Kickfurther is a platform that lets companies seek funding from the Kickfurther community by offering a return on investment (such as 8% profit in 10 months, for example). Technically, these offers aren’t loans. When you invest in a Kickfurther offer, you are actually buying inventory that is then sold on consignment by the company seeking funds. With Kickfurther, you will earn a profit with each offer that you fund as long as the “borrower” pays out as promised. A nice perk for the points & miles crowd is that Kickfurther allows funding by credit card and, in my experience, it is never treated as a cash advance. Regardless of how you fund these offers, Kickfurther charges a 1.5% fee to withdraw the paid back funds to your bank account.

Kickfurther Overview and Strategy

You can find my first Kickfurther review in the post “My half-baked Kickfurther Review.” Please read that post for details about how Kickfurther funding works, along with details about my own Kickfurther funding strategy. Here’s a quick summary of the strategy I previously described:

You can find my first Kickfurther review in the post “My half-baked Kickfurther Review.” Please read that post for details about how Kickfurther funding works, along with details about my own Kickfurther funding strategy. Here’s a quick summary of the strategy I previously described:

- Set a maximum long term investment target

- Invest in offers I believe in

- Diversify

- Wait for interim payments before investing more

Thanks to advice from a friend, I’ve altered this strategy a bit:

- I now focus more heavily on near term payout offers (e.g. I prefer deals that schedule payout in less than 8 months)

- Rather than picking offers based on whether or not I believe in the products, I’m picking offers based on the apparent ability of the company seeking funds to pay out as promised.

It’s too early to know whether this altered strategy will help, but I expect it will.

Kickfurther changes to “per Pack” investments

Kickfurther is a fairly new platform that has been actively changing (mostly for the better) as it matures. One huge change that was made recently is that all consignment investments are now tied to specific “Packs”. A Pack is a set of specific products that you, as the investor, buy on consignment. Previously, you simply owned a percentage of the consignment inventory based on the amount you invested. The following conditions result from this change:

- You can no longer choose the exact amount of money you want to invest. Instead, you pick the number of Packs you want to invest in. For example, if one company offered Packs of products for $100 each, then 10 packs would equal a $1000 investment. In that example, it would be impossible to invest less than $100 in that offer.

- You can earn additional profit and get your investment back more quickly by selling these products through your personalized Kickfurther store.

- You can choose to have your Packs shipped to you If an offer is canceled (which can happen when the product company fails to pay out through Kickfurther). You will have to pay shipping and handling.

Further details about these changes can be found in this Kickfurther blog post.

Manufacturing spend with Kickfurther

Since Kickfurther investments can be funded by credit card, Kickfurther can be a mechanism for both profit and manufacturing spend (i.e. running up credit card spend for the rewards while getting your money back – eventually). Keep in mind the following caveats:

- You have to be able to float the investment long term. Most offer terms are 6 months long or longer. Partial payouts start much sooner, but it can be many months before you earn back your full investment plus profit.

- There is real financial risk. The products you invest in may have production issues, may fail to sell, etc.

Personally, I’ve been using Kickfurther to meet minimum spend requirements when I sign up for great credit card offers, to increase spend for big spend bonuses, and to earn category bonus points. My financial results to-date can be found below. First, though, here are a few “gotchas” to consider if you decide to use Kickfurther for manufacturing spend:

- Your credit card is not charged until an offer is fully funded. This means that Kickfurther isn’t a great option for last minute spend.

- Offers that are not fully funded get cancelled without ever charging your credit card. I had a situation where I had funded an offer in order to complete minimum spend on a Marriott credit card. I then put away the card thinking that I was done with it. However, the offer was never fully funded, so my card wasn’t charged. Fortunately, I figured this out in time and rushed to manufacture spend another way.

- Kickfurther doesn’t show you which credit card was used with each offer. I’ve learned the hard way that It’s a good idea to keep a spreadsheet that details every Kickfurther investment I make, including the credit card used for funding.

- You can no longer pick an exact amount to charge to your credit card. It used to be easy to invest an exact dollar amount. If you needed $300 more spend on a card, it was easy to use Kickfurther to invest that exact amount. Now that they’ve changed to Pack investments, though, all charges are a multiple of the Pack price. While this isn’t a big deal for most purposes, it does eliminate the possibility of using Kickfurther to drain Visa/MasterCard/Amex gift cards.

My Kickfurther results to-date

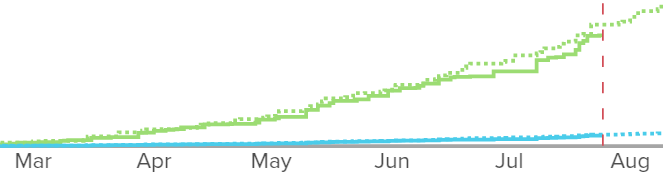

Above is a picture showing my portfolio to-date. The green solid line shows my cumulative payouts. The green dotted line shows the expected payouts. As you can see, the current expected payouts are slightly higher than actual payouts. This means that some companies in my portfolio have missed payout dates or have paid less than expected. The blue line shows cumulative profit. Fortunately, the small gap between the solid green line and dotted green line appears to be smaller than my profit earned to-date. In other words, if I’m reading this correctly, I am coming out ahead, but only just.

