Making Travel Less Taxing: Introduction

Your Tax Home (Away from Home)

Airfare and Transportation

Lodging and Meals

Entertaining Clients

Car Expenses

The Nitty Gritty: Required Receipts and Tax Forms

Ask Scott!

Welcome back to Making Travel Less Taxing! Recall from my first post that business expenses must be unreimbursed and ordinary and necessary in the course of your business to be deductible. After establishing that you have incurred such expenses, then of course you’ll want to account for and claim those expenses in a manner defensible to the IRS. This week, I’ll discuss what records you need to keep, how long you should keep them and where to report all your expenses. Please also note the disclaimer that follows this post.

Required Receipts

Officially

Maintaining an orderly system of records is like carrying your elite status card as a back-up to lounge access. You likely won’t need to show proof of your rights, but if you are asked for proof and can’t produce a card, the mistake will cost you . . . and the tax mistake is likely to cost a lot more than a $50 day pass.

Few taxpayers are audited each year; some are initiated due to taxpayer income, others when a return falls within a focus area of the Service. Recent focus areas include taxing offshore assets and preventing fraudulent refund claims due to identity theft. However, keep in mind that every year some audits are initiated at random.

Every year, the IRS chooses some tax returns at random for audit.

Historically, the IRS releases a few scare tactic informative press releases during tax season as a friendly reminder to those considering playing the audit lottery. In the event of an audit, you will be required to substantiate all of the expenses claimed on your return either by documentary proof or via an exception.

If during an IRS examination, you are offered this shirt in lieu of an increased assessment, take the offer.

Officially, you should keep proof (in either paper or digital form) of the date, amount and business purpose of every expense you claim on a tax return. Exceptions to that rule are as follows:

- Meals and lodging expenses incurred by an employee who is reimbursed by an employer on a per diem basis;

- Non-lodging expenses for less than $75; or

- Transportation (e.g. taxi) expenses for which a receipt is not readily available.

In theory, the cost to the taxpayer of complying with regulations should not exceed the tax benefit of the expense claimed. Due to the above exceptions, I believe that business travel regulations do pass a cost-benefit test unlike some of the minutiae in other areas of tax law, particularly in international disclosure requirements.

Car expenses can be some of the most onerous to document in that in theory you should be tracking each of your business trips. For a vehicle that is used entirely for business, the task is far easier than when a vehicle is used for both business and personal use. Some business owners keep mileage logs in their vehicle console and enter each entry manually, but that old school solution is less than ideal due to the risk of loss of the paper log. Two apps I have used, MileBug and Trip Cubby, are worthwhile if you are a smartphone user wanting a more modern mileage tracking option.

Unofficially

In the event you cannot meet the official documentation requirements, the IRS provide two catchall ways to prove items on your return: (1) through your own written or oral statements containing specific information; or (2) other supporting evidence that is sufficient to establish the tax item. By definition, though, these evidentiary items are far less persuasive, and the IRS has greater discretion to deny them, so I would not plan on relying on these methods to justify your expenses.

Further, my anecdotal experience with IRS agents is that they will occasionally accept credit card statements and not actual receipts as an adequate record of a business expense, but I would certainly not advise reliance on that strategy since it essentially involves catching an agent in a charitable mood.

How Long Receipts Should be Kept

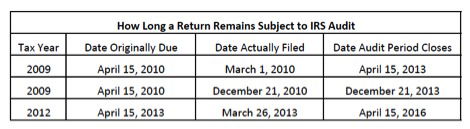

You should retain your tax records as long as the returns remain open to IRS audit since until that date, you may need to provide them to the Service to support the figures therein. A tax return is generally open to audit for 3 years from the later of the date you file or the return’s due date. So, for those taxpayers who timely file, the statute of limitations for an audit begins to run on April 15 each year, but for those who file past that date, the statute does not begin to run until the date of filing. A few examples illustrate how the rule works in practice:

Keep in mind that the same rules applies to taxpayers who wish to amend a return. If you filed your 2009 return before April 15, 2010, you have just a few more weeks to amend it (and by the same token, the IRS has only a few more weeks to inquire about items on that return).

