Stacking offers to save money – my experience

Sometimes your objective may be to get a certain award and other times your objective is just to save as much as possible everyday spending. I’m in the middle of a home improvement project and I don’t have the Chase Freedom card so I can’t get 5% cash-back this quarter from Lowe’s, but it turns out there are better ways to save money.

Frequent Miler posted about triple points in the AA mall, but since the AA mall does me little good for my overall earning style I decided to check out his tools to see how much I can save since I was in the middle of an online purchase anyway.

1. I compared the products I wanted to buy on Amazon.com, Lowes.com, and Homedepot.com and Home Depot had the best price by about 2% (Amazon beats that in sales tax, but I do prefer the ability to return products easily if needed and if you follow this I save more overall). All had free shipping so that is a wash.

2. I went to giftcardgranny.com and compared Amazon, Lowes, and Home Depot to make sure there wasn’t a gift card promo that would make up the difference. Lowes was about 5%, Home Depot 7%, and Amazon had barely any discount (I exclude eBay auctions because it’s too hard to judge the final sales price). Cardpool had the best non-ebay rates for Home Depot electronic giftcards. I under-bought on the gift card by about $10, Partially because I added a last minute purchase, but also partially because I didn’t want to leave any money on the voucher and I wanted to experiment with program rules.

3. I went back to Cashbackholic.com and found TopCashback was offering 2% on the purchase of gift cards from Cardpool. The GC# and pin arrived quickly after I did a few verification questions so now with GC in hand it was time to find a portal for my purchase.

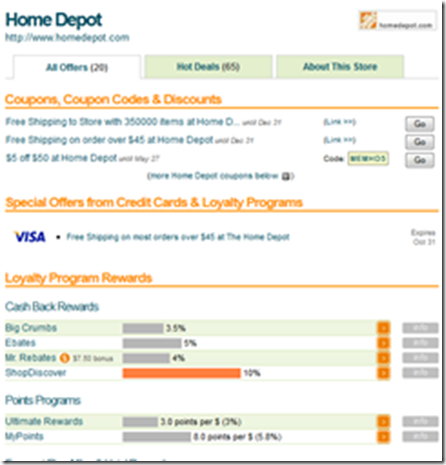

4. Evreward.com said eBates had the best deal…well…Shop Discover technically did, but I don’t have a discover card so I used eBates. eBates also had a $5 off coupon code, but I realized after I clicked the button to complete my order that I hadn’t applied it. Darn!

So…let’s see if I have this math right. I spent $55.38 on a $59.55 gift card for $4.17 (7%) in savings

I bought the gift card through a portal with 2% cash back or $1.11 (total $5.28)

I used a shopping portal with 5% cash back (although eBates does say purchases of gift cards or made with gift cards do not count so this is a test of whether my mixture of GC and CC helps me or not). $71.89 * 5% = $3.59 or possibly $0.62 cents for just the CC portion or $0.00 if nothing counts.

total: $7.76 (11%) if eBates counts my whole purchase or $5.90 (8%) if just the CC portion, or possibly just $5.28 (7%) if nothing counts from eBates.

The gift card and the balance of my order were bought with my Chase Sapphire Preferred for 1 pt per $. Lowes does currently have 5% cash back as a quarterly bonus on Chase Freedom, but the products I was buying were twice as expensive at Lowes over Home Depot. The products were 2% cheaper (based on price) on HD over Amazon, plus the gift card savings alone paid for the sales tax ($4.86).

Now I just wait around and see what actually posts. For small purchases like this having a lot of orphan accounts at places like Mr. Rebates or eBates doesn’t make much sense because often they have thresholds before they will give you the money back plus the time value of money states that a dollar I get back tomorrow is worth less than a dollar I get today so any instant savings or price savings is worth more than cash back rebates later down the line, but if you work this for all online orders it does pay out.

In the grand scheme of things: I made less than minimum wage for this, but the real work was spent upfront comparing door knobs on the home improvement sites and I would have done that regardless. The search for the best site for the transaction takes seconds. If your goal is to earn United miles or Ultimate Rewards points maybe you skip that step and go straight to that portal.

Sometimes gift cards save more than the portals so you have to determine which one is better when they can’t be combined. 7% instant savings with the GC is worth more than 5% cash-back later, but if you over-buy a gift card you do leave money on the table so weigh that out too.

Hi,

I am about to experiment myself with Sephora, so this is timely for me. I have a quick question: you wrote: “but if you over-buy a gift card you do leave money on the table so weigh that out too.”

But you don’t loose the money, do you? Doesn’t the amount you over-bought just stay on the gift card, to be used for a subsequent purchase?

I picked up two gift cards for Sephora – both $25 worth – when I knew I needed more like $40. But there were no $15 cards any place I checked. I bought the $25 ones assuming that the left-over $10 can just be used at another time.

Am I missing something here? Thanks!! And I hope you love the door knobs!

No, Elaine. You are correct. If you know you will use it there is no down-side to purchasing a higher $ card. In reality, I know I will use more at Home Depot in the near future, but this was a bit of an experiment too. Sometimes though, I buy something from a random site I don’t shop at often. In that case I don’t want to leave money on a card because I don’t want to feel like I have to shop there again.

Got it. Thanks!