Today, I examine the seven largest retail chains’ participation in the 20 major 2024 Part D networks that the eight largest plan sponsors will offer. As always, I offer you a handy table for scoring each chain’s participation and changes from 2023 to 2024.

As you’ll see, these companies all maintained strong positions in the major PDP’s preferred networks. Walmart has the highest participation, while Rite Aid has the lowest. In an upcoming post, I’ll delve into how smaller pharmacies will participate in the 2024 Part D plans, by examining the pharmacy services administrative organizations (PSAOs).

Speaking of 2024, please join me for my upcoming live video webinar, Drug Channels Outlook 2024, on December 15, 2023, from 12:00 p.m. to 1:30 p.m. ET. Click here to learn more and sign up.

PREFER ME

Preferred network models have grown rapidly within the Medicare Part D program. The Centers for Medicare & Medicaid Services (CMS) calls them preferred cost sharing networks. CMS calls the pharmacies in such networks preferred cost sharing pharmacies.

For 2024, nearly all of the total 709 Medicare Part D regional prescription drug plans (PDP) have a preferred network. See Medicare Part D in 2024: The Seven Largest Companies' Preferred Pharmacy Networks and the Coming Collapse of the PDP Market for details on next year’s market.

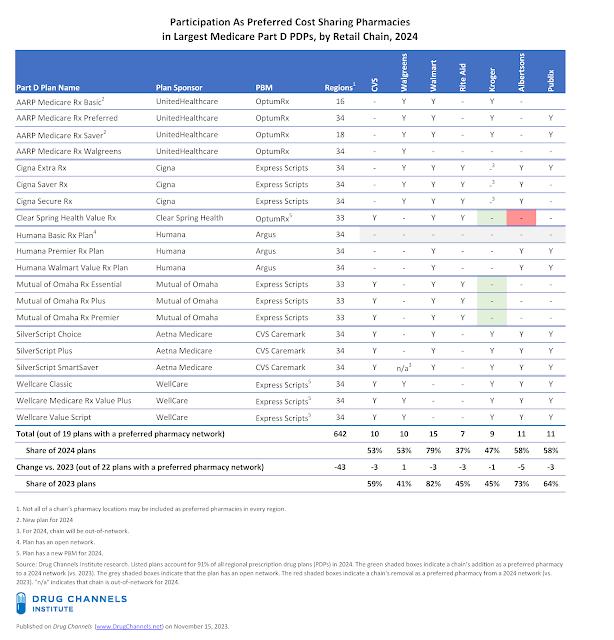

We examined the Part D plans offered by seven major companies. There will be 19 major, multi-regional Part D plans with preferred cost sharing pharmacy networks and one plan with an open network. These companies will operate 642 regional PDPs, which equates to 91% of total regional PDPs. For each plan, we have identified the network status of seven large retail chains.

You can find our analysis of retail chain participation in 2023 plans here: CVS, Walgreens, and Walmart Keep Position in 2023 Part D Preferred Networks—While Kroger Bails Over its Express Scripts Blowup. For more on the economics and strategies of narrow networks, see Chapter 7 of DCI’s Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

CHAIN REACTION

Many major chains will be in a smaller share of the total available networks in 2024 compared with 2023.

The table below summarizes retail chain participation as preferred pharmacies. The green shaded boxes indicate a chain’s addition as a preferred pharmacy to a 2024 network (vs. 2023). The red shaded boxes indicate a chain's removal as a preferred pharmacy from a 2024 network (vs. 2023). "n/a" indicates that the chain is out-of-network for 2024. Note that there are 19 plans with a preferred network and one plan (Humana Basic Rx Plan) with an open network. Click here to download the table as a PDF.

[Click to Enlarge]

Here are the highlights of pharmacy participation in 2023 Part D preferred networks:

- CVS Health. Since the 2018 plan year, CVS Health’s retail pharmacies have actively pursued preferred status in Part D plans. For 2024, CVS pharmacies will be preferred in 10 of the 20 plans tracked in the table above. CVS had participated in three 2023 plans that will not be offered in 2024: two plans from Rite Aid’s Elixir Insurance and one plan from Clear Spring Health.

- Walgreens Boots Alliance. Since 2021, Walgreens has focused on participation in preferred networks. For 2024, it will be preferred in ten plans. For 2024, Walgreens will remain an out-of-network pharmacy for Aetna’s SilverScript SmartSaver.

- Walmart. Beginning in 2020, Walmart reengaged with preferred cost sharing networks. For 2024, it will again have a leading position as a preferred pharmacy in 15 of the 20 major plans. Medicare history buffs should note that Walmart and Humana launched the first Part D preferred network plan, in 2010. This plan is now known as the Humana Walmart Value Rx Plan. Despite the plan’s name, Albertsons and Publix will again be preferred in it for 2024.

- Kroger. For 2024, Kroger will be preferred in 9 of the 20 plans. Notably, it will be an in-network (but non-preferred) pharmacy for the four plans offered by Mutual of Omaha and Clear Spring Health. For 2023, Kroger was initially out-of-network at these plans, because it had terminated its pharmacy provider agreement with Express Scripts. To overcome these restrictions, Kroger has signed direct pharmacy network agreements. Kroger’s still-pending merger with Albertsons will give it much more leverage in PBM negotiations, so this situation may change again.

- Rite Aid. The industry’s most bankrupt chain retained its participation in the major networks, despite its limited geographic scope. For 2024, Rite Aid will participate as a preferred pharmacy in seven plans. Like CVS, Rite Aid had participated in three 2023 plans that will not be offered in 2024.

- Other supermarket chains. Albertsons and Publix will both participate in the preferred networks of 11 plans. Albertsons pharmacies will shift to non-preferred status for Clear Spring Health.

Tune in to my Drug Channels Outlook 2024 video webinar for my thoughts on the retail pharmacy market in the year ahead.

No comments:

Post a Comment