The IRS gives themselves more time protects the public fisc in the case of special circumstances as follows:

- Failure to report income that is more than 25% of the gross income shown on your return: a 6 year statute applies.

- Claiming a capital loss for worthless securities: a 7 year statute applies. (For that remote possibility that a company like Enron makes a comeback!)

- Filing a fraudulent return: no statute applies.

If you invest in a security that later becomes worthless and claim a loss on your tax return, make sure you maintain records related to the security for 7 years after you claim the loss.

Keep in mind that even though the statute has run for purposes of the IRS, there may be other reasons to keep tax records beyond the statute of limitations. For example, tax returns may be helpful in obtaining loans, tracing assets pursuant to a divorce or in tracking tax basis in partnerships or other investments sold or inherited.

Tax Forms

One of the repeated themes of the Making Travel Less Taxing series that I hope has been clear is that travel deductions differ for employees and the self-employed. After you have determined what your eligible deductions are, then the final step is claiming them on your tax return.

Employees

If you are an employee, you will report your unreimbursed expenses on Form 2106 (instructions here) and file the form as part of your Form 1040 individual income tax return. Note that in some cases you may be eligible to use Form 2106-EZ to report your expenses, but I typically use Form 2106 since it covers all possible taxpayer scenarios. The total of the expenses on Form 2106 will flow to line 21 of Schedule A, Itemized Deductions, as a 2% miscellaneous itemized deduction, meaning that until the total of those expenses (along with other 2% items) exceeds 2% of your adjusted gross income, you will not get any tax benefit. And, if the total of your itemized deductions is less than the standard deduction, then you won’t get any tax benefit either since you don’t itemize deductions.

Self-Employed or Business Owners

If you have an unincorporated business or are a single member LLC, then you’ll report your business income and expenses on Schedule C (or Schedule F if you are a farmer) that will be taxed as part of your Form 1040 individual income tax return. Travel expenses are only a few lines of that schedule, but as I mentioned in my first post, due to the personal and business component of lodging, meals and vehicle use, travel expenses attract more IRS scrutiny than other more banal expenses like licenses, rent or sales taxes.

Conclusion and Next Time

This is the last topical post in the series since next week I will answer your questions. To that end, if you have a tax question on business travel or a more general question, please leave it in the comments! Or, you may contact me on my law and CPA firm website or @ScottTaxLaw.

Rather than considering tax flight, hire a tax attorney to represent you in an IRS audit.

Disclaimer: While I hope the information I provide will be helpful (and hopefully even humorous at times), none of this information should be construed as offering legal advice or creating an attorney-client relationship between the reader and my law firm. You should not act or refrain from acting based on this advice and should consult your own attorney or CPA regarding your specific tax matters. IRS Circular 230 Notice: Nothing in these communication is intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law.

Thanks, UAPhil. I recall your earlier question on this and will answer it.

Scott - I own passive residential rental property; I report on Schedule E. If I use a credit card to pay my rental property taxes, can I deduct the 2.5% Official Payments fee as a rental expense?

Hey Patrick! Thanks for the question; I'll answer it in next week's post.

Well here's my tax question... I officiate sports practically everyday from April through July. This is in addition to my real, 9 to 5, job.

I do these games in the evening after getting home from my real job. I have heard differing views on deducting for meals. One view was that I had to be on an overnight officiating gig to deduct the cost of the meal. Another view was that since this...

Well here's my tax question... I officiate sports practically everyday from April through July. This is in addition to my real, 9 to 5, job.

I do these games in the evening after getting home from my real job. I have heard differing views on deducting for meals. One view was that I had to be on an overnight officiating gig to deduct the cost of the meal. Another view was that since this was my own "business" I could deduct for a meal.

Suggestions?

Thanks

I get a 1099 from the association that pays me.