How Miles & Points Can Help You Be With Loved Ones During Emergencies

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Losing a loved one is one of the most painful things we experience in our lives. It’s even harder when you’re far away, and need to get somewhere immediately to be there when it matters.

Paying high ticket prices during a time of loss or during a family emergency can feel hard to overcome. And can seem like you’re choosing between putting a burden on your finances or being with your family to grieve or offer support, which is a decision no one should have to make when they’re still in shock or sorting through pain.

A couple of airlines offer “bereavement fares,” but they don’t actually save you that much money. And most airlines stopped offering them completely long ago.

In a time of emergency, you can use miles, points, or cash back from travel credit cards to offset or completely cover the high cost of a last-minute ticket. Having rewards available can take away the stress of paying for a big expense and allow you to travel quickly to where you need to be without worrying how you’re going to pay for it.

I’ll share ways to use miles & points so you can be with your family as quickly as possible.

Miles & Points Can Get You Home Fast

When I lived in New York, my partner got word his grandfather in St. Louis had collapsed and wasn’t likely to live more than a few days. There was no question that he had to be there as quickly as time would allow.

I checked flights on my phone right away. They were ~$1,000+ for a one-way, non-stop ticket that night. We didn’t have that much between us at the time, so it was a choice between using a credit card or not going. Of course, we were going to charge it if necessary, but we didn’t want to.

I was able to think on my feet, and checked if we could redeem any of our points for the same flight. I found it for only the cost of points and ~$6. I booked it as he packed.

In this case, we were going to pay and deal with the cost later. But having points let him be with his family and see his grandfather one last time. Not having to pay for that ticket was a grace on us during painful and confusing moments.

Only 2 Airlines Still Offer Bereavement Fares

In the past, airlines offered bereavement fares in the event of the death or critical illness of a family member.

But now, most major US airlines do NOT offer bereavement tickets. The only 2 US airlines with these fares are Alaska Airlines and Delta. And you must call to book them.

Alaska Airlines

Link: Alaska Airlines Bereavement Fares

Alaska Airlines will give you a 10% discount off the lowest available fare within 7 days of travel for the passing of an immediate family member. You must be a member of their frequent flyer program (free to join) and book by phone at 800-252-7522.

Immediate family includes:

- A spouse or domestic partner

- A child or stepchild

- A parent (mother, father, stepmother, or stepfather)

- Siblings (brother, sister, half-brother, half-sister, stepbrother, or stepsister)

- Grandparents (grandmother, grandfather, step grandparent, or great grandparent)

- A grandchild (granddaughter, grandson, step grandchild, or great grandchild)

- An aunt or uncle

- A niece or nephew

- In-laws (mother-in-law, father-in-law, daughter-in-law, son-in-law, brother-in-law, or sister-in-law)

The passing of another relative, like a cousin, doesn’t qualify.

Delta

Link: Delta Bereavement Fares

Delta offers bereavement fares if you need to travel due to the death or imminent death of an immediate family member. The discount varies, and you must be a member of their frequent flyer program (also free to join) and call 800-221-1212 for domestic flights or 800-241-4141 for international flights.

You’ll have to send documentation including the name of your family member, relationship, name and phone number of the funeral home, hospital, or hospice, and name of doctor (if applicable). That’s a lot of hoops to jump through at an already stressful time.

Delta considers immediate family to be:

- Spouse

- Domestic partner

- Child

- Parent

- Sister

- Brother

- Stepparent

- Stepchild

- Grandparent

- Grandchild

- Aunt

- Uncle

- Niece

- Nephew

- Stepbrother

- Stepsister

- Mother-in-law

- Father-in-law

- Son-in-law

- Daughter-in-law

- Brother-in-law

- Sister-in-law

Getting a ~10% discount is a nice gesture, but 10% off $1,000 or more is still an expensive ticket. And these fares are mostly for when a loved one has already passed – not when they’re sick or entering the hospital. In my opinion, this type of fare isn’t nearly enough. But they’re hard for airlines to manage, so most removed them completely.

Having Miles & Points Travel Credit Cards Can Help Tremendously

Apply Here: Travel Credit Cards

If you don’t have any miles or points saved, think about where you’ll likely need a last-minute trip. They can help you travel in case of an emergency.

Of course, it’s not always possible to plan for every situation. But knowing which airlines and routes are possible in advance can help you prepare, so you can focus on what’s really important if the unthinkable happens.

