Last month I wrote about a new prepaid product designed for global travelers: Revolut. Revolut is both a smart phone app and a prepaid debit card. Theoretically, it’s perfect for global travelers: there are no fees (no foreign transaction fees, no currency exchange fees, no ATM fees… you get the idea) and it has true chip and pin capability.

Ideally, one could use the card to avoid many of the expenses associated with international travel. You can load money before traveling, use the card while traveling, then withdraw the balance when you return home. Unfortunately, not only is the product plagued with bugs, but if you’re US based, you’re likely to incur hefty fees. I’ll explain…

The company behind Revolut is based in England. And, my guess is that the product works well for those based in the UK. US residents, though, are likely to run into problems…

Load funds to Revolut: Pay a foreign transaction fee

Funds can be loaded to Revolut via debit cards. Unfortunately, when I loaded funds to Revolut, my local bank (PNC) charged a foreign transaction fee. That fee eliminated most of the point of using Revolut in the first place! On the other hand, Revolut won’t charge a fee when using ATMs (but the ATM operator often will) so there may still be savings there. Still, most people would be much better off using a debit card that refunds ATM fees and does not charge foreign transaction fees. A great example is the debit card that comes with the Schwab Bank High Yield Investor Checking Account.

Withdraw funds from Revolut: Pay a $20 international transfer fee

In my first post about Revolut, I described how the Revolut app offers the option to withdraw funds to a US bank account via a routing number and account number. Unfortunately, while that option is there, it does not actually work. Instead, you have to do an international transfer to withdraw your funds. I checked my various bank accounts and found one that doesn’t charge a fee for accepting international transfers. I then transferred $150 from my Revolut account to my bank account. A few days later, $130 appeared in my account. Where did the other $20 go?

I contacted Revolut support. In a few days they got back to me. They said that their payment provider didn’t charge a fee, but that it must have been my bank or an intermediary bank that charged $20.

I called my bank and talked to a wire transfer specialist who assured me that they did not charge the fee. They suggested asking Revolut to put a trace on the exchange. I conveyed that message back to Revolut.

Nine days later, I got this:

Sorry about the extremely later response our payment provider got back to me yesterday stating that there was an intermediary bank and they were the ones the charged you.

I replied:

Great. So, will Revolut reimburse the $20? My understanding was that there would be no fee as long as my bank didn’t charge a fee. I had tried to use the built in functionality of withdrawing directly to a US bank account, but that wasn’t working.

And, their answer:

Unfortunately not, we do state in out FAQs that this may occur as the route that the money has to take to get to your account is not in our control. We do pay the initial SWIFT fee for the funds to be sent from Barclays but after that we have no control of the fees or the path the money takes.

Sigh.

One great Revolut feature

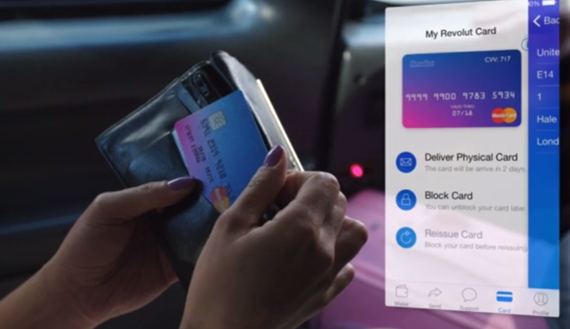

After setting up your Revolut account, you can request a physical Revolut card from the app. And, it comes in the best packaging ever. Check this out:

I’m curious how you got verified by revolut since it’s not in the country where it’s technically available

Unless you didn’t and use for under 200£

Most of my friend in Europe travelling a lot use revolut and can even transfer money between each other it’s pretty awesome app and card to use

They accepted my drivers license for verification

[…] de Revolut n’a pour l’instant pas la meilleur image. Par exemple, un internaute a eu 20$ de frais lors d’un transfert international, ils n’ont rien voulu entendre. On pourrait penser qu’échanger les monnaies n’a pas […]

