Madison among cities luring tech jobs from traditional hubs on the coasts

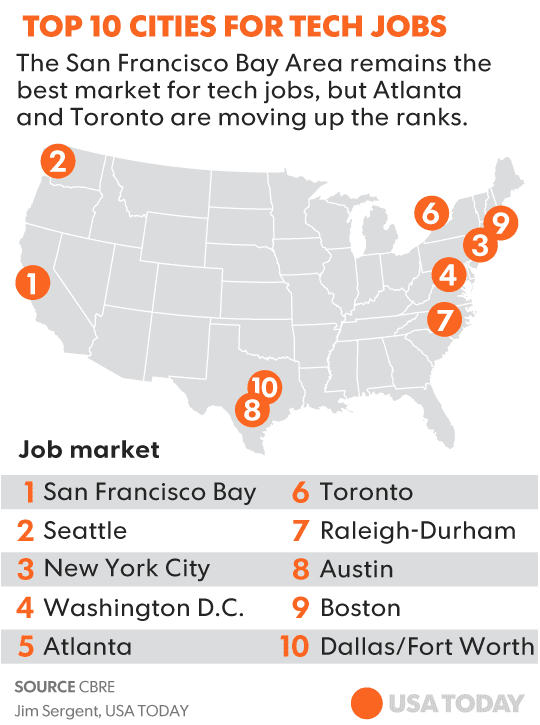

Although Silicon Valley remains a stalwart tech hub, metros like Toronto and Atlanta are breaking into the rankings of the best markets for tech jobs, according to a new study.

And smaller markets — say Madison, Wisconsin — are showing up as locales with momentum as they rapidly increase their small communities of tech workers.

The secret weapon these cities all have in common: rents that aren't through the roof.

An annual analysis released Tuesday from real estate and investment firm CBRE ranked the top cities for tech talent, based on factors including available workers and cost of living.

While the usual suspects — San Francisco, Seattle, New York and Washington, DC — constituted the top four, Atlanta and Toronto made the largest jumps to round out the top six. Both edged out the familiar high-tech hubs of Raleigh-Durham, North Carolina, Austin, Boston and Dallas.

“Atlanta and Toronto are the surprises,” said Colin Yasukochi, director of research and analysis at CBRE, told USA TODAY. “We’re seeing that large, low-cost markets such as Toronto and Atlanta have grown faster in recent years than the larger and more well-known markets.”

Atlanta and Toronto, in particular, moved up in the rankings because both the cost of office space and the cost of living are lower than other cities. For instance, the median price for a house in the San Francisco Bay Area is $750,000, according to real estate research firm CoreLogic. In Atlanta, the median price is $218,350.

Coupled with a high demand for tech jobs and a tightening supply of available tech talent in major metro areas, companies are beginning to look elsewhere to hire, Yasukochi said.

“It’s difficult to grow faster in a constrained market,” Yasukochi added.

The rankings were determined by looking at metrics including the supply, growth and concentration of available tech talent, the number of completed tech degrees and apartment rent cost growth.

The analysis also identified cities with “momentum” in tech job growth. These were usually smaller cities without large tech workforces and even lower costs of living, which make it easier to rapidly increase the pool of tech employees.

In Madison, Wisconsin the tech job market grew 5% in 2013-2014 and a whopping 30% in 2015-2016, making it the market with the most momentum. Madison is followed by Ft. Lauderdale, Florida and Salt Lake City, Utah, which both grew significantly in 2015-2016 after the market shrunk in the previous two year period.

Cities with momentum were classified as having more employment growth during the past two years, 2015-2016, than the prior two-year period, 2013-2014. The number of markets experiencing growth of this kind nearly tripled from last year’s report, increasing from 10 to 28.

None of the top markets for tech jobs gained momentum, another indication that big tech hubs, such as San Francisco and Seattle, are not growing as fast as they once did — although they are still growing, Yasukochi said.

Despite several attempts by some to create Silicon Valley-like technology booms in the Midwest and other smaller cities around the country, the majority of venture capital funding remains on the coasts. As a result, technology jobs are still concentrated in a few cities.

But as the report shows, a scarce supply of tech workers and skyrocketing costs of living make other markets more attractive. CBRE’s research found that Toronto and Vancouver, Canada are the least expensive for employers with the highest quality talent pool. San Francisco and Seattle, conversely, have the highest quality tech workforce, but remain the most expensive.

“If you’re a company trying to identify where to get the best value for my dollar, you should be looking at these places,” Yasukochi said.