Today Nimbus and Celgene announced a significant partnership focused on autoimmune and inflammatory diseases.

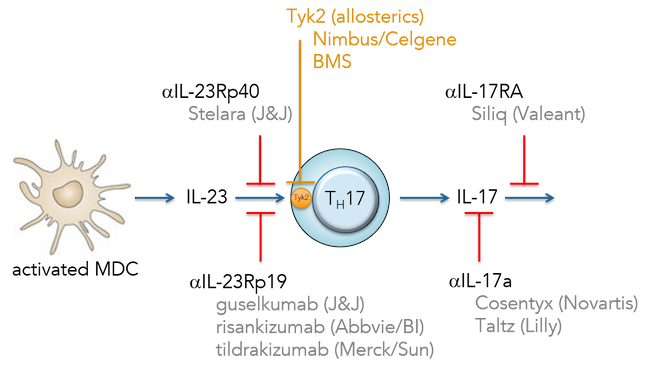

The alliance includes two pre-clinical autoimmune-focused programs in various stages of drug discovery. The most advanced program is a highly selective inhibitor of Tyk2, an immunokinase of the JAK family, which plays a central role in the inflammatory response (triggering IL-23, IL-12, and Type-I interferon). Human genetics, including both loss- and gain-of-function changes, validate Tyk2 as perhaps the most critical JAK family member to attenuate in many major autoimmune diseases. Given Tyk2’s proximal role in regulating both Th17 and Th1 responses, the target is one of the most sought after by immunology R&D groups. BMS has a competing Tyk2 program in early clinical development. The figure below illustrates why a safe, well tolerated oral Tyk2 inhibitor has enormous potential: it would not only replicate the efficacy of multiple blockbuster mAbs, but also explore a large number of other autoimmune diseases beyond psoriasis and RA.

Another program in this alliance with Celgene is a small molecule, non-nucleotide antagonist of STING, a pattern recognition receptor in innate immune responses. In I/O today, STING agonists are believed to be of value in turning up the immune response to tumors; this antagonist program is aimed at doing the opposite to turn down inflammation in the context of autoimmunity, and STING activation has been implicated in the pathogenesis of diseases like lupus.

This deal, dubbed “Project Everest” as a reference to Celgene’s corporate headquarters in Summit, NJ, was the product of over a year’s worth of active dialogues between the two leadership teams. We’re excited to work with Celgene on these programs as they are great fits with their growing I&I franchise.

Beyond affirming the compelling science underpinning these programs, this deal provides further validation for the Nimbus Therapeutics tripartite value creation approach: cutting-edge computational drug discovery; globally-distributed, virtually-integrated operations; and, a novel asset-centric corporate structure LLC.

These three elements were central to our investment thesis when we seeded the startup in 2009, and again when we came out of stealth mode in spring 2011, culminating in our Series A round. Over the past six years, there’s been several posts on Nimbus’ model and success (including early deal-making with the LLC structure, running virtual companies and the Uber-like disruption in this operating configuration, etc.). But to sum up these three pillars briefly:

Compelling scientific platform. Nimbus has a privileged relationship with our computational partner and co-founder, Schrödinger. Early on we were inspired by new approaches to understanding solvent energetics (unstable waters), but this relationship has grown into next generation techniques around FEP of ligands and proteins and better force fields. Further, we bring a host of other key technologies to bear, like crystallography, ADME prediction, and proprietary in silico designed molecular scaffolds, to name a few. On its own, technology isn’t a viable standalone solution, as described in my cautionary post on “Four Decades Of Hacking Biotech And Yet Biology Still Consumes Everything.” Integration of this powerful technology suite within a team of bona fide drug hunters, who possess both a nose and judgment for drug discovery, is the critical ingredient in making this work.

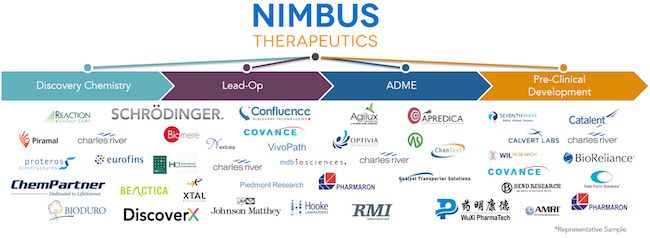

Virtual, global operations. While today its more accepted, back in 2009 it wasn’t common to think about virtual (sans labs) drug discovery at scale. Nimbus helped pioneer that model by building a cloud of partners to augment the core team. With well over a 100 individual contributors from dozens of CROs adding value to our programs, the model requires project management on steroids. This aggressive PM skill is critical as it ensures efficiency and brings global best-of-breeds partners to bear on a program. Most of the burn represents variable rather than fixed costs, so there’s flexibility in deployment of resources. For instance, right now we have 36 chemists on a single program, far higher than normal, just to crack open a particular opportunity. We’ll flex back and shift those onto other projects or other challenges (biology!) over time.

Novel corporate Structure. The passive non-operating LLC holding company model creates a much broader menu of business development options. Back in 2009-2012, we envisioned this model as creating a potential path to liquidity that didn’t exist for early stage companies; as the IPO market opened in 2013, the model has evolved. Nimbus CFO/CBO Jeb Keiper explored Life in the LLC here previously in a From The Trenches post. Fundamentally, the LLC structure offers up deal configurations you otherwise can’t do – and allows Pharma to access balance sheet capital for partnerships. While frustratingly complex at times, its wonderfully enabling when it works – as it lets the goose continue laying golden eggs. This new pair of Celgene partnerships, with two separate subsidiaries, is evidence of this point – coming less than 18 months after the Nimbus Apollo transaction with Gilead.

Initially conceived, we expected to monetize Nimbus’ programs around the Development Candidate nomination point, by finding development stage partners to advance them into the clinic. Over time, and with the rise of competitive alternatives (IPOs) increasing the value of Phase 1-2 stage assets, we’ve benefited by advancing programs into the clinic. This deal with Celgene allows us to do that with two programs in a fully funded manner before the option-to-acquire trigger point. Fundamentally, the scarcity of high quality, novel, early stage assets has become an important tailwind for innovative biotech like Nimbus, and the acquisitions of early stage companies like Delinia, Flexus, IFM, Rigontec, Padlock, etc are clear evidence of that.

Beyond the tripartite pillars underpinning the Nimbus model, as with all great biotech stories, it’s all about the team. The executive leadership team of Don Nicholson, Rosana Kapeller, Jeb Keiper, and Annie Chen are exceptional, as is the rest of Team Nimbus.

With the closing of this deal, and moving into new space with room to grow, the future is bright for this incredible company.