Because of this, I suggest collecting transferable points, like Chase Ultimate Rewards, for the most flexibility as an “emergency fund.”

1. Chase Ultimate Rewards Points

Apply Here: Chase Sapphire Reserve

Our Review: The #1 Premium Travel Credit Card Pays for Itself. Here’s My Full Review!

Apply Here: Ink Business Preferred Credit Card

Our Review: Apply Now for 80,000 With the Chase Ink Business Preferred

My top pick for a miles & points emergency fund is Chase Ultimate Rewards points because:

- Your points are flexible and never expire

- You can transfer points to a spouse or domestic partner

- Points transfers to airline & hotel partners are usually instant and easily done online (note you must have a Chase Sapphire Preferred Card, Chase Sapphire Reserve, Ink Business Preferred Credit Card or (no longer offered) Chase Ink Plus or Chase Ink Bold card to transfer Ultimate Rewards points to travel partners)

- Chase Ultimate Rewards transfer partners include options for domestic or international travel, like Southwest, United Airlines, Singapore Airlines, and British Airways

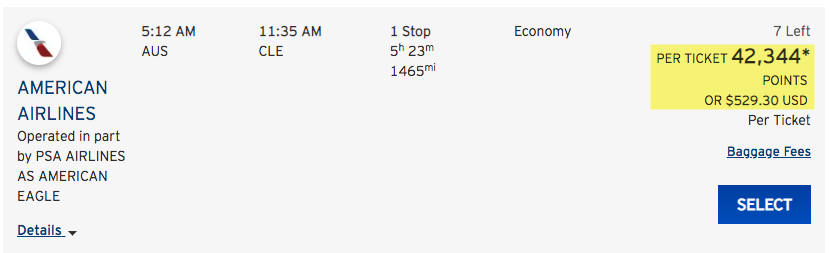

- If you can’t find available award seats, you can use Chase Ultimate Rewards points toward paid tickets (no blackout dates) at 1.25 cents per point through the Chase Ultimate Rewards travel portal if you have the Sapphire Preferred, Ink Business Preferred, Ink Plus, or Ink Bold, or 1.5 cents each with the Sapphire Reserve

a. Award Flights

Using miles for last-minute award tickets can sometimes be challenging. That’s because it can be hard to find award seats close to the date of travel.

But it’s worth checking, because some airlines release award seats a few days before departure (or even the same day).

If you do find available award seats, keep in mind some airlines, like United Airlines, charge an extra fee for bookings made close to the date of travel. Read this post for a trick to avoid United Airlines’ close-in booking fees.

And if you can find saver award seats, you can use Singapore Airlines miles to book United Airlines flights. And they do NOT add a last-minute award booking fee! (Your Chase Ultimate Rewards points also transfer to Singapore Airlines.)

Other Chase Ultimate Rewards transfer partners are better in certain situations. For example, you can book award flights on Alaska Airlines or American Airlines with British Airways Avios points.

Flights under 1,151 miles only cost 7,500 British Airways Avios points each way. And there are no last-minute booking fees.

Southwest is another option, especially because you can always book an award seat as long as there’s a paid ticket available. And you’ll get 2 free checked bags.

That said, their award chart is revenue-based, so you’ll pay more Southwest points for expensive, last-minute tickets. And they don’t always have direct flights.

If you’re unsure of your return date, Southwest could be a better deal. There are no fees to change or cancel your flight, and points are refunded to your account.

Remember, once you transfer Chase Ultimate Rewards points to a travel partner, you can NOT get them back! So be 100% sure award seats are open before you transfer.

b. Paid Flights

If you can’t find award seats, remember you can use Chase Ultimate Rewards points towards paid travel through the Chase Ultimate Rewards travel portal.

They’re worth 1.25 cents per point if you have the Sapphire Preferred, Ink Business Preferred, Ink Plus, or Ink Bold, and 1.5 cents each with the Sapphire Reserve.

They’re worth 1 cent each if you only have other Ultimate Rewards cards, like the Chase Freedom, Chase Freedom Unlimited, Ink Business Cash Credit Card, or Ink Business Unlimited.

Plus, when you book this way there are NO blackout dates. I like that you can use Chase Ultimate Rewards points to pay for all or part of your ticket. So if you have no choice but to book a paid flight, you can at least offset some of the cost by using points.

Remember, you can also use Chase Ultimate Rewards points for hotel rooms and car rentals.

