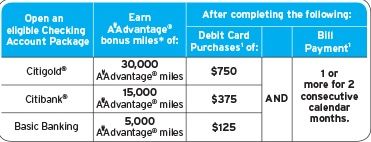

Citibank is again offering American Airlines miles as an incentive for opening a checking account and taking various account actions.

The offer is valid through June 30, and you then have 60 days from account opening to take required additional steps of debit transactions and a billpay in two calendar months.

You can apply on-line, in branch, or over the phone at 866-810-9043 using promotion code DON42OQL3X.

I tend to think 15,000 miles is the sweet spot with this offer since in the past Citibank has sent out 1099 tax reporting forms on mileage offers where the value is greater than $600, as the 30,000 mile offer is likely deemed to be.

I still like the 22,000 point BankDirect signup offer better. BankDirect also offers miles for average balances on an ongoing basis, and doesn’t 1099 the miles, although there’s a $12 per month account fee that cannot be avoided with a high average balance and they’ve capped monthly mileage-earning.

- You can join the 40,000+ people who see these deals and analysis every day — sign up to receive posts by email (just one e-mail per day) or subscribe to the RSS feed. It’s free. You can also follow me on Twitter for the latest deals. Don’t miss out!

Gary

I need Citigold for global banking service access since I travel frequently. Is there any way to play this while maximizing miles earned without incurring a tax burden ?

There’s no link for the offer provided. Only a phone number.

I believe that in the past Citi has overvalued AA miles at an incredible 2.5 cents each. Do the math.

I believe the IRS said this is not taxable. Google the topic. IRS told them to stop even I think

For the Citi Gold: could amazon payments work as a direct deposit AND as the $750/month spend? 🙂

Oh wait. You don’t need direct deposit, just bill pay.

Wasn’t it established somewhere already that a company deciding to send you a 1099 form doesn’t necessarily mean you have generated taxable income in the eyes of the IRS?

Open a charles Schwab investor checking account for travel purposes no fess at all as far as I am aware (no forex atm or monthly fees for maintenance)

I opened a CitiGold last year for 30k miles, I did NOT get a 1099 so far this year. Citi seems to stop issuing 1099.

I just tried to open a Citigold account in a branch in Manhattan using the code above — the agent could not find the promo offer associated with my SSN and could not open the account with the promotion. Appears genuinely targeted.

Had a chat w/ rep. A 1099 is not generated. Fee is $30 a month for the account to get the 30K miles, unless you maintain a $50K balance.

The $30 fee for the 30k miles account is waved for the first 2 months. They give you those 2 months to get your account up to the $50k balance. So by my calculation, you can open this Gold account, put a few dollars in there to pay 2 bills over the course of 2 months and then downgrade it to the lowest tier account (which has no fees) and still get the 30K miles. I just opened one (I got the targeted offer directly) so we’ll see if this works.

Also I was told in the bank that if you don’t get the targeted offer you can’t open an account. I had the bank rep check my wife’s name since she has an AA citi card and that’s who they are targeting, and he said nope, she hasn’t received it yet so she can’t get the points for opening an account, but she probably will soon.

Also, citibank will give you $100 for referring someone and they will give that person $100 for taking the referral. So if you know someone who is going to open an account on this offer, be sure to do it via a referral to get this added bonus.

In 2002, the IRS stated in Announcement 2002-18 that it would not consider frequent flyer miles to be considered towards tax liability (http://taxes.about.com/gi/o.htm?zi=1/XJ&zTi=1&sdn=taxes&cdn=money&tm=103&f=00&su=p284.13.342.ip_&tt=13&bt=6&bts=27&zu=http%3A//www.irs.gov/pub/irs-drop/a-02-18.pdf)

Just because you are 1099’d by Citibank as having received the miles, doesn’t mean you have any additional tax liability as per this announced and as of yet still formal policy of the IRS.

Aww too bad I already have a account with them for 4years. 🙁 wish this could apply to ppl who already have account with them.

Read the Fine Print! It may not be easy to find, especially for this offer, but one had better do it. The $30 Monthly fee (Or aver balanvce of $50k or better to avoid it) was the deal=breaker for me. Even if the fees are waived for a month or two, getting the dates exactly correct is almost impossible. Not worried about the 1099 thing and the monthly spend is easy to cover if one pays attention, but the precise dates are simply not worth the 30K miles from AA. I have to wonder what Citi actually pays AA for those credits; you can bet that it is nothing close to the mentioned $0.025. While this may ‘net-out’ as a good deal for a few folks, the Fine Print includes too many little gotcha traps for most and – if you’ve ever dealt with Citi Bank before, you know that they are difficult to reach, difficult to deal with, absolutely unforgiving and will make it as difficult as possible for the ‘consumer customer’ to access funds promptly or conduct other business without extracting hefty additional fees. In short, unless one keeps an Average Daily Balance at or above $50k, calculated on their terms, they do NOT want you. Extracting the advertised 30K AA miles without paying some serious fees *may* be possible, but I cannot believe that it is worth the effort. Please be careful.

https://online.citibank.com/US/JRSAO/ao_online/AOEntryPoint.do?direct=true&Promo_ID=CKC2&product_list=citigold_interest_checking&package=citigold_account

delete the code that is there and poaste in the code given above

it brings you to the next step.

I have done the offer a couple times and in my experience the fee is waived 3 or 4 months. It did take the full 90 days to get the miles but I still ended up paying the $30 fee just one time. Well worth the cost to get the full 30,000 miles.

Data point. My wife and I got citi gold accounts. Met the odd but easy requirement. Her points posted one month, mine the next. Closed before fees. Total time 4 months.

JB, I just was approved but it never asked for my AA#. Where is that step in the process? Thanks!

@Devon, this is a targeted promotion so that’s probably why it never asked you for the AA information.

So I should verify the bonus with Citi before I finish setting up the account? Their email said they’d me calling to complete account setup. I will say that on the confirmation page there was a link to Promotion Disclosures that laid out the AA bonus stipulations