[…] Concernant Revolut, j’ai pu lire que leur support de n’est pas vraiment bien (voir source). […]

[…] not everyone is impressed with the company. Frequent Miler detailed an exchange with the company in November after he was charged a $20 fee from an intermediary bank, which […]

[…] not everyone is impressed with the company. Frequent Miler detailed an exchange with the company in November after he was charged a $20 fee from an intermediary bank, which […]

RE-Posting a comment I made on your earlier column in regards to Revolut:

Just a note for you, Greg and all the folks checking this out the Day After Birdopocalypse… (1/9/2016)

Revolut’s website says that Revolut 2.0, the next big release is in just over 3 days. (Noon on 1/12/16)

I would wait until after that to try it. I am going to check it out myself since I have a could VGCs on the way (still, after a couple weeks) from Staples.

Might as well give it a shot, right?

Reply

Just tried to load a US Bank VGC from Kroger and it was declined. I’ll wait for the 2.0 release to try it again.

It may have been declined due to a foreign transaction fee being added on top.

I have a couple metabank prepaid cards without a pin, so tried loading and had to account for a 1% foreign transaction fee to get the full balance to load for one of the cards. Now hopefully I can unload without incurring fees. If the total cost can be limited to 1% then there is utility in the US to MS with Revolut, as an alternative to unloading prepaids (without pins) via normal spend.

No go with a brand new card (US Bank / Kroger) with plenty of money on it. Tried loading $10.00 and it was declined. Not a big deal as there are other options out there.

Thanks. As I posted in the other thread, I tried the new app, but still couldn’t withdraw money via ACH to my bank account

NW Buxx charges a 1% foreign transaction fee to load to Revolut.

If you want to avoid intermediary fees on international transfers, make sure the sending and receiving banks are swift members first. Many local and regional banks in the US are not swift members.

I used Citi and they have their own swift code, so I assume they are members.

When you talk about “Loading funds to Revolut” and say:

“Still, most people would be much better off using a debit card that refunds ATM fees and does not charge foreign transaction fees. A great example is the debit card that comes with the Schwab Bank High Yield Investor Checking Account.”

You are missing the point here, since the whole intention is to avoid the USD>EUR exchange fees, and Revolut is meant for that purpose, while using those debit cards isued from US based banks would still charge and exchange fee while shopping abroad.

You are actually providing the workaround for that issue, so the wording should be:

“People should use a debit card [to load funds to Revolut] that refunds ATM fees and does not charge foreign transaction fees, like the one that comes with the Schwab Bank High Yield Investor Checking Account.”

Also when you talk about “Withdrawn funds…” From the point of view of MS won’t make sense although it is understandable you are being charged since you already converted the money (to either EUR or GBP) BUT for people who need to transfer money to their foreign accounts in Europe, it would actually work, since withdrawing to a foreign account which is funded in the same currency (for ex. EUR) you would not incurr ANY fees, since the money is getting there in te same currency.

In any case, I want to thank you for taking the time to explain about it and for elaborating sbout your experience with it which undoubtely have help other like me to know about it.

The person above that states it was not worth a post should think about how unlucky he was it did not help him but iit actually helped many others! (This is a polite way to say he should shut his mouth like we say back in my country 😉

Not sure this was worthy of a blog post.

Not sure this was even worth a midnight musing at pillow talk with your wife.

Not sure ur comment was worth posting.

Perhaps your broad indictment of Revolut (“it doesn’t actually work”) should be limited to your particular experience with your particular bank.

Using my ordinary Chase checking account, I added $100 to Revolut about two weeks ago. The entire amt showed up in Revolut w/ no fees.

After the Paris attacks, I used Revolut to send Euros to a Parisian charity that only takes Euro-denominated credit cards. No fees taken from that transaction either.

Sounds like this could be the next redbird!

Ok, passing on this one, thanks.