CRISPR/Cas genome editing has captured the attention of the popular media, scientific community, and the investment world: the promise of going into a cell and precisely making changes in their genetic code to cure them of illness is certainly captivating. The opportunities to treat disease and improve health are indeed tremendous.

The discovery of the CRISPR/Cas9 gene editing approach has already transformed the biomedical research field, much like how tools such as PCR and monoclonal antibodies created step-changes in the power of scientists to probe the frontiers of science. Its simplicity, and its relatively cheap cost, make CRISPR an ideal tool to explore a myriad of genetic manipulations – point mutation edits, full gene knockouts, transgene knock-ins, combinations, etc… And it can be done in high throughput screening formats. This technology is without a doubt one of the major molecular biology revolutions.

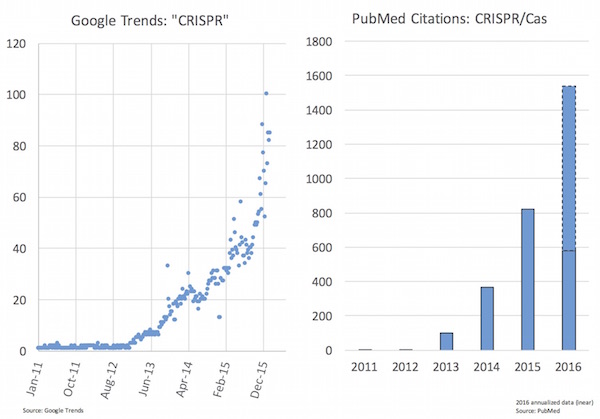

As you might expect given the excitement, the last 12-24 months have seen huge upswing in popular interest in CRISPR as well as in the scientific literature (see chart below). Jennifer Doudna and Emmanuelle Charpentier’s groups published their seminal Science paper in August 2012 on the CRISPR/Cas9 system for synthetic editing, and it’s among the most high impact recent papers tracked by Altmetrics (here).

But beyond being a revolutionary research tool, CRISPR/Cas9 also holds enormous potential for changing medicine, and this has certainly attracted the attention of the business and investor community in biotech.

We and others got excited by the space in the winter of 2012-2013, a few short months after Doudna and Charpentier’s groups published their landmark paper. After spending a year understanding the landscape and the key players, Atlas formally launched Intellia Therapeutics in May 2014 with one of our EIRs and now Intellia’s CEO, Nessan Bermingham, working closely with Atlas partner Jean Francois Formela. Intellia assembled a great group of scientific founders and advisors in those formative moments (here). Further, Intellia had two important corporate partners: Caribou Biosciences and Novartis. Caribou, which focuses primarily on the research applications of CRISPR/Cas9, helped create Intellia by exclusively licensing human therapeutic rights to the technology as part of a founding partnership. Novartis, one of Atlas’ Limited Partners (“Corporate Strategic Partners”), helped us co-lead the Series A and put in place an early and enabling R&D collaboration. For full disclosure, Atlas Venture remains a significant investor in Intellia (NASDAQ:NTLA).

Earlier this month, almost exactly two years from founding, Intellia priced its IPO at the top of the range, raising $168M and debuting with the highest post-money valuation ever for a preclinical company (see S1 here for details on the company). Intellia joins Editas Medicine (NASDAQ:EDIT) in the publicly-traded CRISPR space; a third company, CRISPR Therapeutics, is rumored to be preparing a public offering.

The promise of this gene editing revolution has enabled this trio of startups to amass well capitalized balance sheets. Collectively, in just the last three years, they have raised over $660M in equity funding and over $500M in upfront and R&D support through business development deals involving Novartis, Regeneron, Bayer, Vertex, Juno, and others.

Although these remain preclinical companies, they are building deep pipelines of programs addressing a host of important unmet medical needs: Intellia’s pipeline is advancing programs for both in vivo therapies (e.g., Transthyretin Amyloidosis, Alpha-1 Antitrypsin Deficiency, and Hepatitis B virus) and ex vivo therapies (e.g., HSC transplants and CARTs). Editas is developing programs aimed at eye diseases like Leber Congenital Amaurosis, hematologic diseases like hemoglobinapathies, and engineered T-cells (e.g., CARTs), among others according to its S1. And CRISPR Therapeutics is working on curing various blood disorders, blindness, congenital heart disease, and cystic fibrosis. With this list of big unmet needs, if/when these companies are successful, medicine could change dramatically for the better for a broad range of conditions.

The incredible trajectory over the past few years of this CRISPR/Cas space is in large part due to this very promising medical potential; but it’s important to note that the field also benefits from two major “long-cycle” tailwinds.

First, CRISPR/Cas is standing “on the shoulders of giants”, as scientists with appropriate humility like to say. Scientific progress emerges out of the work of those before you, and CRISPR gene editing is no different. The first generation of gene editing technologies emerged in the early 1990s in the form of zinc finger nucleases (ZFNs): these DNA-binding proteins could be engineered to have specificity to certain genetic sequences and edit them through double-strand break repair. Sangamo Biosciences was established in 1995 to exploit the therapeutic potential of ZFNs, and went public in 2000 (NASDAQ:SGMO). Other meganucleases were also discovered in the 1990s, and many have been matured since that time. A more recent second generation in genome editing came in the form of TALENs, which were adapted from the bacterial plant pathogen Xanthomonas; these were demonstrated to be an efficient gene editing tool in 2010 (here). Both of these prior generations made meaningful contributions to the science of genome editing; however, in general they suffer from higher complexity and cost in comparison with CRISPR, as well as potential genome specificity issues, which have made their widespread adoption in the lab and for medical applications more challenging. But these prior generations, and over two decades of work, help set the stage for CRISPR gene editing to quickly mature into widespread usage and broader application.