2. Citi ThankYou Points

Apply Here: Citi Premier℠ Card

Our Review: This Offer Can Earn You HUNDREDS in Travel (or Potentially $1,000+ When You Transfer to Airlines!)

Citi ThankYou points aren’t as good for transferring to travel partners as Chase Ultimate Rewards points, because most of their airline partners are NOT US based.

And it can take up to 14 days for transfers to complete (although in my experience it usually takes a few days). That’s NOT helpful if you need to fly in a day or two!

But there are still good options for using your Citi ThankYou points for last-minute paid flights.

And it’s easy to earn Citi ThankYou points. Right now, the Citi Premier Card has 50,000 Citi ThankYou point welcome bonus after you spend $4,000 in the first three months, which is worth $625 toward travel.

I like the Citi Premier Card because it has terrific spending category bonuses, like travel, dining, and entertainment. So if you spend a lot in these categories you can earn points quickly to save when you need them.

Book Paid Flights With Citi ThankYou Points

You can book paid flights with Citi ThankYou points through the Citi ThankYou travel center.

Citi ThankYou points earned with the Citi Prestige (not currently available to new applicants) and Citi Premier Card are worth 1.25 cents each toward flights. There are NO blackout dates.

If you have the Citi Premier Card, this rate also applies to hotels and car rentals.

What About Other Programs?

Apply Here: Capital One® Venture® Rewards Credit Card

Our Review: $500 Off Your Next Vacation With This 50,000 Mile Capital One Venture Card Offer

Other transferable points programs, like Marriott and American Express Membership Rewards, are NOT ideal for last-minute travel.

That’s because it can take weeks for points to transfer to airline partners!

And while you can use American Express Membership Rewards points to book paid tickets on the American Express Travel site, your points are only worth 1 cent each.

That said, if you know your home airport is only served by a couple of airlines, it might be worth collecting miles and points in their frequent flyer programs. Or consider the Capital One Venture Rewards card to redeem miles for travel statement credits for any flight on any airline and take the guesswork out completely.

Book Travel for Others

You can also book a flight for a friend or family member who needs to be with their loved ones during a difficult time. Or be with you.

It’s easy to book award flights for friends and family members. And it could make a huge difference to someone who might not otherwise be able to make it to a bedside or funeral.

If You Can See the End Is Near

If a family member or dear friend has fallen ill and it’s only a matter of time before you say goodbye, please accept my condolences. There’s no worse feeling than watching someone you love slip away.

If you know you’ll eventually have to purchase last-minute travel any time, you can prepare yourself now by becoming familiar with which programs would work best for you. It’s also helpful to do a few “test run” bookings so you can do it without much thought. When you’re stressed, you don’t want to navigate a new award booking process.

Here are our picks for the best travel credit cards so you can get the most rewards saved.

Booking Last Minute Travel Tips

You never know, sometimes flights the next (or same!) day might be cheap. I recommend checking prices through Google Flights before you redeem your points. If you see a cheap flight, you might decide to pay cash for it. And Google Flights will search all the major airlines for the best price and route.

Remember, Southwest doesn’t show their fares anywhere except their own website. So if you’re a Southwest fan, be sure to check their prices directly. And on that same note, consider the value of the Southwest Companion Pass, which allows you to travel with someone else for only the cost of taxes and fees. That can save a lot of money if you need to travel with a partner to get home.

Bottom Line

I’m grateful to have miles and points in case I need to support someone in an emergency.

I would never want to feel helpless because I was unable to get on a plane to spend time with family. Thankfully, miles and points give us an opportunity to jump on a plane at a moment’s notice when being at a loved one’s side makes all the difference. And they can save you a lot of money on last-minute flights.

Chase Ultimate Rewards points are ideal for this situation, because they transfer to most airline partners instantly. Or you can use them to book paid travel through the Chase Ultimate Rewards travel portal with no blackout dates.

For paid tickets, another good option is Citi ThankYou points. Citi Prestige and Citi Premier Card cardholders can redeem their points at 1.25 cents each toward flights booked through the Citi ThankYou travel portal. You can use points to pay for all or part of your flight.

Finally, consider the Capital One Venture Rewards card if you want the flexibility to book any flight on any airline and redeem your points for a statement credit later.

Our team members have personally used rewards from travel credit cards during difficult situations, myself included. It truly makes all the difference to have options when you need them.

If you have a story to share about using miles & points this way, feel free to share with us in the comments.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!