Everyone knows that the biotech IPO market is and has been challenging. But one of the most troubling developments, and the least transparent to the outside, has been the increased importance of significant insider participation to get IPO’s priced.

In the 1990’s, it was unheard of for VCs to have to buy into the IPOs of their portfolio companies; some may have done so, but many actually sold shares into those offerings, strange as that may seem today. In the early 2000’s when the markets opened back up for IPOs, insider participation began to occur but it certainly wasn’t a requirement to “get out” as a public company in most cases.

Today, the vast majority of biotech offerings since early 2010 have only gotten priced because they had major insider participation. The offerings just wouldn’t have happened without it. IPOs, long viewed as simply financings in biotech circles, are now not much different than a typical private round: insiders purchasing between one- and two-thirds of the offering to anchor the transaction. Its worth noting that Tech IPOs rarely if ever have insider participation as a requirement for getting public.

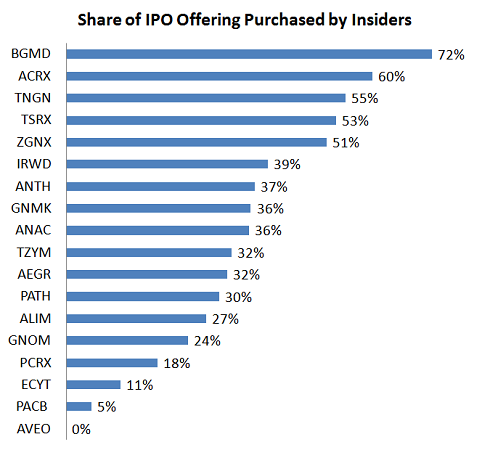

For the 18 most recent biotech IPOs since January 2010 that I could obtain the relevant data, both the average and median participation by insiders was 34%. Here’s the data on the 18 companies*:

- This group raised over $1.2B in their IPOs and nearly $350M of it came from VCs and other insiders. That’s nearly 10% of the total biotech venture capital flows over the past 16 months just to support getting these players public.

- Five of these offerings had over half the shares bought by insiders.

- BG Medicines took the prize with 72% of the round purchased by insiders. Hard to call that an initial “public” offering rather than a listing with the new shares sold to VCs.

- Ironwood’s insiders put up $74M of their $185M offering. While that may seem like a lot, they put up nearly $350M privately over the past 10 years.

- Having smart crossover investors (hedge funds that do late stage private deals) was not a guarantee for smooth pricing in the IPO: while PACB had some crossovers (and they were the only insiders that participated), so did IRWD and TNGN. So certainly not an indicator of good pricing or lower insider participation.

But now that these biotechs are publicly traded, the most important thing is how they perform. As a group, they are up 19% and 10% on average and at the median, respectively, from their offer price. Two companies have doubled in value: Aegerion (AEGR) and Endocyte (ECYT). Pretty impressive.

To examine whether post-IPO performance was correlated in some way to the struggle to get a company public, I looked at performance to date relative to the increasing amount of insider participation. Although the statistical correlation is weak, the trendline suggests a modest inverse correlation in line with what one might expect. The market presumably sees something they don’t like if insiders have to buy a greater portion of a new offering.

Of the other factors – like how much of the company got sold in the offering, the overall size of the offering, etc… – none appear to correlate with insider participation or post-IPO performance.

So a couple takeaways for the biotech CEO dreaming of an IPO: first, you may want to check with your physician regarding masochist tendencies, and potentially get a prophylactic Rx of SSRIs; second, get ready to ask your investors for 33%+ of the IPO offering. You need insiders who can do this or don’t even bother trying to go public. Lastly, and related to that, it might help to consider ways of broadening the capital base prior to an IPO. The well-trodden path has been to find smart crossover investors, but as noted above that doesn’t always help (nor does it hurt). A small round with expectation of IPO participation could be a real enabler. For the creative, try to get a Pharma partner to sign up for purchasing 10%+ of any future IPO offering. I’ve seen this in a deal before, but sadly we never got a chance to tap into it (company never went public) but its a nice feature to add in a deal if you can get it.

Since insider participation in IPOs isn’t going away any time soon, being more transparent about the data will hopefully help set proper expectations.

The trend is yet another affirmation that biotech IPOs are just financing events, and tough ones at that.

* It’s worth noting that the source data comes from manually grabbing data off of SEC filings. John Dyer at Aquillo Partners and a second banker/advisor (who prefers to be unnamed) generously helped provide me with most of the data. Thanks! A second note is that Pacific Biosciences is an estimate: they clearly had some participation from a few of their Series E/F investors in the IPO like Deerfield according to SEC filings, but it did not appear to be a significant amount of their monster $200M offering.