SNBL for preclinical models, Catalent and KBI for drug substance and formulation, and LakePharma on the research-grade material side. These CRO partners were important to Delinia’s success, as was Mike Curtis, Atlas EIR and next door neighbor to Saurabh’s team, who provided his extensive CMC expertise. It’s great to be able to call attention to their stellar work.

With regard to investment returns, the financial terms disclosed speak for themselves. This is the first exit from Atlas Venture Fund X, a 2015 vintage fund, and provides an attractive venture outcome. Although Delinia’s time as an independent startup was short and sweet, it’s fair to say the story has all the hallmarks of a great biotech investment: venture creation around innovative and cutting-edge science, efficient use of equity capital, lots of strategic options, a superb team and, in the end, a like-minded corporate partner/acquirer to take it to the next level.

Now integrated into Celgene’s I&I franchise, we’re excited to see Delinia’s novel programs advance to patients.