Second, the CRISPR/Cas revolution has also benefited from the momentum of several parallel technology waves: the advance of ex vivo cell manipulation and transplantation (like for stem cell transplants and CARTs), the resurgence in gene therapy and viral vectorology (like AAV and lentiviral approaches), and the maturation of nucleic acid delivery technologies (such as lipid nanoparticles). Each of these other waves began over two-decades ago, but have only become significant and successfully clinic-enabled in the past 5-8 years. CRISPR/Cas gene editing techniques converged with and reinforced these other technology waves. CROs and academics advanced the former two waves (ex vivo cell manipulation, gene therapy) until industry dove in headfirst post-2010 with the CART players (e.g., Novartis, Juno, Kite, etc) and gene therapists (e.g., bluebird, AGTC, Spark, etc.). And the latter wave of RNA delivery emerged out of billions in investment from Alnylam, Novartis, and many others. Many of the enabling advances supporting these other waves are and will continue to be critical enablers to the success of the CRISPR/Cas gene editors.

These two long-cycle tailwinds acted as accelerants for the “biotech” launch of the CRISPR/Cas field.

Three additional business-building related concepts are also worth calling out as they’ve played a catalytic role in Intellia’s emerging success, as well as that of Editas and Crispr Therapeutics.

- Recruiting a world-class team that knows how to translate technology into products. Under Nessan’s leadership, Intellia has assembled a fantastic team of R&D veterans to lead the translation of CRISPR/Cas into the clinic: CMO John Leonard brings his deep experience in running R&D organizations (former Abbott R&D Head); CSO Tom Barnes brings protein engineering and biologics expertise from Eleven and Genelogic; and CTO David Morrissey is one of the most knowledgeable in the oligo drug world, including delivery, from his time at Novartis and Sirna. This group, and the scores of scientists working on Team Intellia, bring the right mix of skills to bring this new class of medicines into the clinic and to patients. New technologies frequently take multiple cycles in preclinical drug discovery before they approach clinical development; with CRISPR/Cas, this timeline is likely to be dramatically shortened as the lessons of prior technologies (and the waves described above) are applied by this seasoned team.

- Building strong investor syndicates that can facilitate a public market transition. From the outset, Intellia focused on strategically assembling a group of long-term investors with shared conviction about the big vision for CRISPR/Cas medicines and how to execute against that vision. The $70M Series B was raised less than year after the Series A, and brought a great group of investors to the team, including OrbiMed, Fidelity, Janus, Foresite, Sectoral, and EcoR1, along with a few others. With the continued support of Novartis, and recent addition of Regeneron, Intellia has broadened out the equity base with corporate partners as well. This thoughtful syndication strategy certainly helped catalyze greater public market interest in the story during an otherwise challenging capital markets environment (i.e., NASDAQ Biotech Index was down 8% while Intellia was on its IPO roadshow). The same could be said of Editas’ syndication strategy.

- Executing a platform-enabling BD strategy that brings capital and capabilities to bear. At launch, Intellia was busy crafting an enabling R&D collaboration with Novartis, announced a few months after the Series A (here), that brought both capital and capabilities to the story. Beyond the $50M in upfront payments and R&D support, as well as future product milestones, the deal enables Intellia to access Novartis’ patent estate around lipid nanoparticles (LNPs) for delivery, as well as ex-vivo HSC expansion technologies, for CRISPR/Cas related therapeutics. The recent Regeneron deal adds a second major partnership, bringing $75M in an upfront payment, $50M in equity, and up to $320M in future potential milestones per product. These deals bring a combination of capital, unique capabilities, and market validation to the Intellia story, and enable them to broadly apply their CRISPR/Cas technology to a wide range of applications.

Lastly, I’d be remiss if I wrote about CRISPR/Cas and didn’t comment on intellectual property, as there’s been a very public dispute on the subject (here, here). Rather than wade into an ongoing patent interference case, I’ll just comment that IP battles like this are hallmarks of many of the most impactful technologies in the history of biotech. For example, recombinant protein expression for initial biotech breakthroughs like EPO created early IP battles with Amgen and Genetics Institute (here). Monoclonal antibody patents like Cabilly/Boss were subject of several lawsuits (e.g., Celltech, Medimmune, Genentech), as were the phage display patents around antibodies (e.g., CAT, Morphosys, Dyax, etc). Like all new fields with enormous potential, the foundational patents in a field are a subject of keen interest to the academic institutions, the biotechs involved, their investors, and their army of lawyers. CRISPR/Cas certainly is no exception.

Stepping back, it’s truly staggering how fast the CRISPR/Cas gene editing field has exploded across research, medicine, and business. Multiple companies with considerable market valuations were created just in the last few years. Intellia and the other players in the field now have considerable resources to support the broad development of new medicines based on gene editing. Excited to see what the next few years brings.