I’ve funded a total of 38 offers to-date. Of those, 20 have had at least their first payouts due by now. The following stats apply to those 20 investments:

- 3 are complete (e.g. they fully paid both the original investment amount plus the promised profit %)

- 15 are in-progress

- 2 have been cancelled due to failure to pay

- 8 (including the 2 cancelled investments) have paid less than expected to-date

- 4 have paid more than expected to-date

The two that were cancelled represent less than 2% of my total cash investment. And, both of the cancelled offers have already paid about a third of expected. Theoretically we can recover more of the loss through seized products, but I’ll have to wait and see how that pans out. In the meantime, I’m happy that I heavily diversified my investments.

The 8 investments that have paid less than expected to-date (including the 2 cancelled investments) make up 33% of my cash investments (not counting investments not yet due for payment). I’m not too concerned though, since a number of these are seasonal businesses that are expected to have “lumpy” payouts.

The 4 investments that paid more than expected to-date make up 30% of my cash investments. It appears that I bet well and invested more heavily in these companies than most others.

Wrap Up

To-date, I’ve done OK manufacturing spend with Kickfurther, but I haven’t made much of a profit. Thanks to advice from a friend, though, I’ve altered my Kickfurther investment strategy towards shorter offers from more solid companies, and I think that decent profits are likely in the future. I’ll write up a new Kickfurther update once I’ve given the latest strategy time to pan out.

If you’re interested in trying Kickfurther, you’ll get $5 to invest if you signup with my referral link. Or, if you already use Kickfurther, feel free to post your referral link in the comments below (note: URLs within comments are often flagged as Spam so I can’t promise that your referral comment will show up).

[…] See: Kickfurther review 2. Manufacturing profit and spend. […]

[…] See: Kickfurther review 2. Manufacturing profit and spend. […]

[…] Kickfurther review 2. Manufacturing profit and spend. […]

I’m trying out KickFurther with the BrewJacket product: https://www.kickfurther.com/status/brewjacket-inc

I can use and sell the rest if the campaign goes bust.

As long as the pack price is under the $500 CC limit, you can order multiple packs one at a time, so I ordered 3 packs for a $1014 investment, and covering $1k of the $5k spend on a new card.

As mentioned above KF funding isn’t actually tapped unless the campaign gets full funding, so here’s hoping! 🙂

Kickfurther/Kiva are not MS. It is gambling, pure and simple. I imagine you always win every time you gamble Greg. And you pay for it with your credit cards. The fact that you don’t put caveats on these methods makes me wonder if you get Kickbacks ala the Points Guy.

VERY YMMV. Personally I’d avoid.

I agree. There are way too many red-flags that are happening on the KF platform. I request Greg not to promote this platform.

[…] Consignments. This is an opportunity to increase credit card spend AND earn a profit. See: Kickfurther review 2. Manufacturing profit and spend and Kickfurther limits credit card claims to $500 at a […]

[…] See: Kickfurther review 2. Manufacturing profit and spend. […]

There’s a lot of discussion on the Kickfurther subReddit at the moment (link already posted by brteacher). It’s definitely worth reading the subReddit before opening a Kickfurther account. Having said that, there’s a couple of Reddit users who are extremely vocal and very negative, so don’t believe everything.

For the last week or so, it has been very difficult to invest in any of the more popular deals. They’re being funded in seconds and I just don’t have the computing power or internet speed to get in on them. Expect this to only get worse in the future. I’ve had doubts lately about whether I should keep my account, or pull my money out as each offer finishes. It’s a coin-toss at the moment. I have to say that the communication from the KF team is very good, even if they’re not so good at sorting out the bugs on the website.

Anyway, if you’re considering joining after all that, I’d be very grateful if you could consider using my link. Thanks Greg for allowing the links!

http://kickfurther.com/u/3yf8bzw29l

I started off a bit more conservatively than you Greg. Participated in 3 offers that, to date, have all maid early or on-time payments.

PS. Have 7 keys saved up – what about you?

made

Yep I have tons of offer keys saved up

Which is https://www.reddit.com/r/getgrowing/

I used Kickfurther once last year and was pleased with the results, though I don’t plan to do it again any time soon, as I’m not very liquid right now. I think it’s a solid investment platform, though. If you’re really interested, then you may want to follow the Kickfurther subReddit to discuss various offers, strategies, etc.

[…] update on Kickfurther from Frequent Miler. I’ve been using Kickfurther myself, more for the investment opportunity, where the miles / […]

[…] A review of Kickfurther. This is NOT for newbies, this is why I put it here. I lost interest when I read this…”Kickfurther charges a 1.5% fee to withdraw the paid back funds to your bank account.” But it could work for some of you needing to meet min spends quickly and can afford to wait to get paid. […]

just put it all on red or black…seems easier and odds of payout might be the same…

Help a brother out.

http://kickfurther.com/u/1xrkz86xty